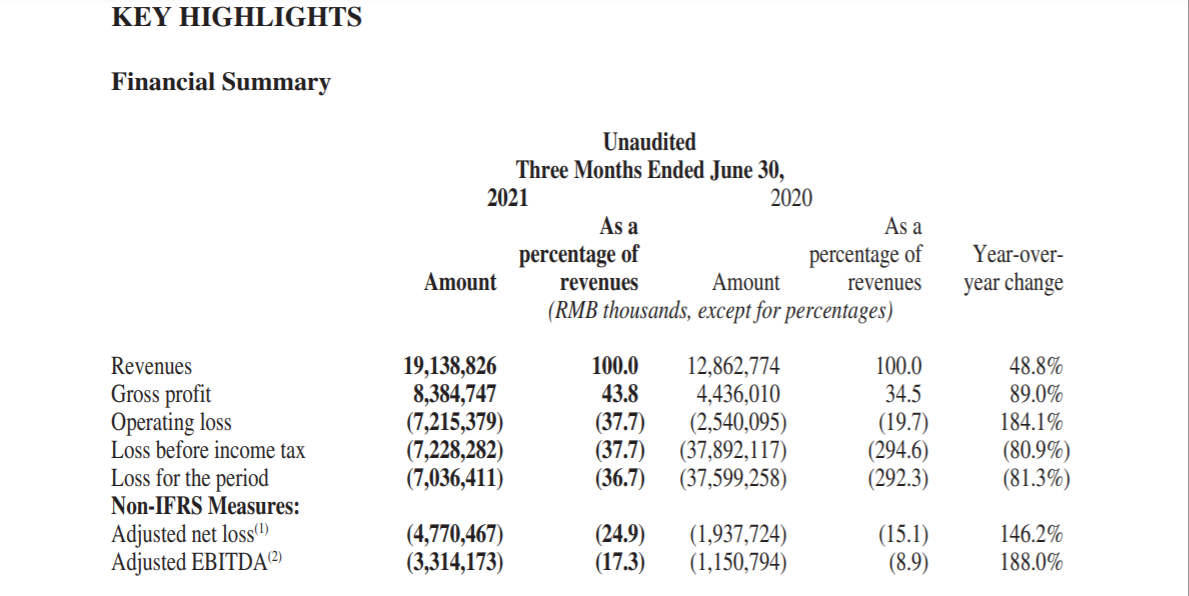

Kuaishou Technology announced the unaudited consolidated results of the Company for the three and six months ended June 30, 2021.Kuaishou Technology’s revenue beat estimates.Sales rose to 19.1 billion yuan ($3 billion) for the three months ended June, versus the 18.7 billion yuan average forecast. Net loss was 7.04 billion yuan, compared with the 6.25 billion yuan loss projected.

Q2 2021 Kuaishou Technology Earnings Conference Call

BUSINESS REVIEW AND OUTLOOK

As a leading content community and social platform with hundreds of millions of daily active users, we, Kuaishou, are well-positioned to continue cultivating a vibrant, trust-based ecosystem, while bolstering our monetization capabilities through better management of our massive traffic, and further strengthening our value proposition for our users and customers.

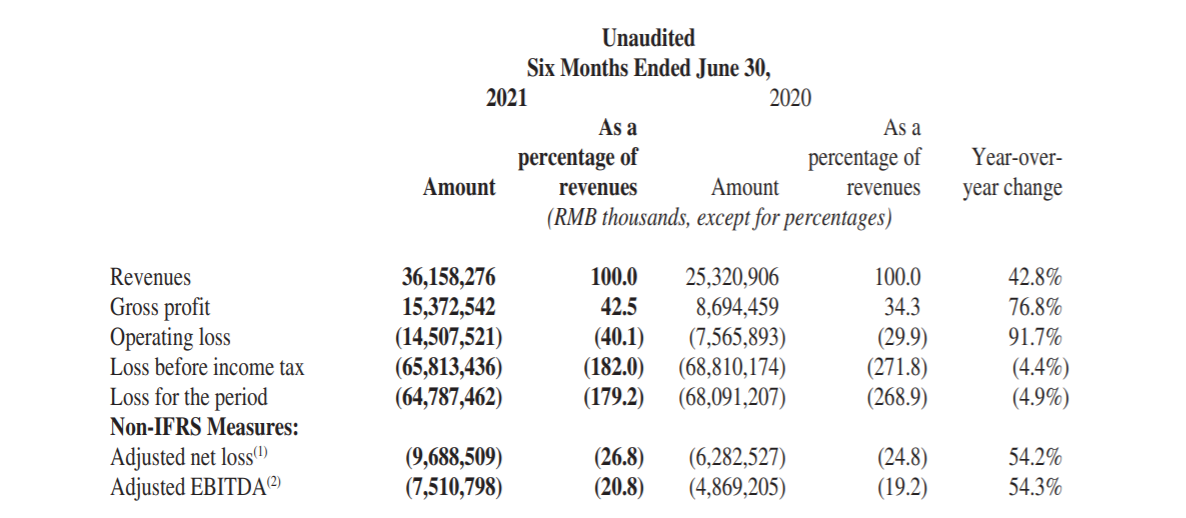

Amid consistent improvements to the experience for users as well as service capability of advertisers and merchants, and efforts to empower them with our unique content and ecosystem, we achieved total revenues of RMB19.1 billion in the second quarter of 2021, representing a year-over-year increase of 48.8% which outpaced the 36.6% year-over-year increase in the first quarter of 2021. Revenues from online marketing services grew by 156.2% year-over-year to RMB10.0 billion in the second quarter of 2021, contributing over 50% of our total revenues once again. Revenues from other services including e-commerce increased by 212.9% year-over-year to RMB2.0 billion in the second quarter of 2021.

Ecosystem

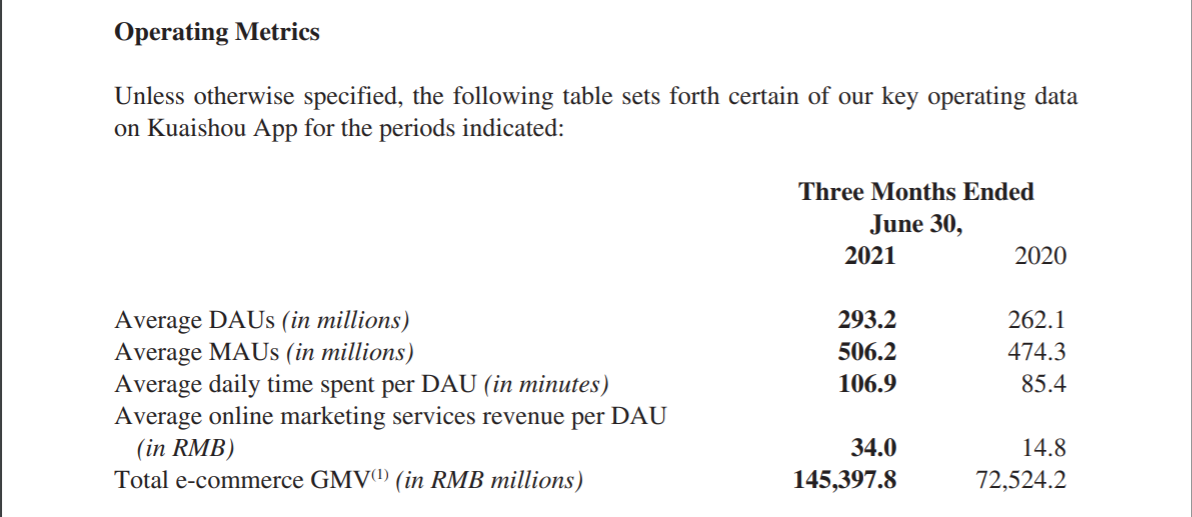

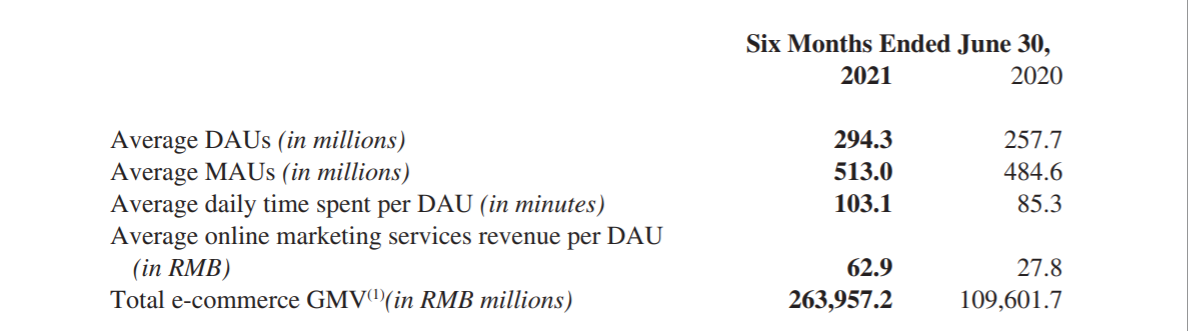

Driven by our investments to continuously iterate traffic distribution algorithms and to enhance social trust and enrich content ecosystem, we further increased user engagement and user activeness on our platform. This helped propel the average daily time spent per DAU on Kuaishou App to reach 106.9 minutes in the second quarter of 2021, increasing by 7.7% quarter-over-quarter and 25.2% year-over-year. Leveraging the growing public domain traffic on our platform, we have continuously optimized our algorithms by deepening our insights and understanding of user behaviors and preferences in content consumption as well as the evolving user needs, which allows us to continuously improve our distribution algorithms, leading to further optimized user experience.

Besides improvements in user engagement, we also achieved solid results in promoting user activeness. Through the improved efficiency of traditional user acquisition channels and retention measures as well as organic growth driven by strong social trust and diversified content, our DAUs to MAUs ratio reached 57.9% in the second quarter of 2021 on Kuaishou App, expanding by 1.1 percentage point quarter-over-quarter. Our average DAUs on Kuaishou App increased by 11.9% year-over-year to 293.2 million in the second quarter of 2021, while the year-over-year growth rate accelerated every month during the quarter, showing a healthy momentum. The growing user activeness was also driven by our improved user retention rate resulted from our efforts to facilitate full-cycle user management which spans user acquisition, user retention and monetization, as well as providing optimized content recommendation and personalized services. This synergistic user management also allows us to continuously improve our products and address user needs more promptly and effectively.

The strong social trust is the backbone of our ecosystem and differentiates us from other industry players. In the second quarter of 2021, social trust was further strengthened on our platform, as demonstrated by the increasing number of pairs of mutual followers on Kuaishou App, which reached 12.6 billion pairs on a cumulative basis by the end of the second quarter of 2021, increasing by 60% year-over-year.

Continuous expansion in our leading content categories and the scale and diversity of our content ecosystem also contributed to our increasing user engagement and growing user activeness. We have continually strived for differentiated and refined content offerings that cater to diverse user needs. Our featured Kuaishou Playlet delivered excellent results, contributing over 800 series of short plays, each of which received more than 100 million video views accumulatively by June 30, 2021, and including 40 exclusive series produced by our own Project Astral. On new content verticals side, we are proud to have become an industry benchmark in the sports category. In addition to our colorful professionally generated and user generated sports content library, we have recently become the official broadcaster of the Tokyo 2020 Summer Olympics and the Beijing 2022 Winter Olympics, bringing our users a more innovative sports viewing experience and an even more interactive experience in sports content creation through short videos and live streams.

To encourage content creation and optimize content distribution, we have distributed not only short videos, but an increasing amount of premium live streaming and e-commerce content to users through refined algorithms for public domain traffic. By doing so, we have enabled our users to discover a broader variety of more interesting, meaningful and useful content that serve their new needs. This has also allowed our platform to become increasingly attractive and friendly to content creators, as evidenced by the number of high quality content creators growing continuously and healthily on a monthly basis during the second quarter of 2021. These factors further reinforced our strong flywheel effects in content creation and content consumption.

Online marketing services

We achieved strong online marketing services growth in the second quarter of 2021, with revenues increasing 156.2% year-over-year to RMB10.0 billion. In particular, revenues from brand advertisements maintained its high growth, outpacing the year-over-year growth rate of revenues from online marketing services once again, while the number of brand advertisers on our platform increased by nearly four times compared with the same period of last year. These results were driven by our continuous efforts to improve our brand image, marketing efficiency as well as service capabilities, helping brands attract and grow user base, increase popularities and further enhance user stickiness and loyalty through private domain operations.

Brand advertisement has become one of the strategic focuses for us. As we continue to invest in infrastructure and tools to unlock the value of our massive traffic and improve efficiency for advertisers, we endeavor to establish a closed-loop solution offering endto-end online marketing services to brand advertisers. These marketing services include production of customized short video ads, live streaming marketing support, follower base and private traffic management, as well as e-commerce monetization. From this services tool box, our brand partners can execute their strategies in brand discovery, promotion and product sales all within our platform. This in turn enhances the environment for our content creators to reap rewards from their talents and establishes an all-in-one destination where our users can discover trusted brands and sources and even socialize and make purchases from them.

To bring our solutions and platform-wide benefits to more brands, we have also expanded our sales teams for brand advertisements to cover more industries together with brand advertising agencies that further bolster our market reach. The main industries we focus on include fast moving consumer goods, beauty and cosmetics, and electronics. For each industry, we offer a customized traffic conversion model based on the industry’s characteristics, which we continually refine and upgrade

On feeds advertisement, in order to boost our value proposition and drive strong return on investment for our advertising partners, we have been investing in infrastructure, which includes an iterative intelligent bidding system with improved advertising effectiveness and efficiency across the board. This system is underpinned by optimized algorithms to provide better matching between ad content and target audiences. With AI-based tools, we were able to assess the effectiveness of different ad content and assist in the production of creative content to not only generate higher returns for advertisers, but also maintain the user experience hence growing room for ad loads. These efforts helped drive our online marketing services with better effectiveness and stronger pricing power in the second quarter of 2021.

On the product side, we launched the Magnetic Taurus platform in the second quarter of 2021, which provides comprehensive closed-loop e-commerce marketing solutions connecting public and private domain traffic. This platform offers multiple options for customization, as well as data visualization and data monitoring, which allows more precise marketing services for merchants. The introduction of Magnetic Taurus has helped improve the efficiency of our algorithms and traffic monetization capabilities and broaden the diversity of advertisers on our platform as well as enhance their engagement. Following the launch of Magnetic Taurus, the number of advertisers served by Magnetic Taurus has continuously increased.

Live streaming

Our live streaming ecosystem remained active and healthy, anchoring a thriving platform for us. The engagement level of our live streaming users improved to a higher level as evidenced by a DAUs penetration rate of over 70% in the second quarter of 2021 on Kuaishou App.

With respect to content creation, we maintained our leadership in terms of number of active streamers and depth and breadth of content offering in various categories catering to different users’ interests, setting us apart from other platforms. The number of daily active streamers on our platform stayed elevated at about 1.9 million during the second quarter of 2021, attracting diverse user cohorts and contributing to a rich and healthy live streaming ecosystem.

We have started undertaking initiatives to deepen monetization of live streaming in the public domain. Through extensive cooperation with talent agencies for live streaming, we have provided enhanced exposure to high-quality content in the public domain and had more systematic operations. In the second quarter of 2021, we launched Project Blue Ocean with the intention to cultivate long-term partnerships with talent agencies nationwide, to collaboratively facilitate healthy development of our live streaming ecosystem and promote high-quality live streaming content leveraging our massive public domain traffic. The drive to cooperate with more talent agencies has brought notable results. By June 30, 2021, the number of talent agencies on our collaboration roster increased by nearly 400% year-over-year comparing with that by June 30, 2020, helping us achieve a 16.9% quarter-over-quarter growth and an 18.2% year-over-year growth in monthly ARPPU for live streaming services on Kuaishou App.

Besides leveraging public domain traffic to promote live streaming, we have also worked on enhancing the governance of live streaming in the private domain, which can inspire more trust and interaction from our users. We believe it will help us create more opportunities for superior content creators. With constant improvements in governance capabilities, traffic efficiency and content offering, we are committed to sustaining the healthy growth and vibrancy of our live streaming ecosystem. This allows content creators with a stickier follower base to further develop, which in turn improves our overall user stickiness and monetization potential of our platform.

Other services including e-commerce

Our other services maintained strong growth momentum in the second quarter of 2021 with revenue increasing by 212.9% year-over-year to RMB2.0 billion, primarily driven by e-commerce, which generated GMV of RMB145.4 billion, doubling from the GMV in the same period of last year. With respect to Kwai Shop, the closed-loop mode of our e-commerce business, its contribution to the total e-commerce GMV for the second quarter of 2021 increased to 90.7%, compared with 66.4% in the same period of 2020. We have continued to enhance the e-commerce infrastructure, including the introduction of tools to make the account opening and management procedures easier for merchants, operate their stores and utilize multi-dimensional data to analyze product performance and user behavior, facilitating and optimizing their product selection. Our closed-loop e-commerce ecosystem has also been further expanded and reinforced continuously.

We further upgraded our e-commerce strategy, strengthening our advantageous trustbased e-commerce model through private domain, which is more suitable for promoting longtail or non-standardized products, while introducing more products from established brands through public domain. To be specific, we have adopted a two-pronged e-commerce strategy: first, solidify our competitive edge in trust-based e-commerce by leveraging the immersive nature of our content and the trust our merchants and streamers fostered through their private domain operations; second, work to fully unlock the value of the public domain in e-commerce by adding more branded products and gradually building users’ trust and confidence in our products and our platform.

Private domain is the bread and butter of our platform. It contributed the majority of our total e-commerce GMV in the second quarter of 2021. As we continually refine our unique business model with content and trust at its core, this will further drive the average repeat purchase rate as well as the conversion rate to e-commerce buyers.

In the public domain, we have strived for a full spectrum of business solutions to support brand self-operated e-commerce live streaming, which include elite distribution, public traffic support, private traffic conversion and operation as well as other brand supporting policies. These efforts have not only broadened our merchants base and merchandise supply, but also expanded users’ circle of trust from streamers to products and to our platform itself, which helps incentivize more e-commerce transactions and reinforce our position as a highly trusted one-stop e-commerce platform.

In addition to supporting merchants, during the second quarter of 2021, we also spared no effort to enrich merchandise supply, strengthen platform governance for consumers, and enhance user experience, all aiming at further optimizing our e-commerce ecosystem.

Our efforts on branded products have also effectively contributed to improvements on merchandise supply, as well as e-commerce DAUs penetration rate and average order value for e-commerce on Kuaishou App. In the second quarter of 2021, we have expanded our merchandise offerings beyond the top-selling categories of women’s apparel, jewelry and jade, beauty and cosmetics. Some emerging product categories such as men’s apparel and sportswear, home appliances and digital products, as well as household goods all achieved high growths in terms of e-commerce GMV during the second quarter of 2021, contributing to an increasing percentage of total e-commerce GMV on a quarter-over-quarter basis. Going forward, we will continue to explore more categories with sufficient scale and high e-commerce compatibility to further fuel our e-commerce GMV growth.

Becoming a safe and trusted platform for users has always been our core value proposition. As such, we have continued to focus on quality control and ecosystem governance to safeguard a vibrant and healthy ecosystem. In the second quarter of 2021, we continued the reinforcement of Kuaishou Selection, our official platform of e-commerce product selection, which has improved the e-commerce experience for our users as well as the efficiency of influencers and merchants. First, we introduced more branded products to Kuaishou Selection in the second quarter of 2021. By providing and promoting officially selected branded items, we have enhanced the overall product quality on our marketplace, making the shopping experience more carefree for consumers. In addition, by deepening collaborative partnerships with brands, we have significantly broadened our selection of products for customers. Kuaishou Selection has also lowered the entry barriers for e-commerce streamers to promote merchandise on our platform and improved their activeness and engagement levels. Driven by these factors, total e-commerce GMV of Kuaishou Selection increased by nearly 90% on a quarter-over-quarter basis in the second quarter of 2021.

We also proactively enhanced our ecosystem governance and consumer rights protection. In the second quarter of 2021, we launched a “Trust Card” that offers a series of guarantees provided by merchants to consumers, such as refund without return, compensation for fake goods, 7-day unconditional return, etc. We will continue to strengthen our platform governance to better protect the rights of our users and business partners, and improve overall customer experience.

Overseas

Overseas expansion has become one of our key strategic efforts given the time window and high growth potential in the overseas markets. The overseas short video and live streaming industry is much less mature and still at an earlier stage of development and commercialization. It has low user penetration and is full of opportunities for future growth and development with user needs yet to be fully met, representing significant and diverse monetization potential.

Underpinned by our experience as the pioneer and a leader of the short video and live streaming industry, with deep insights, mature products and strong technological capabilities accumulated through more than a decade’s rich experience entrenched in the industry, and outstanding advantages in establishing and improving content ecosystems, we are ready to seize the current window of opportunity in the overseas markets by building interactive content communities and social platforms to encourage more people to create value through creation, communication and interaction.

We strategically focus our overseas development efforts in countries and regions that have high population density, strong cultural acceptance for short videos and good upside monetization potential. In the first half of 2021, we primarily focused on markets in South America, Southeast Asia, and the Middle East. We have been actively investing in user acquisition and user activeness improvement. Simultaneously, we have been working to enrich and deepen our content ecosystem, encouraging localized content creation and growing content in different categories, which improve user engagement and retention, as well as rapidly establish an ecosystem that builds a self-reinforcing virtuous cycle between content community and user community. Besides encouraging user generated content, we have also proactively explored premium localized professionally generated content. In June 2021, we became an official sponsor and the official social media platform of the CONMEBOL Copa America 2021 held in Brazil, with rights to short video production of this event. Our successful operation of CONMEBOL Copa America 2021 events effectively improved the user engagement and activeness in the South America market.

During our initial exploration of overseas markets, we achieved encouraging results that well exceeded our original expectations, further solidifying our resolve to grow our overseas business. In June 2021, we achieved MAUs of more than 180 million in the overseas markets. The growing user base in overseas markets helps us to gain better insights into our users by leveraging our technology and data analysis capabilities, enabling us to provide optimized recommendation algorithms, and continuously refine our products and user experience. All these investments, efforts and accumulated experience will be invaluable assets for our longer-term development in the broad overseas markets.