(Sept 23) The Federal Reserve on Wednesday telegraphed it could hike rates six to seven times by the end of 2024, illustrating the central bank’s optimism that the COVID-19 recovery will progress well enough for the Fed to tighten its easy money policies in a few years.

The policy-setting Federal Open Market Committee still held interest rates at near-zero in its updated statement, but said it had advanced talks on paring back its asset purchase program.

Since the depths of the pandemic, the Fed has been absorbing about $120 billion a month in U.S. Treasuries and agency mortgage-backed securities. But Fed officials have said in recent weeks that by the end of the year, the economy will likely make the “substantial further progress” needed for the central bank to begin slowing the pace of those purchases.

“If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted,” the FOMC statement reads.

The central bank only has two more meetings this year to announce a taper: in early November and in mid-December.

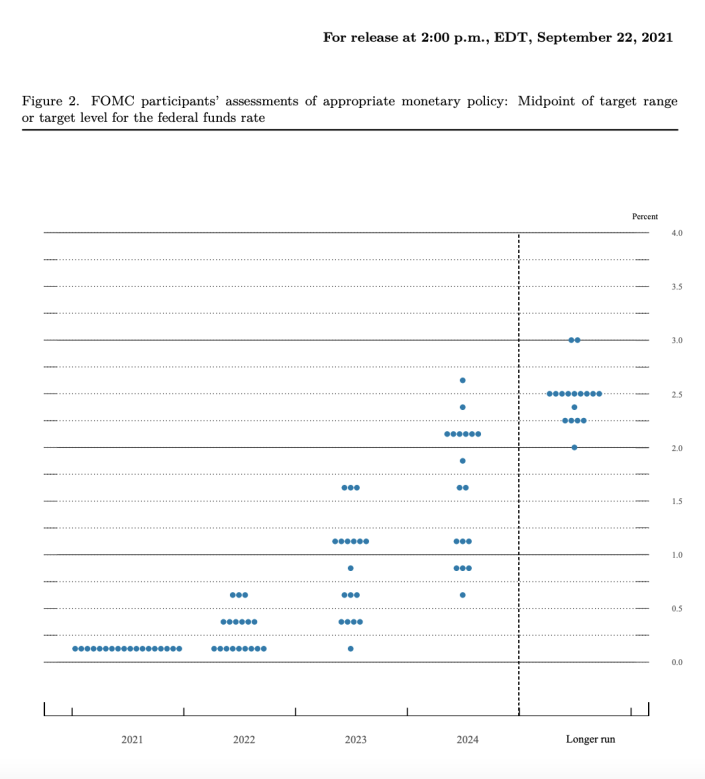

The Fed has insisted that thetiming of a taper is not a “direct signal”on the timing of rate liftoff. But “dot plot” projections, which map out each of the 18 FOMC members’ expectations for where rates will be in coming years, suggest that the central bank is pulling forward its forecast for 25 basis point rate hikes.

Through the end of 2024, the median FOMC member sees six to seven total rate hikes.

In thelast round of projections released in June, the median member of the FOMC saw no rate hikes through the end of 2022 but two rate hikes in 2023.

The expectation to raise interest rates earlier coincides with higher expectations on inflation. Although the Fed stood pat on its expectation for rising price pressures to be “transitory,” the median FOMC member raised their forecast on PCE inflation to 4.2% this year (compared to 3.4% in June). The median member expects inflation to then fall to 2.2% in 2022. The Fed’s inflation target is 2%.

The spike in COVID-19 cases from the Delta variant also weighed on forecasters’ expectations for GDP growth. The central bank now expects the U.S. economy to grow by 5.9% this year (compared to 7.0% in June) but revised up growth expectations for 2022 to 3.8% (compared to 3.3% in June).

After a softer August jobs report, the Fed revised its expectation on the unemployment rate by the end of 2021 to 4.8% (compared to 4.5% in June). The central bank is hopeful it can return to the pre-pandemic record low on headline unemployment of 3.5% by the end of 2023.

The next FOMC meeting is scheduled to take place November 2 and 3.