Excitement about the metaverse has lifted Nvidia stock to record highs—a surge of enthusiasm so powerful that it seemed that blowout third-quarter results would be needed to give the shares an extra lift.

Yet the stock is rising, at least for now. The chip maker delivered.

Nvidia on Wednesday reported October quarter adjusted net income of $2.97 billion, or $1.17 a share. Revenue surged about 50% year over year to a record $7.10 billion. Analysts were only looking for adjusted earnings of $1.11 a share and sales of $6.82 billion, according to FactSet.

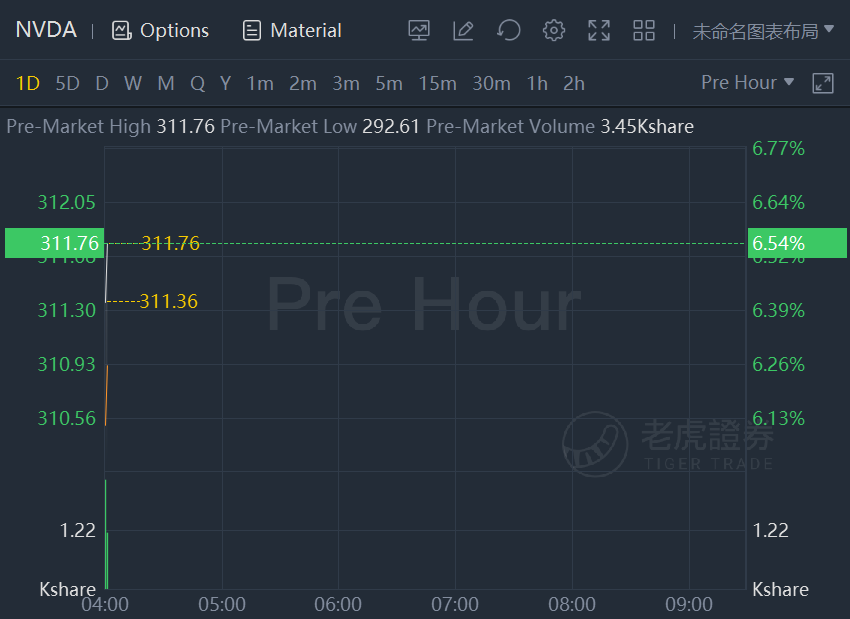

Nvidia stock jumped 6.5% in premarket trading Thursday.The company will pay a 4-cent-per- share dividend on Dec. 23 for shareholders of record on Dec. 2.

“Demand for NVIDIA AI is surging, driven by hyperscale and cloud scale-out, and broadening adoption by more than 25,000 companies,” CEO Jensen Huang said in the earnings release. “NVIDIA RTX has reinvented computer graphics with ray tracing and AI, and is the ideal upgrade for the large, growing market of gamers and creators, as well as designers and professionals building home workstations.”

For the fourth quarter of fiscal 2022, the company expects revenue of $7.4 billion, plus or minus 2%.

Though videogame firms and chip makers have been talking about the metaverse for years, it was Mark Zuckerberg, CEO of Meta Platforms, formerly known as Facebook,who put the investing theme on the map for mainstream analysts last month. He has portrayed the metaverse as a natural step for the internet, and Nvidia stands to benefit.

Connectivity and social interaction in virtual 3D worlds were at the center of Zuckerberg’s pitch. Investors know that such online worlds will be powered by graphics cards like the ones Nvidia makes.

Nvidia shares surged earlier this month as analysts took a stab at sizing up the chipmaker’s metaverse opportunity. Aside from the chips, experts point to an opportunity found in Nvidia’s efforts to build an open platform for virtual collaboration that it calls Nvidia Omniverse.

“Omniverse will be used from collaborative design, customer service avatars and videoconferencing, to digital twins of factories, processing plants, even entire cities,” Huang said in the earnings release. “Omniverse brings together NVIDIA’s expertise in AI, simulation, graphics and computing infrastructure. This is the tip of the iceberg of what’s to come.”

The offering will help artists collaborate in real time and create accurate simulations with realistic lighting; analysts at Wells Fargo wrote earlier this month that as many as 20 million designers and engineers could turn to it. The analysts argued Nvidia is an “enabler/platform for the development of the Metaverse across a wide range of vertical apps.”

All the excitement has led to a metaverse frenzy in Nvidia stock. After its decline in regular hours on Wednesday, Nvidia closed with a $731.5 billion market capitalization.