U.S. stock index futures slid on Monday after a bruising selloff last week, as geopolitical tensions in Ukraine roiled risk appetite ahead of a Federal Reserve policy meeting later this week.

Market Snapshot

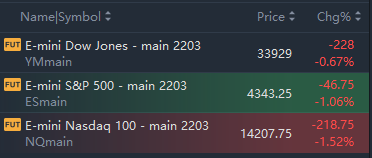

At 08:31 a.m. ET, Dow e-minis were down 228 points, or 0.67%, S&P 500 e-minis were down 46.75 points, or 1.06%, and Nasdaq 100 e-minis were down 218.75 points, or 1.52%.

Pre-Market Movers

Kohl’s (KSS) – Kohl’s soared 27.3% in premarket trading as takeover interest in the retailer ramps up. Starboard-backed Acacia Research is offering $64 per share for Kohl’s, compared to Friday’s close of $46.84 a share. People familiar with the matter say private-equity firm Sycamore Partners has reached out with a potential offer of at least $65 per share.

Snap (SNAP) – Snap shares slid 5.3% in the premarket after it was downgraded to “neutral” from “outperform” at Wedbush, which sees various headwinds impacting the social media network operator’s revenue growth.

Philips (PHG) – Philips slid 4.2% in premarket action after the Dutch health technology company reported falling profit due in part to supply chain issues that are expected to persist in coming months. Philips did predict a strong recovery in sales for the second half of the year.

Peloton (PTON) – Activist investor Blackwells Capital is calling on Peloton to fire its CEO and seek a sale of the company. The fitness equipment maker’s stock is down more than 80% from its all-time high, as it struggles to deal with rapidly changing supply-and-demand dynamics. Peloton fell 2% in premarket trading.

Halliburton (HAL) – Halliburton rose 1.5% in the premarket after the oilfield services company beat top and bottom line estimates for the fourth quarter. Halliburton earned 36 cents per share, 2 cents a share above estimates. Demand for the company’s services jumped as oil prices rose. Halliburton also raised its quarterly dividend to 12 cents per share from 4.5 cents a share.

Unilever (UL) – Unilever surged 6.6% in the premarket following reports that Nelson Peltz’s Trian Partners has built up a stake in the consumer products giant. The size of the stake could not be determined, and Trian said it did not comment on market rumors when contacted by CNBC.

Fox Corp. (FOXA) – Fox added 1.6% in premarket trading after UBS upgraded the stock to “buy” from “neutral.” UBS said among traditional media companies, Fox is among the best poised to benefit from an acceleration in sports betting, and also pointed to Fox’s strong position among pay-TV providers.

Discover Financial (DFS) – Discover Financial was upgraded to “overweight” from “neutral” at Piper Sandler, which cites several factors including the financial services company’s valuation. Discover gained 1.1% in premarket trading.

Coinbase (COIN) – The cryptocurrency exchange operator’s shares tumbled 7.8% in the premarket, reflecting the downward move in crypto over the weekend and this morning, with Bitcoin touching its lowest level since July. Microstrategy (MSTR) – the business analytics company that holds several billion dollars in bitcoin – plunged 12.2%.

Comcast (CMCSA) – The NBCUniversal and CNBC parent was upgraded to “outperform” from “sector perform” at RBC Capital, which thinks that subscriber growth concerns have been overblown. Comcast added 1.1% in the premarket.

Market News

Blackwells Capital to push stationary-bike maker to explore a sale, sources say. An activist investor wants Peloton Interactive Inc. to fire its chief executive and explore a sale after the stationary-bike maker’s stock plummeted more than 80% from its high, as growth slowed.

American banking giant JPMorgan has merged most of its European Union businesses into a single entity in Germany, it said on Monday, seeking to make its business in the bloc more competitive after Britain's departure.

U.S. department store Kohl's Corp may soon receive a second takeover offer as private equity firm. Sycamore Partners has reached out to Kohl's about a potential offer that would value the company around $9 billion, one source said. The firm is willing to pay at least $65 a share in cash for the company, the source said.

Accell Group, the maker of bicycle brands such as Sparta and Batavus, has agreed to an all-cash takeover by a consortium led by KKR that values the company at 1.56 billion euros ($1.77 billion), it said in a statement on Monday.

Wynn Resorts is looking to unload its online sports-betting business at a steep discount as the fledgling niche faces painful losses from stiff taxes and costly promotions needed to lure customers.

A stake that Nelson Peltz’s activist hedge fund has built in Unilever Plc is adding to pressure on the Dove soap maker’s chief executive officer, Alan Jope, after Jope’s failed bid to buy a consumer-health unit from GlaxoSmithKline Plc.