- Stock futures rise, steadying after tech selloff.

- Nike, FedEx, Skillz, Ford & more making the biggest moves in the premarket.

(March 19) Stock futures edged higher Friday morning to recover some losses from Thursday's session, when another technology-led selloff dragged on the three major indexes.

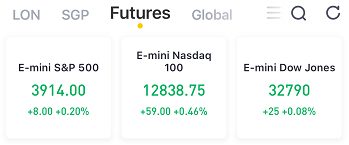

At 8:24 a.m. ET, Futures for the Dow Jones Industrial Average up 25 points to 32,790.00, while the Standard & Poor’s 500 index futures rose 8 points at 3,914.00. Futures for the Nasdaq 100 index rose 59 points to 12,838.75.

A day earlier, the Nasdaq slid by 3% for its worst session in three weeks as bond yields resurged. The 10-year Treasury yield spiked to the highest level since January 2020 and concerns over inflation reignited. The S&P 500 fell 1.5%, and the Dow dropped 0.5%.

Stocks making the biggest moves in the premarket: Nike, FedEx, Skillz, Ford & more

1) Nike(NKE) – Nike came in 14 cents a share above estimates, withquarterly profit of 90 cents per share. The athletic footwear and apparel company’s revenue came in below analysts’ projections, however, and its full-year revenue outlook was also shy of estimates. Nike said North American revenue was hit by port-related issues which delayed shipments by up to three weeks. Nike shares slid 3.2% in premarket trading.

2) FedEx(FDX) – FedExreported quarterly earnings of $3.47 per share, beating the consensus estimate of $3.23 a share. Revenue also came in above forecasts. FedEx’s average revenue per package for its Ground service rose by 11%, as it continues to benefit from the pandemic-related surge in e-commerce orders. Its shares jumped 4% in premarket action.

3) Skillz(SKLZ) – Skillz tumbled 7% in premarket action after the mobile gaming company announced a 32 million share public offering. The offering priced at $24 per share, with Skillz selling 17 million shares and certain stockholders selling the rest. Skillz said it would use the proceeds for general corporate purposes.

4) AstraZeneca(AZN) – AstraZeneca’s Covid-19 vaccine received the backing of Canada regulator Health Canada, which joined European countries in saying the vaccine is not linked to an increase in blood clots. Countries that had temporarily halted use of the vaccine have now resumed administering shots.

5) Hartford Financial(HIG) – The financial services company saidit is “carefully considering” a takeover proposalfrom insurance companyChubb(CB) for $65 per share or more than $23 billion. Hartford shares surged 18.7% Thursday following news of the offer, although it Is giving back about 1.4% in premarket trade.

6) Ollie’s Bargain Outlet(OLLI) – Ollie’s beat estimates by 14 cents a share, with quarterly earnings of 97 cents per share. The discount retailer’s revenue also came in above Wall Street forecasts. Comparable-store sales jumped 8.8%, beating the consensus FactSet forecast of a 3.2% increase. Ollie’s shares gained 4.6% in premarket trading.

7) Enphase(ENPH),SolarEdge Technologies(SEDG) – Susquehanna Financial upgraded both alternative energy stocks to “positive” from “neutral,” based on an anticipated expansion in solar installations in the years ahead and the strength of the two companies in the residential sector. Enphase rose 3.3% in the premarket, while SolarEdge gained 2.1%.

8) Ford Motor(F) – Ford shares are up 2.5% in premarket trading after Barclays upgraded the stock to “overweight” from “equal weight,” and increased its price target on the stock to $16 per share from $9. Barclays is encouraged by Ford’s developing electric vehicle strategy, among other factors.

9) Coherent(COHR) – The laser technology company remains on watch, as it mulls competing takeover bids fromLumentum(LITE) andII-VI(IIVI). Coherent first struck a deal to be acquired by Lumentum in January, but has received eight subsequent bids and revised offers since then.

10) Molson Coors(TAP) – The beer brewer’s stock fell 2.3% in premarket action after Deutsche Bank added it to its “short term sell catalyst” list. Deutsche Bank said the call is based on short-term concerns, including a material impact on first-quarter results from adverse February weather in Texas.

11) Petco Health(WOOF) – The pet supplies retailer was upgraded to “buy” from “neutral” at Bank of America Securities, saying Petco’s fourth-quarter results and 2021 were ahead of its expectations. The stock jumped 2.8% in premarket trading after losing 3.8% in Thursday trading.

12) Hims & Hers Health(HIMS) – Hims & Hers Health shares fell 3.3% in the premarket after the telehealth company reported a net quarterly loss of $3.1 million, even though that was smaller than the $12.4 million loss reported a year earlier. Revenue came in higher than anticipated, however, and total revenue was up by 80% for 2020.

13) Sarepta Therapeutics(SRPT) – The drugmaker’s shares rallied 5.4% in premarket trading after it reported upbeat results in a trial involving an experimental muscular dystrophy treatment.

Big News

1. Bond market rebels as it adjusts to Fed inflation polic

The10-year Treasury yieldpulled back Friday,one day after hitting a 14-month highof 1.754%.Traders revoltedover the Federal Reserve's willingness to let the economy and inflation to run hot as the job market recovers. Yields barely moved Wednesday afternoon after the Fed's meeting concluded, responding initially to the forecast for no rate hikes through 2023. The rapid rise in yields is being driven by concerns that more Covid stimulus on top of an already recovering economy will spark worrisome inflation. The 10-year yield started the year at less than 1%.

2. First U.S.-China meeting under Biden gets off to a rocky start

The first high-level meeting of U.S. and Chinese officials under the Biden administrationbegan with a flurry of insultsat a pre-meeting press event in Alaska on Thursday. The planned four-minute photo session for the officials to address reporters ended up lasting one hour and 15 minutes due to the frothy exchanges, according to NBC News. Expectations going in to the two-day talks, which are set to conclude Friday, were already low.