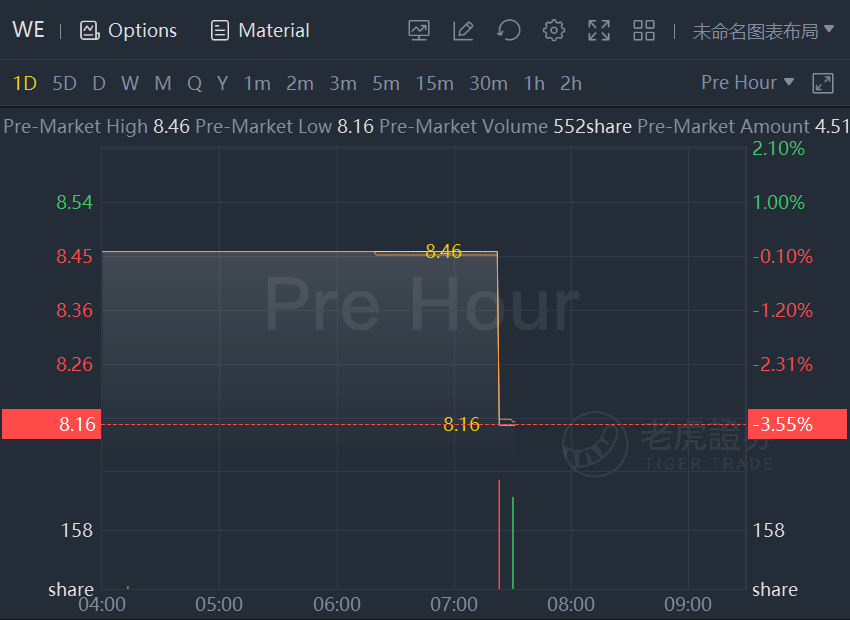

WeWork shares dropped 3.6% in premarket trading as the company to restate results due to classification error with its SPAC acquirer.

WeWork Inc. said in a securities filing that it would restate several quarters of its results, including its latest one, and that management has concluded there was a material weakness in its internal control.

The office-sharing company,which went public in October through a combination with BowX Acquisition Corp., a special-purpose acquisition company, said Wednesday that the reinstatement relates to accounting classification of common shares issued as part of BowX’s initial public offering.

It classified a portion of those shares as permanent equity. Given that the shares had “certain redemption features not solely within the company’s control,” they should have been classified as temporary equity.

Given the classification error, “There was a material weakness in internal control over financial reporting relating to the interpretation and accounting for certain complex features of the public shares,” the company said in a securities filing.

As a result of the finding, the company plans to restate financial statements for 2020 and the first three quarters of 2021.

The company said in a statement Wednesday that the restatement plans aren’t related to its current operations.

“The ‘material weakness’ referenced in the filing today existed at BowX and does not carry over to WeWork,” the company said.