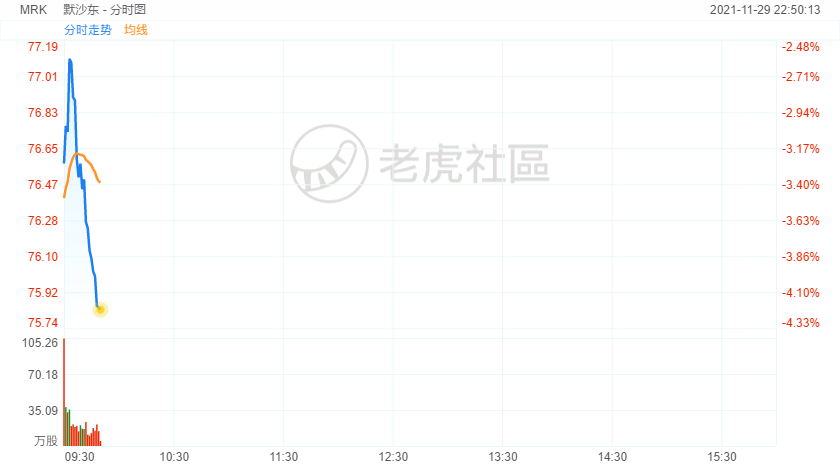

Merck stock dipped more than 4% in morning trading as it was downgraded to neutral from buy by Citi Research.

Disappointing results for some major drugs has limited the upside for Merck’s stock, according to Citi.

Analyst Andrew Baum downgraded Merck to neutral from buy, saying in a note to clients on Monday that development struggles for the company’s HIV drug islatravir was taking a bite out of Merck’s long-term potential.

“Our long-standing investment thesis on MRK was based on underappreciation of MRK’s pipeline, especially islatravir for HIV to help to offset the forthcoming Keytruda [loss of exclusivity] ... We have removed our $4bn risk adjusted 2030 estimate from our model, reducing our EPS estimates up to 10%,” the note said.

Citi cut its price target on Merck to $85 per share from $105. The new target is about 7% above where the stock closed on Friday.