U.S. stocks fell on Tuesday, with tech names dragging down the Nasdaq and the broader markets as Treasury yields traded near three-month highs.

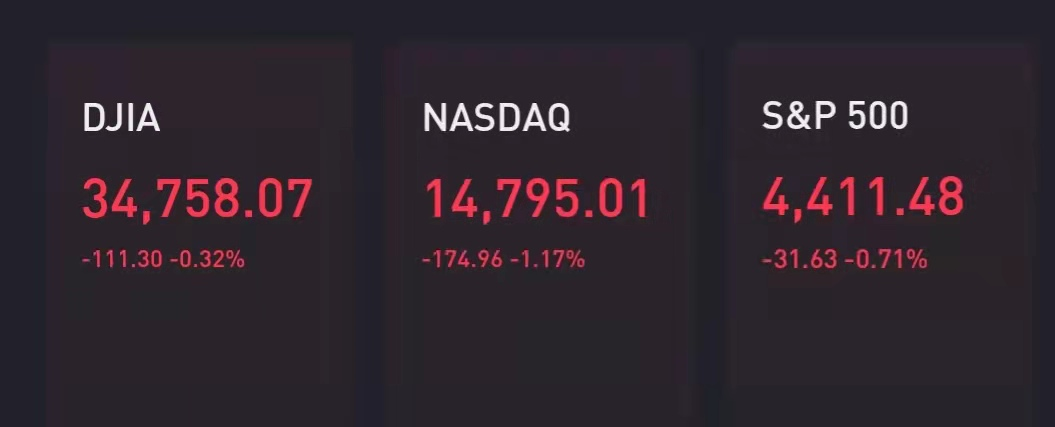

The Nasdaq Composite was down 1.2% in early trading, and the S&P 500 shed 0.7%. The Dow Jones Industrial Average lost about 111 points, or 0.3%.

The 10-year Treasury yield continued its speedy climb on Tuesday, rising as high as 1.546% as investors bet the Fed would carry through on its promise to curb its emergency bond-buying stimulus as inflation jumps. The 10-year yield has reversed dramatically to the highest levels since June since the Fed signaled last week it would taper its $120 billion in monthly bond purchases "soon."

The 10-year rate was as low as 1.29% at one point last week and was as low as 1.13% as recently as August. The 30-year Treasury yield has also been on the move, topping 2%.

Tech shares were dropping as a rapid rise in rates makes their future cash flows less valuable, and in turn makes the popular stocks appear overvalued. Higher rates also hinder tech companies' ability to fund their growth and buy back stock.

Facebook, Amazon, Apple and Alphabet shares all lost more than 1% in morning trading. Large chip stocks like Nvidia shed 2%.

The drop in tech dragged down sentiment on the markets though there were pockets of strength. Energy stocks like Exxon rose in early trading as WTI crude topped $76 a barrel. Shares of Ford rose more than 3% after the company announced plans to build new production facilities in the U.S.

"Rather than ending the equity rally, we expect the rise in yields to favor cyclical sectors such as financials and energy over growth sectors such as technology, which experience a bigger drag on the present value of future cash flows from higher rates," said Mark Haefele, chief investment officer at UBS Global Wealth Management.

Also weighing on sentiment was a budget showdown in Washington.Senate Republicans blocked a House-passed bill Monday that would have funded the government into December and suspended the debt ceiling until December of 2022. Congress must approve government funding by Friday to avoid a shutdown and must raise the debt ceiling soon to avoid an unprecedented U.S. default.

Equities saw an uneven session on Monday amid the spike in rates.

The Dow Jones Industrial Average on Monday gained 71 points, and the small-cap Russell 2000 rallied 1.5%. However, the S&P 500 fell 0.3%. The Nasdaq Composite was the relative underperformer, dipping 0.5%, as the drop in bond prices pressured growth names like Microsoft and Amazon.

“The stock market increasingly indicates that the U.S. economy has entered another reopening cycle,” Leuthold Group chief investment strategist Jim Paulsen.

“A Covid-led resurgence in economic activity may well worsen supply chain woes and eventually reignite inflation concerns. But, for now, it has forced investors to reevaluate whether they have too much in growth and tech and not enough in economically sensitive investments,” Paulsen added.

Traders will be watching testimony from Federal Reserve Chair Jerome Powell to the Senate Banking Committee on Tuesday. In prepared remarks, the central bank chief said that inflation could persist longer-than-expected.

“Inflation is elevated and will likely remain so in coming months before moderating,” Powell said. “As the economy continues to reopen and spending rebounds, we are seeing upward pressure on prices, particularly due to supply bottlenecks in some sectors. These effects have been larger and longer lasting than anticipated, but they will abate, and as they do, inflation is expected to drop back toward our longer-run 2 percent goal.”

The central bank indicated last week that it was ready to begin “tapering” — the process of slowly pulling back the stimulus they’ve provided during the pandemic. The Fed left rates unchanged but penciled in possibly one interest rate hike in 2022, followed by three apiece in the 2023 and 2024.

Treasury Secretary Janet Yellen, who will also testify in the Senate on Tuesday, warned Congress in a letter that lawmakers need to raise the debt limit by Oct. 18 to avoid a government default.

Thursday marks the final day of trading of September and the third quarter. The Dow is down 1.4% for the month, and the S&P 500 is off by 1.8%. The Nasdaq Composite has lost 1.9% in September.

The Covid-19 delta variant, the Federal Reserve's tapering plan and inflation have worried investors. However, the Dow is still up nearly 14% year to date despite the weakness in September. The S&P 500 and Nasdaq are also sharply higher.