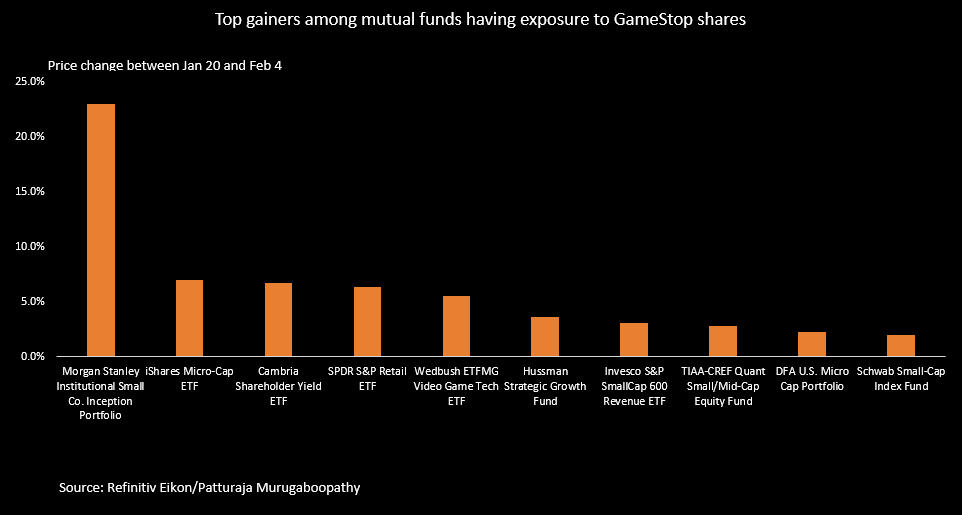

(Reuters) - The Morgan Stanley Institutional Small Co. Inception Portfolio fund was among the top gainers among mutual funds over the past two weeks having exposure to videogame retailer GameStop, data from Refinitiv Lipper showed.

Crowds of retail punters sent shares in GameStop up by more than 2000% last month, causing some Wall Street hedge funds to lose billions of dollars on their short bets on the stock.

The Morgan Stanley fund, which had 346,943 shares of GameStop as per the latest filing, gained 23% in the last two weeks, according to the data, which was based on the last two weeks’ price performance.

The fund’s net assets rose 61% to $746.7 million in January, the data showed.

Shares of iShares Micro-Cap ETF and Cambria Shareholder Yield ETF also gained about 7% each in the past two weeks.

Graphic: Mutual fund gainers in the past two weeks

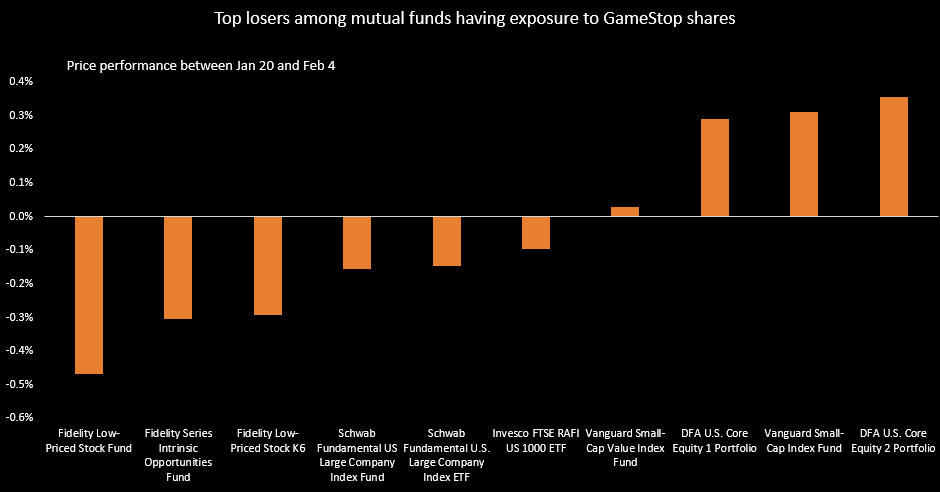

Shares of GameStop have fallen more than 83.5% in the first four days of this month as the retail frenzy faded.

Graphic: Bottom performers in the past two weeks