What Happened:Shares of NIO Inc lost 4% Tuesday as many U.S. and Asian stocks fell due to omicron COVID-19 variant concerns.

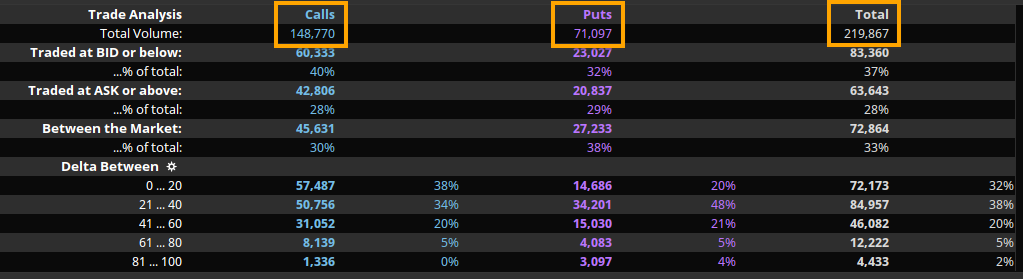

The stock is approaching a major support level around $30 that has held since October of 2020. Looking at the option flows on the day, there are over 148,000 calls and 71,000 puts, so two out of every three options on the day are calls (image below).

Prior to Tuesday's trading, there were approximately 1.8 million calls and 1.6 million puts in NIO for a total of 3.48 million options.

This means that the option flows for Tuesday represent about 7% of the total options, which is solid considering the FOMC meeting on Wednesday, Dec. 15 is putting a damper on flows.

Why It Matters:Generally traders do not make aggressive bets ahead of a FOMC, meeting, especially the last one of the year, which could set the tone for trading in 2022.

Of the approximately 219,000 options traded today, only about 60,000 of them are short dated (expiring Friday, Dec. 17), which means the majority of flows are forward looking beyond the FOMC and monthly op-ex.

The next largest option expiry by volume is the Jan. 21 op-ex, which means a strong amount of traders are taking bullish bets on Nio into next year.

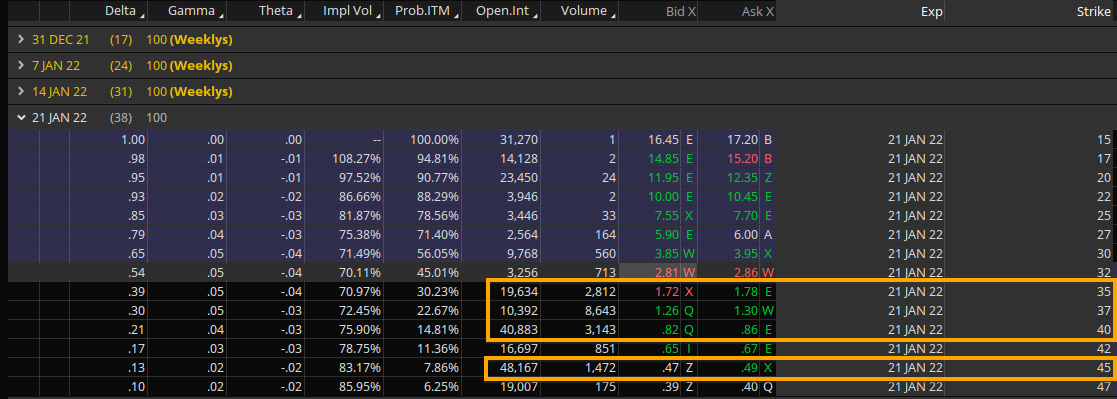

What's Next:Looking at the option chain for the Jan. 21 expiry next year, the largest strikes by volume are concentrated between the $35 and $40 strikes (image below).

Meanwhile, the largest strikes by open interest are the $40 and $45 strikes, which shows a fair amount of interest for a bounce off support and a move back up into the $40s.

It should be noted the option market is currently pricing in a 14% probability NIO closes at or above $40 by the January op-ex next year, so it's currently a lower probability event.

But if the $30 level can hold for this week and there is no hawkishness out of the Fed for the FOMC on Dec. 15, then equities might get a Christmas rally to end the year, as the bearish pressure leading into the FOMC could subside.

On the other hand, if the stock closes below the $30 level on a weekly closing basis, then the next support does not come in until around $25.