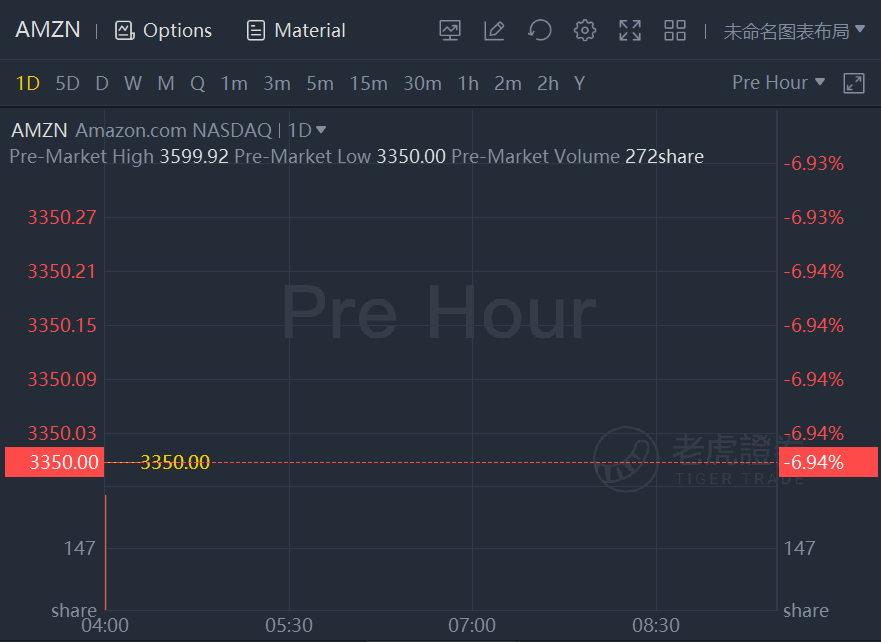

Amazon shares tumbled 7% in premarket trading after the e-commerce and cloud computing giant reported mixed results for the June quarter, with better-than-expected profits but sales that fell shy of Wall Street estimates.

The miss reflects a shortfall in Amazon’s e-commerce business, which suffered a sharp deceleration from recent growth trends. The e-commerce slowdown was partially offset by better-than-expected results in the company’s cloud computing, advertising, and third-party seller segments.

For the quarter, Amazon (ticker: AMZN) posted sales of $113.1 billion, up 27% from a year ago, or 24% when adjusted for currency, right in the middle of the company’s guidance range of $110 billion to $116 billion, and a little shy of Wall Street’s consensus of $115.4 billion. Earnings were $15.12 a share, ahead of analysts’ $12.28 per share forecast. Operating income was $7.7 billion, toward the top of the company’s projected range of $4.5 billion to $8 billion, and just below the Wall Street consensus of $7.8 billion.

Revenue from online stores was $53.2 billion, up 16% from a year ago, or 13% adjusted for currency, well shy of the Street consensus forecast of $57.3 billion. That was below the 41% growth in the March quarter and 49% growth a year ago.

Amazon chief financial officer Brian Olsavsky said on a call with analysts that since May the company’s growth—aside from Prime Day—dropped into the mid-teens, from recent growth in the 35% ro 40% range, and 44% growth in the March quarter. The company sees growth for the September quarter int he 10% to 16% range.

Olsavsky pointed to wider availability of vaccines and consumers leaving the house more as factors in the slowdown, in addition to tough comparisons with a year ago.

Olsavsky added that the company expects a “pattern of difficult comps” to continue for the next few quarters until the company laps the pandemic period.

Third-party services revenue was $25.1 billion, up 38%, or 34% adjusted for currency, above the consensus forecast at $24.8 billion. But that was nonetheless a slowdown from 60% in the March quarter and 53% a year ago.

Amazon Web Services, the company’s cloud business, had revenue of $14.8 billion, up 37%, and well ahead of the Street estimate at $14.3 billion, accelerating from 32% growth in March and 29% growth a year ago.

“Other” revenue, mostly advertising, was $7.9 billion, up 87%, or 83% on a currency adjusted basis, well ahead of consensus at $7 billion, and consistent with recent strong advertising data from Facebook,Alphabet and other ad-driven businesses. Physical store revenue was $4.2 billion, up 11%, topping the Street view at $3.9 billion.

North American sales growth, excluding foreign exchange effects, slowed to 21% in the quarter, down from 39% in March and 44% a year ago. Operating margin in North America was 4.7%, down from 5.4% in March, though up from 3.9% a year ago. International sales were up 26%, down from 50% in the March quarter, and 41% in the year earlier quarter.

For the September quarter, Amazon is projecting sales of $106 billion to $112 billion, shy of the Street consensus at $118.6 billion, with operating income ranging from $2.5 billion to $6 billion, versus $6.2 billion a year ago. The company said guidance assumes about $1 billion in costs related to Covid-19.

Amazon shares are down 7.1% in late trading. The stock is up 11% in 2021 , trailing the S&P 500‘s 18% gain.