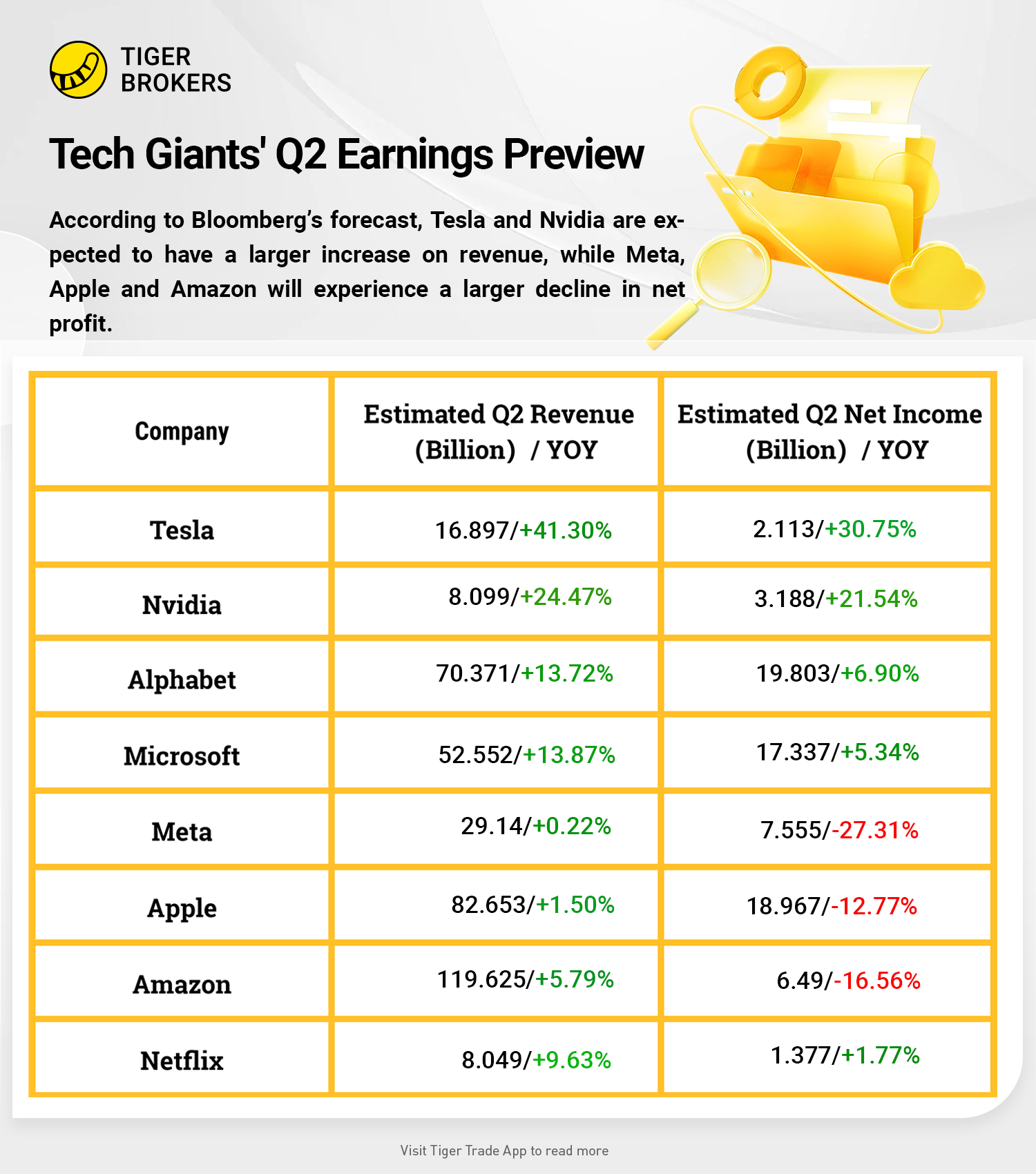

Second-quarter earnings season kicks off this week. According to Bloomberg’s forecast, Tesla and Nvidia are expected to have a larger increase on revenue, while Meta, Apple and Amazon will experience a larger decline in net profit.

Microsoft, for it part, hasalready forecast lower-than-expected earnings June quarterthanks in part to headwinds linked to the strength of the U.S. dollar. Shares in the group are down around 21.2% so far this year.

In an end-May trading updatepublished on its website, Microsoft said it sees current quarter revenues in the region of $51.94 billion to $54.74 billion, with operating income of between $20.6 billion to $21.3 billion. Earnings will likely come in between $2.24 and $2.32 per share, Microsoft said, down from its April estimate of $2.28 to $2.35 per share.

Apple, meanwhile, told investors in April that Covid and supply chain disruptions around what he called the "Shanghai corridor", as well as Russia's war in Ukraine,would clip between $4 billion and $8 billion from June quarter revenues. Apple is down 20.2% so far this year.

Alphabet CFO Ruth Porat was also cautious on the group's second quarter prospects,telling investors in April that the Google parent would face "a tough comp" for search revenues.

"I would say, in addition, the second quarter results are going to continue to reflect that we suspended the vast majority of our commercial activities in Russia," she added on the group's first quarter conference call. Shares in the group are down 19.5% so far this year.

Amazon, which is down 34% so far this year andrecorded its biggest single-day decline in late April following a surprise first quarter loss, said June quarter operating income would fall between -$1 billion to +$3 billion on revenues in the range of $116 billion to $121 billion, a tally that would be essentially flat to the prior period.

Netflix: There are worries that net subscriber losses will be larger than the two million that Netflix has projected, as competition intensifies, and consumers cut budgets. Netflix has been trying to bring costs under control. As part of those efforts, the streaming giant has laid off employees, including 150 in May and another 300 in June.