What happens when the Fed tapers? That is the billion (or trillion) dollar question. Before we delve into the possible outcome(s) though, we must first understand what tapering means.

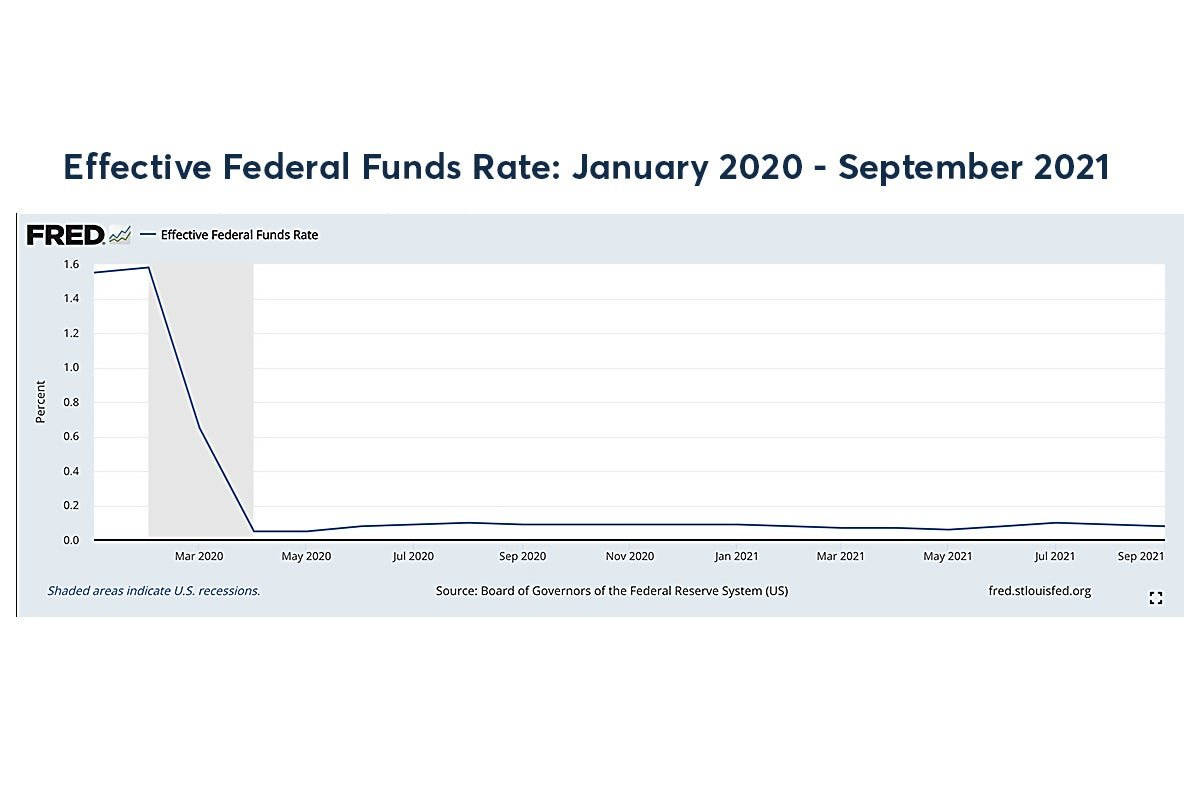

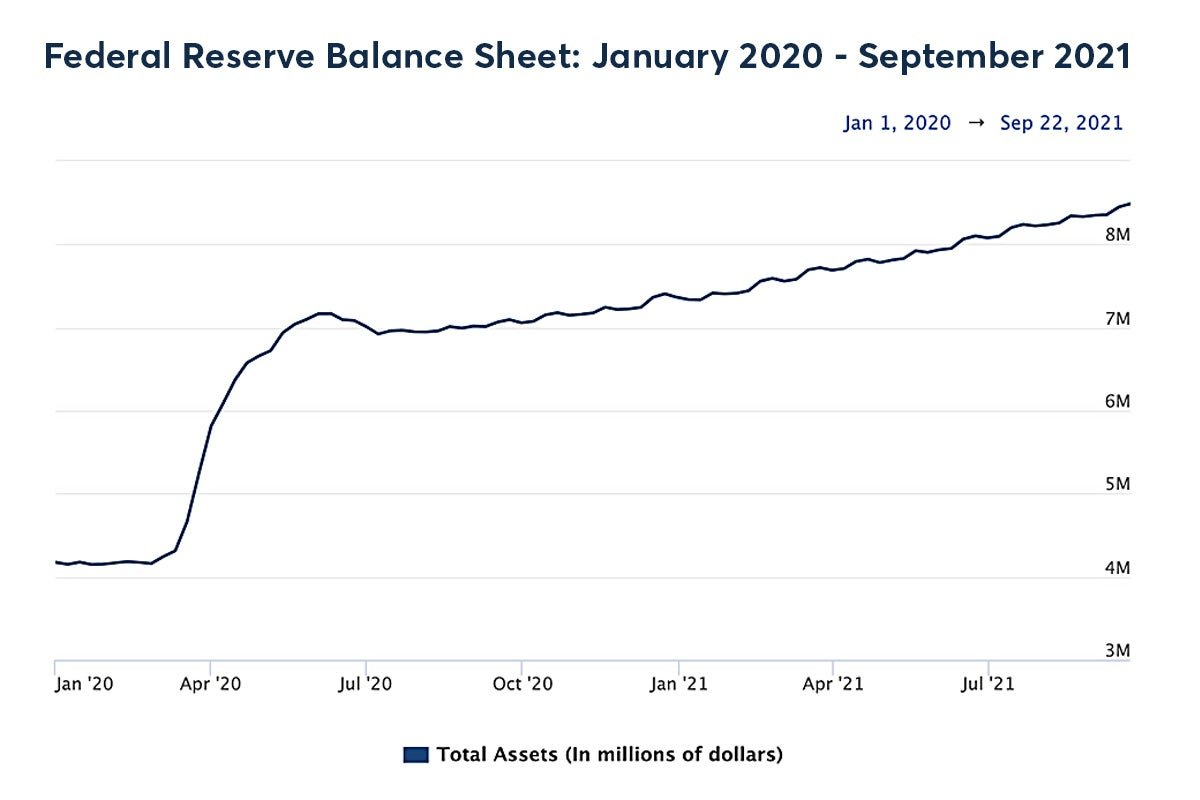

In response to the coronavirus pandemic, the Federal Reserve slashed interest rates to zero in March 2020 to help bolster growth. It also began its $120 billion in monthly asset purchases, a program known as quantitative easing (QE) that has roughly doubled the Fed’s balance sheet to about $8.5 trillion since the start of the pandemic.

QE helps by reducing long-term interest rates, thereby encouraging borrowing to help spur spending, and in turn, the economy. In doing so, the Fed essentially reduces the available supply of these bonds in the open market, forcing investors who want to own them to drive up prices. Driving up bond prices has the effect of lowering interest rates, which lowers the borrowing costs of households on their mortgages, or the costs of corporations to borrow by issuing debt.

As the Fed eases the pace and pares back the amount of these purchases, tapering begins with the ultimate goal of sending interest rates back to “normal.” Tapering can impact long-term interest rates, as this typically sends a signal to the markets that the Fed is shifting to a less accommodative policy stance in the future. The key is to understand that tapering does not mean the Fed stops purchasing assets, but it just reduces the pace of its balance sheet expansion. This is different than tightening, which means the Fed will no longer add assets to its balance sheet and will instead reduce the assets it holds by selling them — with large companies recently including Caterpillar Inc. and Home Depot taking advantage of to issue new bonds.

Aside from interest rates, tapering could have an impact on the U.S. dollar. The trajectory of the U.S. dollar is important for investors as it impacts everything from commodity prices to corporate earnings. Higher yields make dollar-denominated assets more attractive to income seeking investors. Tapering is typically bullish for the dollar as it means a move toward tighter monetary policy. Since currencies normally appreciate when their domestic short-term rates rise, as the Fed continues to signal imminent tightening, markets are pricing in higher rates. This offers support to the dollar amid an already choppy risk environment that is a positive for the safe haven dollar. As mentioned above, if the Fed will be buying fewer debt assets, there would be fewer dollars in circulation.

The market is anticipating the beginning of the taper process could begin sometime in the fourth quarter of this year, possibly as soon as November. In addition, half of the Fed vice presidents project interest rates rising at some point in 2022. Fed Chairman Powell is anticipating the taper process could end around the middle of next year, as long as the recovery remains on track. The Central Bank has insisted that they expect to keep the funds rate near zero until labor market conditions have reached levels consistent with their projections of maximum employment. We are nowhere near pre-pandemic unemployment levels (with 8.4 million unemployed persons in the U.S. now versus 5.7 million in February 2020). This could lead to concern over whether the Fed risks tightening monetary policy at a time when the economy might be significantly weaker than it already is today. At the end of the day, if the Fed is priming the markets for a taper in the fourth quarter of 2021, we could be in for a period of extended volatility.