Meta Platforms Inc is having a strong close thus far to end the week, up almost 3.5% and only $7 off the weekly highs.

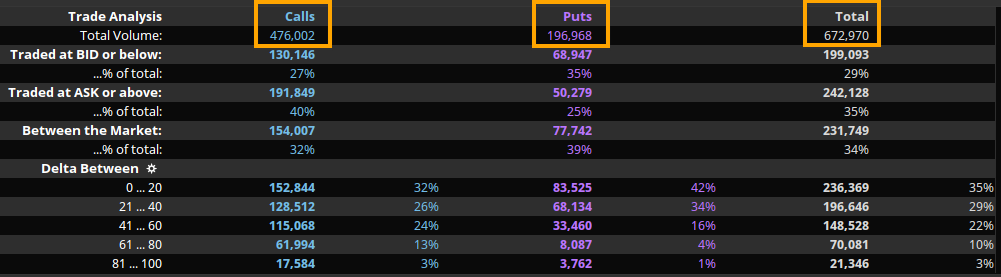

What Happened: While the volume of shares traded is solid at 17 million vs. the 10 day average of 21 million, options traders are quite active on the day, trading more than 672,970 options with 476,002 being calls and 196,968 being puts. This comes out to about 7 out of every 10 options being calls (image below).

What It Matters:Prior to this Friday, there were 1,519,000 calls and 1,207,750 puts for a total of 2,726,000 options. Hence this Friday's options activity and flows of 672,970 comprise 25% of the total option flows out there.

Any time a stock trades 25% of its total options in one day, it means options traders are particularly active in the stock.

Of note, only 11% of the options were set to expire this Friday (~300,000 options) so today's 672,970 options suggest a lot more forward-looking flows.

What's Next:Looking at the option flows expiring next week on Nov. 19, you can see on the call side the majority of volume and open interest is between the $330 and $360 strikes. And on the put side, there is a consistent but small volume between the $340 and $300 strikes (image below).

This suggests bullish traders are targeting between $330 and $360, but don't have much appetite above that. Meanwhile, bearish options traders don't see much downside below $300.

It should be noted the steady volume of puts from $340 to $300 appears to be a mix of bullish traders selling cash-secured puts down to the $322.5 strike, but likely long stock traders seeking protection below that as the premium is very low.

Hence bullish traders will want to see the $360 strike cleared by next week to lift their expectations higher while bears will want to see a weekly close below $300 to open up the downside.