U.S. stock futures edged higher on Friday and pointed to weekly gains for major indexes, after results from Goldman Sachs and retail sales data.

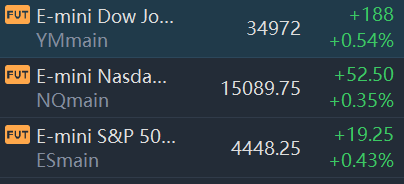

At 08:35 a.m. ET, Dow e-minis were up 188 points, or 0.54%, S&P 500 e-minis were up 19.25 points, or 0.43%, and Nasdaq 100 e-minis were up 52.5 points, or 0.35%.

Goldman Sachs crushed analysts’ estimates on strong investment banking and trading results.The shares rose more than 2% in premarket trading.

Strong results from a clutch of banks, including Citigroup and Morgan Stanley, propelled the S&P 500 to its biggest daily percentage gain since early March on Thursday, while data on the labor market and inflation eased fears over the outlook for higher rates.

U.S. retail sales climb 0.7% in September, above forecast.Consumers spent at a much faster pace than expected in September, defying expectation for a pullback, the Census Bureau reported Friday.

Retail sales for the month increased 0.7%, against the Dow Jones estimate for a decline of 0.2%. Excluding auto-related sales, the number rose 0.8%, better than the 0.5% forecast.

Stocks making the biggest moves premarket:

Moderna(MRNA) – Moderna added 3.3% in premarket trading after rising 3.2% yesterday, following an FDA panel recommendation for a booster dose of its Covid-19 vaccine. The panel recommended approval of a booster for people 65 and over as well as those at high risk.

Virgin Galactic(SPCE) – Virgin Galactic shares tumbled 17.5% in the premarket after it said it would delay the launch of its commercial space service to the fourth quarter of 2022 from the third quarter. The company is taking the extra time to work on improvements to its space vehicles.

TSMC(TSM) – TSMC stock surged about 2% in premarket trading after Japan planning to subsidize TSMC plant.The world's leading contract chipmaker announced Thursday that it will build its first-ever Japanese plant, responding to years of calls by the Ministry of Economy, Trade and Industry to set up shop.

Nio(NIO) – Nio stock rose nearly 2% in premarket trading.The chinese electric vehicle maker said it would double the capacity of its Hefei plant to 240,000 vehicles a year, up from 120,000 units.

fuboTV(FUBO) – fuboTV’s Sportsbook unit struck a deal with Nascar to become the racing circuit’s authorized gaming operator. fuboTV shares added 2.2% in premarket trading.

Alcoa(AA) – Alcoa reported an adjusted quarterly profit of $2.05 per share, beating the consensus estimate of $1.80. The aluminum producer’s revenue topped estimates as well on higher aluminum prices. Alcoa jumped 6.8% in premarket action.

Western Digital(WDC) – Western Digital stock dipped 2.1% in premarket trading.Goldman Sachs downgraded the storage hardware maker's stock to "neutral" from "buy".

Truist Financial(TFC) – The bank beat estimates by 21 cents with adjusted quarterly earnings of $1.42 per share and revenue also above estimates. Truist’s results were helped by stronger fee income as well as loan and deposit growth.

PNC Financial(PNC) – PNC reported adjusted quarterly earnings of $3.75 per share, compared with a consensus estimate of $3.20 and revenue also topping Wall Street forecasts. PNC benefited from the recapture of credit loss provisions as well as the integration of BBVA USA, a deal that closed last October. PNC rose 1.3% in premarket trading.

Pearson(PSO) – Pearson tumbled 11.3% in premarket trading after the educational materials company said higher education sales have fallen 7% so far this year, even though the company maintained its full-year guidance. Pearson said enrollments at community colleges in the U.S. appear to have been hit by the delta variant of Covid-19.

Corsair Gaming(CRSR) – Corsair shares slid 5.5% in the premarket after the maker of video game-related peripheral products said supply chain issues were hurting sales. Corsair said 2021 will still be a “strong growth year.”

23andMe(ME) – The consumer genetics company’s stock surged 9% in premarket trading, following a positive mention by EMJ Capital founder and portfolio manager Eric Jackson on CNBC’s “Closing Bell” Thursday. Jackson said 23andMe should be more properly thought of as a therapeutics company in addition to being a subscription service, which he thinks bodes well for future growth.

Del Taco(TACO) – The restaurant chain reported adjusted quarterly earnings of 11 cents per share, a penny above estimates, with revenue essentially in line with Wall Street forecasts. However, comparable sales rose 1.8%, short of the 2.1% estimate from analysts surveyed by FactSet. Shares slid 3.6% in the premarket.