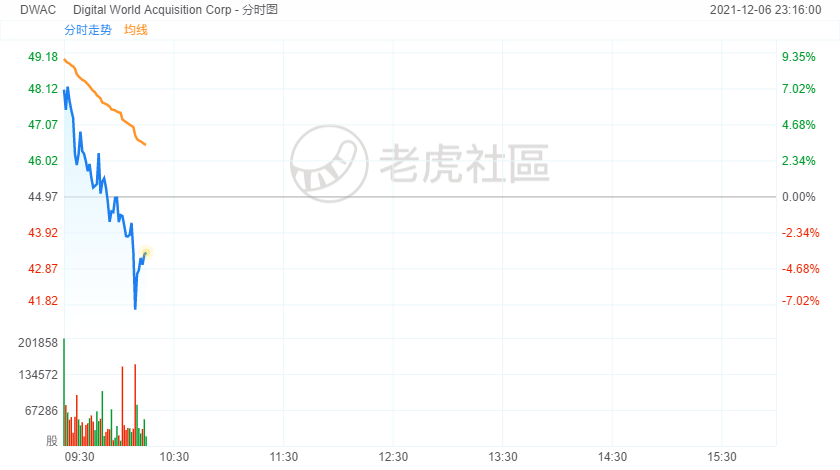

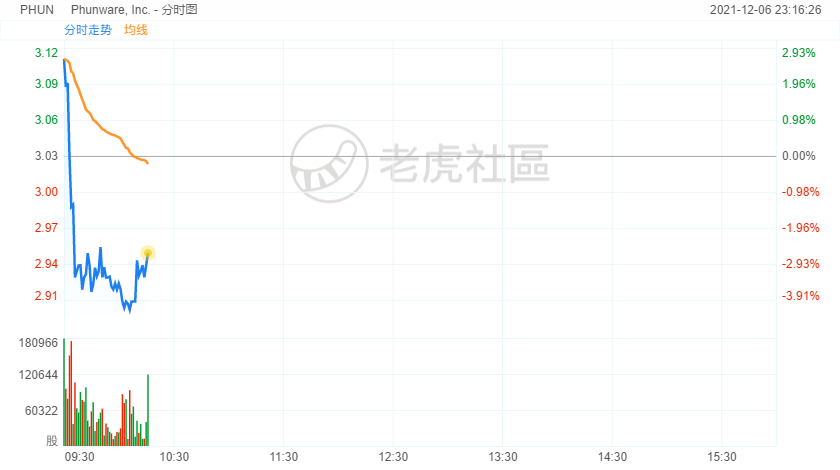

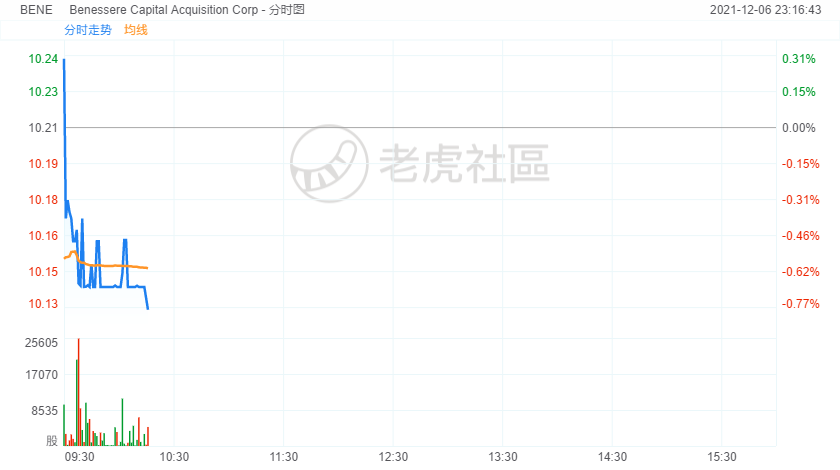

Trump stocks slid in morning trading after Trump SPAC investigated by federal regulators including SEC.

The publicly traded SPAC that has announced plans to merge with former President Donald Trump's new social media company said in a new filing that the SEC and FINRA regulatory agencies have asked for information regarding stock trading and communications with Trump's company before the deal was announced.

The investigations were disclosed in an 8-K filing by Digital World Acquisition Corp., the special purpose acquisition company.

"DWAC has received certain preliminary, fact-finding inquiries from regulatory authorities, with which it is cooperating," the company said in the filing.

"Specifically, in late October and in early November 2021, DWAC received a request for information from FINRA, surrounding events (specifically, a review of trading) that preceded the public announcement of the October 20, 2021 Merger Agreement," the filing said.

"According to FINRA's request, the inquiry should not be construed as an indication that FINRA has determined that any violations of Nasdaq rules or federal securities laws have occurred, nor as a reflection upon the merits of the securities involved or upon any person who effected transactions in such securities."

"Additionally, in early November 2021, DWAC received a voluntary information and document request from the SEC which sought, inter alia, documents relating to meetings of DWAC's Board of Directors, policies and procedures relating to trading, the identification of banking, telephone, and email addresses, the identities of certain investors, and certain documents and communications between DWAC and TMTG," DWAC's filing said.

"According to the SEC's request, the investigation does not mean that the SEC has concluded that anyone violated the law or that the SEC has a negative opinion of DWAC or any person, event, or security."