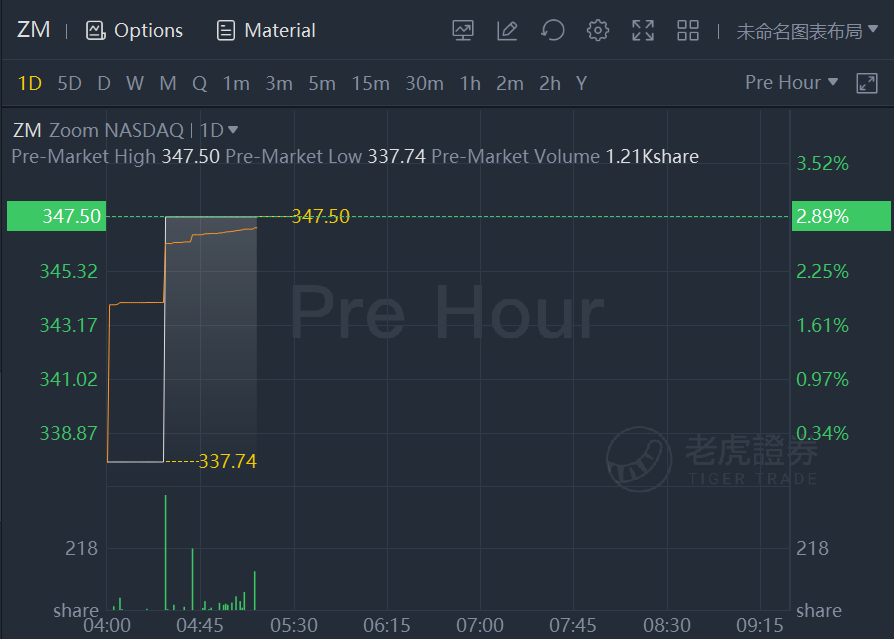

Zoom shares rose nearly 3% in premarket trading.Zoom will report earnings early next week.Here’s what to expect.

Video collaboration platform specialist Zoom Video Communications (NASDAQ:ZM) is set to report its fiscal second-quarter results early next week. After making a habit of regularly obliterating analyst expectations, the company will need to deliver outstanding results to impress investors. Sure, the growth stock has floundered year to date with a paltry 1% gain. But shares are up 400% from the beginning of 2020, giving the stock a valuation that leaves little room for error.

Ahead of the company's earnings report on Aug. 30, here's a preview of some things investors should keep in mind.

The backdrop: staggering momentum

Zoom's recent quarterly results have shown a company firing on all cylinders. Revenue in the company's most recent quarter, for instance, surged 191% year over year. This was powered by 160% year-over-year growth in customers contributing more than $100,000 in trailing-12-month revenue, and an 87% year-over-year jump in customers with more than 10 employees.

Zoom also flexed the scalability of its business model by delivering outsize growth in profits. Net income was $227 million, up from $27 million in the year-ago period. Free cash flow, or cash from operations less capital expenditures, also made great strides. The key metric came in at $454 million, up from $252 million in the year-ago period.

It was a stellar first quarter of fiscal 2022 for Zoom by just about any measure.

Expect a deceleration in fiscal Q2

As the economy reopens and work-from-home catalysts lose some of their momentum, investors expect a deceleration in growth for fiscal Q2. Management guided for fiscal second-quarter revenue between $985 million and $990 million, up from $664 million in the year-ago period. Analysts, on average, expect Zoom's revenue to come in at $991 million, representing 49% growth.

Checking in on Zoom's Five9 acquisition

Investors should also check on what management has to say about its recently announced definitive agreement to acquire cloud-based contact center platform Five9 (NASDAQ:FIVN).

The leading provider of cloud-based contact center solutions will strengthen Zoom's value proposition with enterprise customers.

"Enterprises communicate with their customers primarily through the contact center," said Zoom founder and CEO Eric Yuan in a July 18 press release about the deal, "and we believe this acquisition creates a leading customer engagement platform that will help redefine how companies of all sizes connect with their customers."

At the time the deal was announced last month, it was valued at $14.7 billion. Five9 shareholders will receive 0.5533 shares of Zoom stock for every share of Five9 stock they own.

Investors should look to see if management says the timeline for the deal to close is still the first half of calendar 2022. It would be nice to see this anticipated timeline narrow to the first quarter of 2022. In addition, investors should look for more insight from management about the tech company's plans to integrate Five9 and to build out more enterprise features.

Zoom will report its second-quarter results after market close on Monday, Aug. 30.