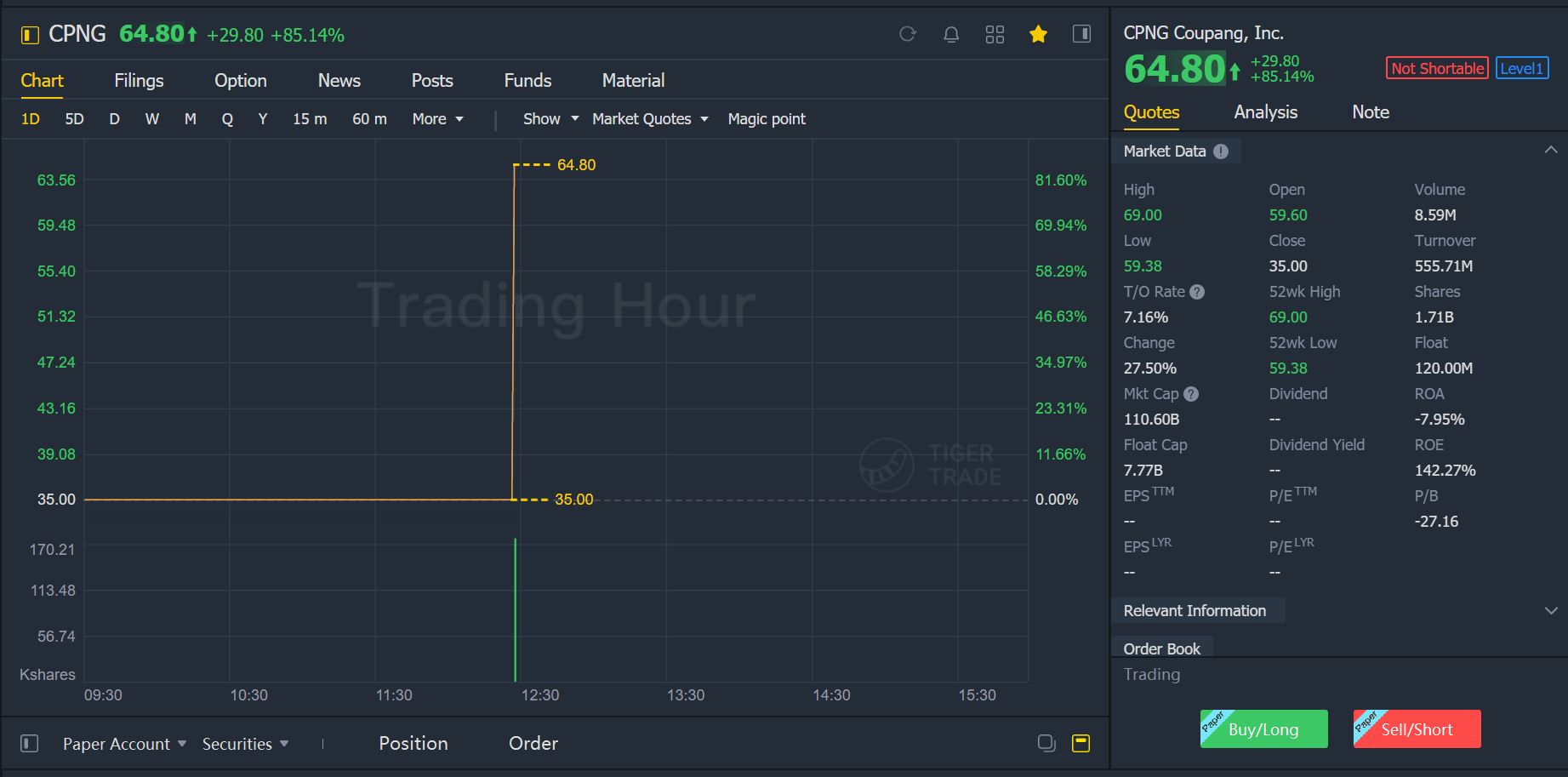

Coupang shares opened at $64.8 each on Thursday, about 85% higher than the company’s IPO price.

Investors looking to buy shares of South Korean e-commerce firm Coupang when it goes public in New York should consider if the company has what it takes to be profitable in the future.

That’s the advice Daniel Yoo, head of global asset allocation at Yuanta Securities, Korea, has for clients.

“What you really need to know is whether or not, in the business environment of Korea and e-commerce, can they be able to generate a huge, profitable return on capital,” Yoo said Thursday on CNBC’s “Street Signs Asia.”

Coupang is set to debut on the New York Stock Exchange under the ticker “CPNG” later in the day when U.S. markets open.

The company said it had priced 130 million shares at $35 apiece, raising $4.55 billion and valuing the company around $60 billion. That makes Coupang the largest IPO in the U.S. this year and one of the top 25 biggest listings of all time stateside, by deal size.

The price is also above the company’s most recent expected range of between $32 and $34 a share.

Market leader

Yoo explained that the valuation and IPO price likely rose because Coupang is the only e-commerce company in South Korea that showed a sizeable gain in market share last year. He said its market size rose from 18.1% in 2019 to about 24.6% last year due to the coronavirus pandemic.

“Most of the other competitors really did not show any type of changes in terms of market share,” he said. Coupang’s rivals include eBay-owned Gmarket, WeMakePrice, Naver Shopping among others.

“The fact is that (Coupang is) becoming the biggest e-commerce business within Korea and 24% market share, I think, it might actually even rise further,” Yoo said. “It is possible that they can actually gain as much as 30%+ over the next few years.” That, he explained, would justify why the company’s IPO price has increased.

Coupang’s regulatory filing showed the company sustained losses over eight quarters through Dec. 31. But a sharp jump in sales last year helped narrow net losses from $770.2 million in 2019 to $567.6 million in 2020

Comparisons with Alibaba, Amazon

The company, whose prominent backers include SoftBank’s Vision Fund and Sequoia Capital, has drawn comparisons with Amazon and Alibaba. Those firms have become tech behemoths after making their public debuts.

But Yoo said that the consumer markets in the U.S. and China are significantly larger than South Korea. So, even if Coupang is able to increase its market share, he said it is unlikely to see the same kind of sales growth the other two companies saw in the last decade.

South Korea’s e-commerce market has an estimated value of $90.1 billion in 2020 with an annual growth rate of 22.3%, according to data analytics firm GlobalData. That is expected to grow at a compounded annual rate of 12% to reach $141.8 billion in 2024.

Spending some of its IPO proceeds on building out a strong distribution platform within Korea could benefit Coupang, according to Yoo.

The e-commerce firm was founded by Korean-American billionaire Bom Suk Kim in 2010 and is headquartered in Seoul. It has more than 100 fulfilment and logistics centers in over 30 cities that provide next-day delivery for orders placed before midnight. Coupang employs 15,000 drivers in South Korea for its deliveries and has branched out into other services such as food and grocery delivery.