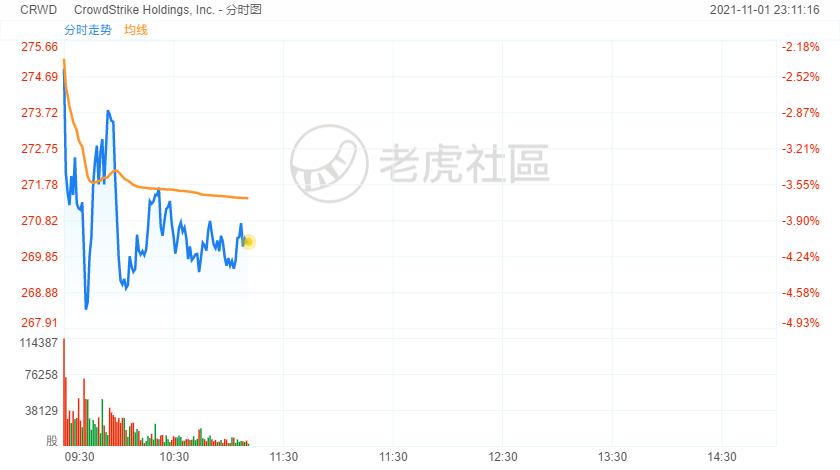

CrowdStrike shares fell more than 4% in morning trading after a BTIG analyst downgraded the cybersecurity company to neutral from buy.

Analyst Gray Powell, who downgraded CrowdStrike without a price target, said in a research note that his channel checks indicate that competition "is on the rise" and that tailwinds to CrowdStrike's growth in 2022 will ease from 2021, according to the Fly.

As such, Powell said the company's growth in annual recurring revenue will likely moderate into the 40% to 45% range in a fiscal 2023 "upside scenario."

The analyst said this means that investors "will be faced with the difficult task of gauging the slope of a deceleration and sustainable long-term growth rates over the next 6 to 12 months."

Last week, CrowdStrike's shares rose after the company unveiled new features to the CrowdStrike Falcon platform, which works with services from Amazon Web Services.

The expanded features provide joint customers with comprehensive visibility, dynamic scale, automation and flexibility to better prevent, detect and respond to threats in the cloud and across endpoints, the company said.

In September, several analysts raised their price targets for CrowdStrike after the company beat Wall Street's second-quarter-earnings expectations.

CrowdStrike reported earnings of 11 cents a share, beating the FactSet consensus of 9 cents a share. Revenue totaled $337.7 million, up 70% from a year earlier. Analysts were looking for $323.2 million.

The company also raised its revenue guidance for the year to a range of $1.39 billion to $1.4 billion.