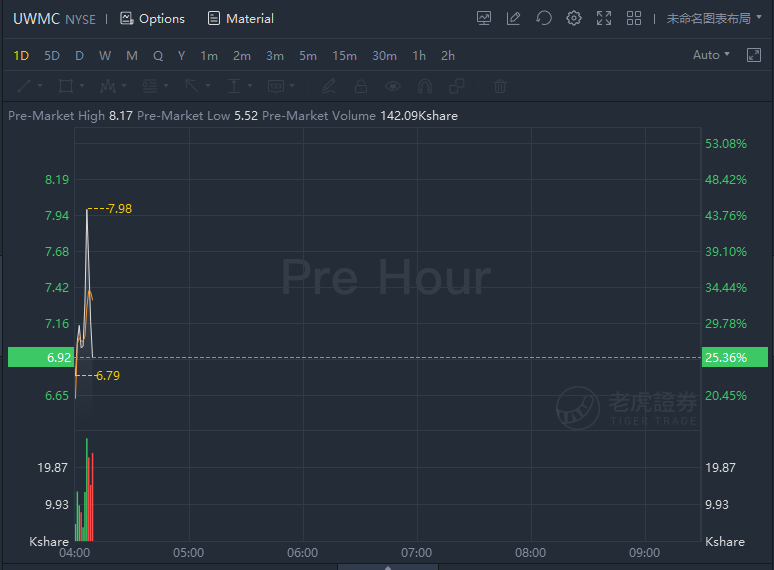

UWM Holdings jumped over 25% in premarket trading as it announcedintent toacceleratebuyback in Lieu.

UWM Holdings jumped over 25% in premarket trading as it announced intent to accelerate buyback in Lieu

Tiger Newspress2021-11-19

免责声明:本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性做出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任。

28

举报

登录后可参与评论

- SGoh·2021-11-19Yeah1举报

- Sunshine2000·2021-11-19[龇牙]1举报

- Never ever f·2021-11-19Power UWM2举报

- KLS·2021-11-19Buy4举报

- dzgunners95·2021-11-19Great3举报

- sugar87·2021-11-19niceeee3举报

- HENGJR·2021-11-19help like pls6举报

热议股票

关于我们·老虎社区守则·老虎社区账号管理规范·老虎社区服务协议·老虎社区隐私政策

公司名称:北京至简风宜信息技术有限公司

违法和不良信息投诉:010-5681-3562(工作时间9:30-18:30)

© 2018-2024 老虎社区 版权所有

营业执照:91110105MA01A4U55R

ICP备:京ICP备18016422号