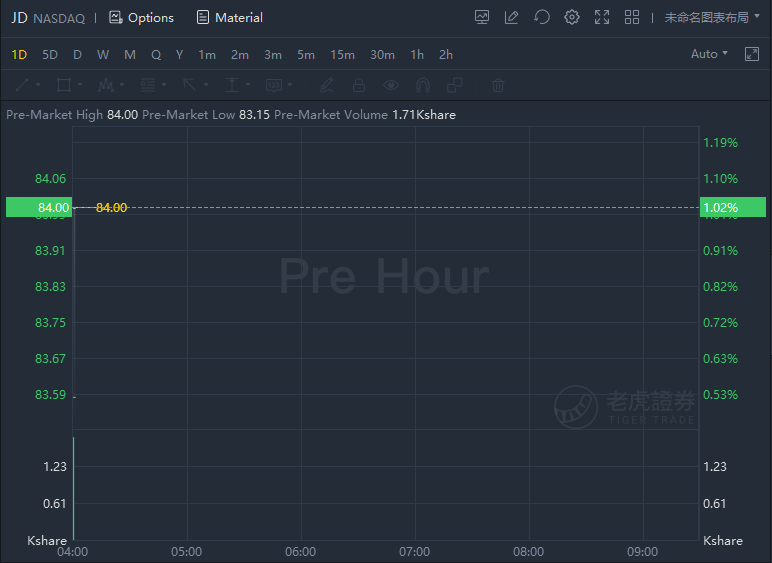

JD.com rose over 1% in premarket trading after showing its financial report.Its stocks in Hong Kong dipped 3.58% today.

The company today announced its unaudited financial results for the three months ended September 30, 2021.

Third Quarter 2021 Highlights

- Net revenues for the third quarter of 2021 were RMB218.7 billion (US$133.9 billion), an increase of 25.5% from the third quarter of 2020. Net service revenues for the third quarter of 2021 were RMB32.7 billion (US$5.1 billion), an increase of 43.3% from the third quarter of 2020.

- Income from operations for the third quarter of 2021 was RMB2.6 billion (US$0.4 billion), compared to RMB4.4 billion for the same period last year.Non-GAAP income from operationsfor the third quarter of 2021 was RMB4.6 billion (US$0.7 billion), compared to RMB5.3 billion for the third quarter of 2020. Operating margin of JD Retail before unallocated items for the third quarter of 2021 was 4.0%, compared to 4.2% for the third quarter of 2020.

- Net loss attributable to ordinary shareholders for the third quarter of 2021 was RMB2.8 billion (US$0.4 billion), compared to a net income of RMB7.6 billion for the same period last year.Non-GAAP net income attributable to ordinary shareholders for the third quarter of 2021 was RMB5.0 billion (US$0.8 billion), compared to RMB5.6 billion for the same period last year.

- Diluted net loss per ADS for the third quarter of 2021 was RMB1.81 (US$0.28), compared to an income per ADS of RMB4.70 for the third quarter of 2020.Non-GAAP diluted net income per ADSfor the third quarter of 2021 was RMB3.16 (US$0.49), compared to RMB3.42 for the same period last year.

- Operating cash flow for the twelve months ended September 30, 2021 increased to RMB41.0 billion (US$6.4 billion) from RMB37.3 billion for the twelve months ended September 30, 2020. Free cash flow, which excludes the impact from JD Baitiao receivables included in the operating cash flow, for the twelve months ended September 30, 2021 was RMB28.5 billion (US$4.4 billion), compared to RMB30.2 billion for the twelve months ended September 30, 2020.

- Annual active customer accounts increased by 25.0% to 552.2 million in the twelve months ended September 30, 2021 from 441.6 million in the twelve months ended September 30, 2020.

Business Highlights

Environment, Social and Governance

- In August, Jingxi, a platform for everyday shopping under JD.com, donated over 100,000 prevention supply kits, including facemasks and hand sanitizers to local residents in Nanjing in response to the COVID-19 outbreak. Nanjing residents can apply to receive kits free of charge through Jingxi’s multiple online platforms.

- During the 4th Chinese Farmers’ Harvest Festival in September, JD.com announced that in 2021, the company’s supportive measures for agriculture in rural areas have promoted the development of local brands from scratch, such as Suqian King Crabs in Jiangsu Province, and increased the transaction volume of local agricultural products by more than 200%. In continuing its commitment to rural rejuvenation, JD.com has constructed logistics infrastructure in production regions, and built an agricultural product marketing ecosystem which integrates JD’s sales channels.

JD Retail

- In September, JD.com opened its first “JD MALL” offline store in Xi’an offering consumers an immersive omni-channel shopping experience. In addition to traditional electronic categories offered by JD Super Experience Store, JD MALL provides over 200,000 items from more than 150 brands, in categories including home, furniture, kids, smart healthcare products and auto accessories. Through its partnership with furniture maker Shangpin Home Collection, JD MALL meets the demand among younger consumers for bespoke one-stop-shop home design services that incorporate furniture and home appliances categories.

- In the third quarter, over 20 domestic and international household and home decor brands launched official stores on JD.com, including Camerich, Lost & Found, QEEBOO, and Lattoflex, bringing a variety of high-quality and stylish home goods to address consumers’ increasingly diverse lifestyle preferences.

- Sephora, a high-end beauty retailer owned by LVMH, recently joined JD.com’s omni-channel service network. Products ordered through the Sephora store on JD.com can be delivered to consumers’ doorsteps within one hour from nearby Sephora offline stores. Chinese beauty brand Perfect Diary also joined JD.com’s omni-channel service network to offer delivery from its 120 offline stores in 84 cities.

- During the quarter, JD.com and Dada Group formed a strategic partnership with ASUS, a global technology leader, launching more than 150 ASUS stores on JD Daojia (JDDJ) and “Shop Now”, JD.com’s new on-demand consumer retail section. The three parties will further accelerate the digital transformation of physical stores in the second half of 2021 to improve the offline shopping experience for computer and digital products, including the extension of “one-hour delivery” service to all ASUS offline stores in China.

JD Health

- In July, JD Health and Allianz JD, JD.com’s joint venture with Allianz, one of the world’s leading insurers and asset managers, jointly launched a comprehensive online clinical insurance service offering a one-stop platform for healthcare, medicine purchasing and insurance services. By connecting users directly with doctors, pharmacies and insurance companies, JD Health improves the experience of insured users through its full cycle service that provide online health consultations, prescriptions, direct claims and reimbursements as well as medicine purchasing and door-to-door delivery.

- In September, over 200 institutional exhibitors and participants attended JD Health’s third Online Pharmaceutical Expo under the theme “Intelligent Digital Empowerment and Ecosystem Interconnection”. JD Health helped to facilitate transactions between up and downstream players among the participating companies to create a “Intelligent Digital Pharmaceutical Circulation Supply Chain Ecosystem” to support digital transformation and optimize user experience in the health care industry.

JD Logistics

- In September, JD Logistics launched an air cargo route between East China and London marking JD Logistics’s first regular cargo charter flight between China and Europe. Further expanding JD Logistics’s international transportation network, the route will deliver products from China’s major manufacturing regions with same day port-to-port delivery and product arrival within one week.

- In the third quarter, JD Logistics established a strategic partnership with Volvo Cars to build integrated supply chain services for the mid and high-end auto aftermarket. The two parties will cooperate in areas such as supply chain warehouse networks planning, inventory management and store delivery.

- As of September 30, 2021, JD Logistics operated approximately 1,300 warehouses, which covered an aggregate gross floor area of over 23 million square meters, including space in cloud warehouses managed under the JD Logistics Open Warehouse Platform.

Third Quarter 2021 Financial Results

Net Revenues. For the third quarter of 2021, JD.com reported net revenues of RMB218.7 billion (US$33.9 billion), representing a 25.5% increase from the same period of 2020. Net product revenues increased by 22.9%, while net service revenues increased by 43.3% for the third quarter of 2021, as compared to the same period of 2020.

Cost of Revenues.Cost of revenues increased by 27.3% to RMB187.6 billion (US$29.1 billion) for the third quarter of 2021 from RMB147.4 billion for the third quarter of 2020.

Fulfillment Expenses.Fulfillment expenses, which primarily include procurement, warehousing, delivery, customer service and payment processing expenses, increased by 23.2% to RMB14.3 billion (US$2.2 billion) for the third quarter of 2021 from RMB11.6 billion for the third quarter of 2020. Fulfillment expenses as a percentage of net revenues was 6.5% for the third quarter of 2021, compared to 6.7% for the same period last year.

Marketing Expenses.Marketing expenses increased by 42.3% to RMB7.8 billion (US$1.2 billion) for the third quarter of 2021 from RMB5.5 billion for the third quarter of 2020.

Research and Development Expenses.Research and development expenses was RMB4.0 billion (US$0.6 billion) for the third quarter of 2021, as compared to RMB4.1 billion for the third quarter of 2020.

General and Administrative Expenses. General and administrative expenses increased by 91.1% to RMB3.1 billion (US$0.5 billion) for the third quarter of 2021 from RMB1.6 billion for the third quarter of 2020. The increase was primarily due to the increase in share-based compensation expenses.

Income from Operations and Non-GAAP Income from Operations.Income from operations for the third quarter of 2021 was RMB2.6 billion (US$0.4 billion), compared to RMB4.4 billion for the same period last year. Non-GAAP income from operations for the third quarter of 2021 was RMB4.6 billion (US$0.7 billion), compared to RMB5.3 billion for the third quarter of 2020. Operating margin of JD Retail before unallocated items for the third quarter of 2021 was 4.0%, compared to 4.2% for the third quarter of 2020.

Non-GAAP EBITDA.Non-GAAP EBITDA for the third quarter of 2021 was RMB5.9 billion (US$0.9 billion), compared to RMB6.6 billion for the third quarter of 2020.

Share of Results of Equity Investees. Share of results of equity investees was a loss of RMB1.9 billion (US$0.3 billion) for the third quarter of 2021, as compared to a loss of RMB0.3 billion for the third quarter of 2020. The loss for the third quarter of 2021 was primarily due to non-cash impairment in certain equity investees.

Others, net.Other non-operating loss was RMB3.1 billion (US$0.5 billion) for the third quarter of 2021, as compared to other non-operating income of RMB4.5 billion for the third quarter of 2020. The decrease was primarily due to fair value change of investment securities, which resulting from decreases in the market prices of equity investments in publicly-traded companies.

Net Income/(Loss)Attributable to Ordinary Shareholdersand Non-GAAP Net IncomeAttributable to Ordinary Shareholders.Net loss attributable to ordinary shareholders for the third quarter of 2021 was RMB2.8 billion (US$0.4 billion), compared to a net income of RMB7.6 billion for the same period last year. Non-GAAP net income attributable to ordinary shareholders for the third quarter of 2021 was RMB5.0 billion (US$0.8 billion), compared to RMB5.6 billion for the same period last year.

Diluted EPS and Non-GAAP Diluted EPS.Diluted net loss per ADS for the third quarter of 2021 was RMB1.81 (US$0.28), compared to a diluted net income per ADS of RMB4.70 for the third quarter of 2020. Non-GAAP diluted net income per ADS for the third quarter of 2021 was RMB3.16 (US$0.49), compared to RMB3.42 for the third quarter of 2020.