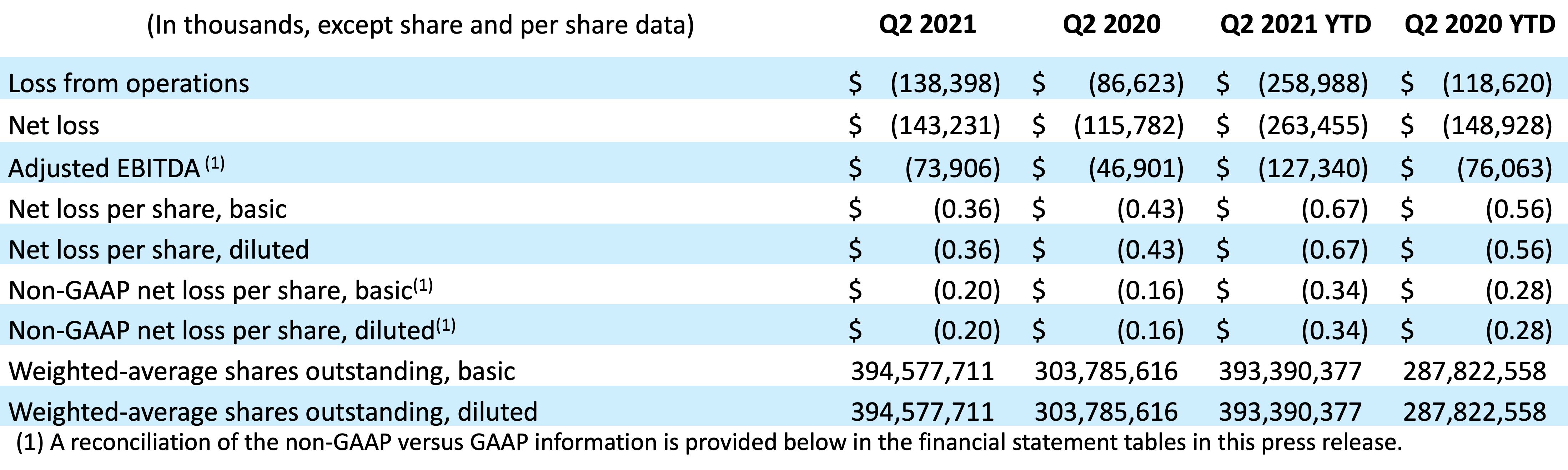

(August 3) Nikola Corporation Q2 adj. per-share loss 20 cents; FactSet loss consensus 30 cents.

Nikola Q2 per-share loss 36 cents vs. loss 43 cents a year ago.

Nikola Q2 net loss 143.23 bln vs. net loss 115.78 bln a year ago.

Nikola expects to deliver pre-series Tre BEVs for use on public roads in 2H2021.

Business Outlook

- Nikola looks forward to achieving the following milestones in the second half of 2021:

- Deliver pre-series Nikola Tre BEVs for use on public roads hauling customer freight;

- Announce additional fleet testing customers/dealers;

- Break ground on our first commercial hydrogen station and/or centralized hydrogen production facility; and

- Announce additional hydrogen infrastructure/ecosystem partners

Acquired 20% Interest in Wabash Valley Resources

On June 22, Nikola acquired a 20% equity interest in Wabash Valley Resources LLC (WVR), a clean hydrogen project being developed in West Terra Haute, Indiana in exchange for a $54.1 million cash and stock consideration. The project plans to use solid waste byproducts such as petroleum coke combined with biomass to produce clean and sustainable hydrogen. As part of the agreement, Nikola acquired the right to offtake up to 20% of the clean gaseous hydrogen produced at the facility at the anticipated price of less than $1.00 / kg*.

The offtake agreement with WVR could provide Nikola with approximately 50 tons of hydrogen per day following completion of the plant. This would allow us to supply clean hydrogen in a critical geography.

Closed $300 Million Purchase Agreement with Tumim Stone Capital

On June 11, Nikola entered into a common stock purchase agreement with Tumim Stone Capital LLC (Tumim), obligating Tumim to purchase up to $300 million of Nikola common stock. Under the agreement, Nikola has the right, but not the obligation to sell shares of its common stock to Tumim, subject to certain limitations. Purchase notices may be issued to Tumim over the period commencing from the date of the purchase agreement and ending on the first day of the month following the 36 months anniversary. The shares will be issued at a 3% discount to the three-day forward volume weighted average price (VWAP) from the date a purchase notice is issued.

This allows us to sell shares to Tumim at our sole discretion and provides us with additional liquidity to execute on our business plan.

Nikola Corporation gained nearly 2% in premarket trading.