Meta Platforms stock climbed more than 1% in morning trading as Facebook stock could get a big boost from surging Oculus sales,analyst said.

Meta's latest Oculus VR handset dubbed the Quest 2 appears to have been a hot gift this holiday season, underscoring one reason why shares of the social media giant remain a buy, says Jefferies analyst Brent Thill.

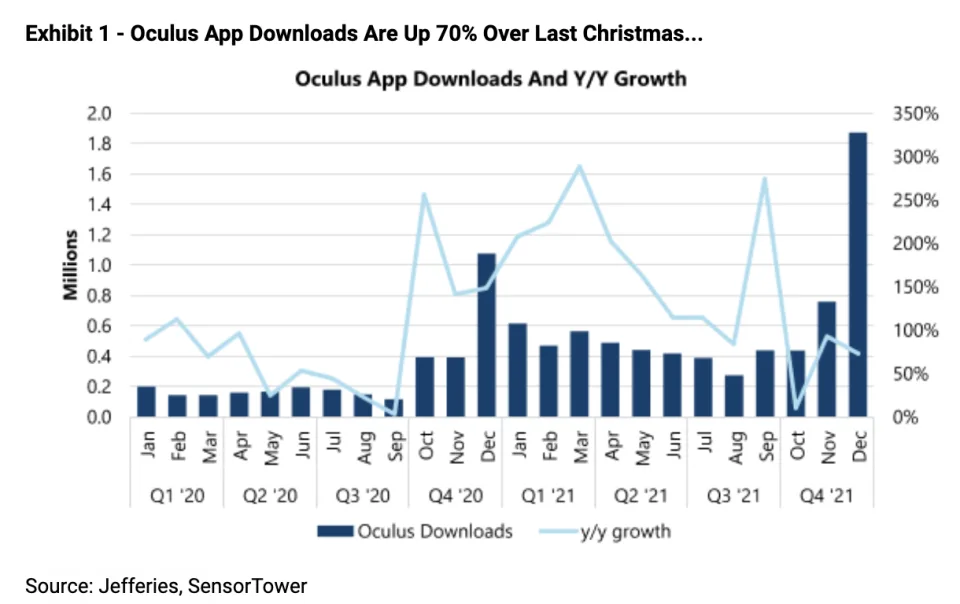

Based on new research by Thill on Tuesday, the Oculus app was the number one most downloaded app in the App store on Christmas Day. Oculus downloads and daily active users on Christmas Day surged 70% and 90%, respectively, from the prior year.

The gains are impressive in the sense the Quest 2 isn't cheap at nearly $400.

"We view this massive uptick in app usage as evidence that the improved slate of games and experiences is resonating with users and that Quest 2 sales are likely to surprise. Quest 2s were popular gifts in our households this Christmas with 'SuperHot' and 'Eleven Table Tennis' among our favorite games," Thill said.

Added Thill, "As teens spend an increasing amount of time on services like SNAP, TikTok, RBLX, and Fortnite it is becoming more challenging for FB to attract and retain younger users. We believe that Quest 2 could serve as an on-ramp for attracting these users, as they can more easily be introduced to FB's diverse offering of games, experiences, and social platforms. We also see Oculus' mainstream success as a potential catalyst for game developers to work more closely with FB.

Thill — a long-time Meta bull — maintained a Buy rating on Meta with a price target of $420.

While Thill acknowledges headline risk to Meta's stock from privacy concerns, he contends valuation is too compelling to ignore in light of key fundamental drivers such as Oculus.

"Our most recent advertiser checks point to a healthy environment for digital ad spending. Additionally, recent Mastercard data indicates that online retail Holiday sales were up 11% year-over-year (and 61% vs. 2019), providing further evidence that holiday ad demand was likely robust. With the stock trading at just 20x FY23E earnings per share (vs. Nasdaq comparable 26x), we see plenty of opportunity for a higher stock over the next 12 months," Thill concluded.