(Sept 24) Cue Health Inc. opens for trading at $19.2, up 20% from IPO price.

Company & Technology

San Diego, California-based Cue was founded to first develop a COVID-19 test kit and integrated information platform for processing and communication.

Management is headed by co-founder, Chairman and CEO Ayub Khattak, who has been with the firm since inception and holds a B.S. in mathematics from UCLA.

The company’s primary offerings in its Cue Integrated Care Platform:

Health monitoring system

Rader

Cartridge

Wand

Data

Delivery apps

Enterprise dashboard

Ecosystem integrations

Cue has received at least $176 million in equity investment from investors including ACME Capital, Cove Investors, Decheng Capital China Life Sciences, Madrone and NVGA I.

Customer/User Acquisition

The company pursues healthcare provider relationships through its in-house direct sales team focused on healthcare providers, large enterprises and public sector clients.

Management expects 2021 customer demand for its COVID-19 test kits to exceed its manufacturing capacity.

Sales and Marketing expenses as a percentage of total revenue have varied as revenues have increased sharply, as the figures below indicate:

Sales and Marketing |

Expenses vs. Revenue |

Period |

Percentage |

Six Mos. Ended June 30, 2021 |

1.0% |

2020 |

3.1% |

2019 |

1.3% |

The Sales and Marketing efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing spend, was 100.5x in the most recent reporting period, as shown in the table below:

Sales and Marketing |

Efficiency Rate |

Period |

Multiple |

Six Mos. Ended June 30, 2021 |

100.5 |

2020 |

22.9 |

Market & Competition

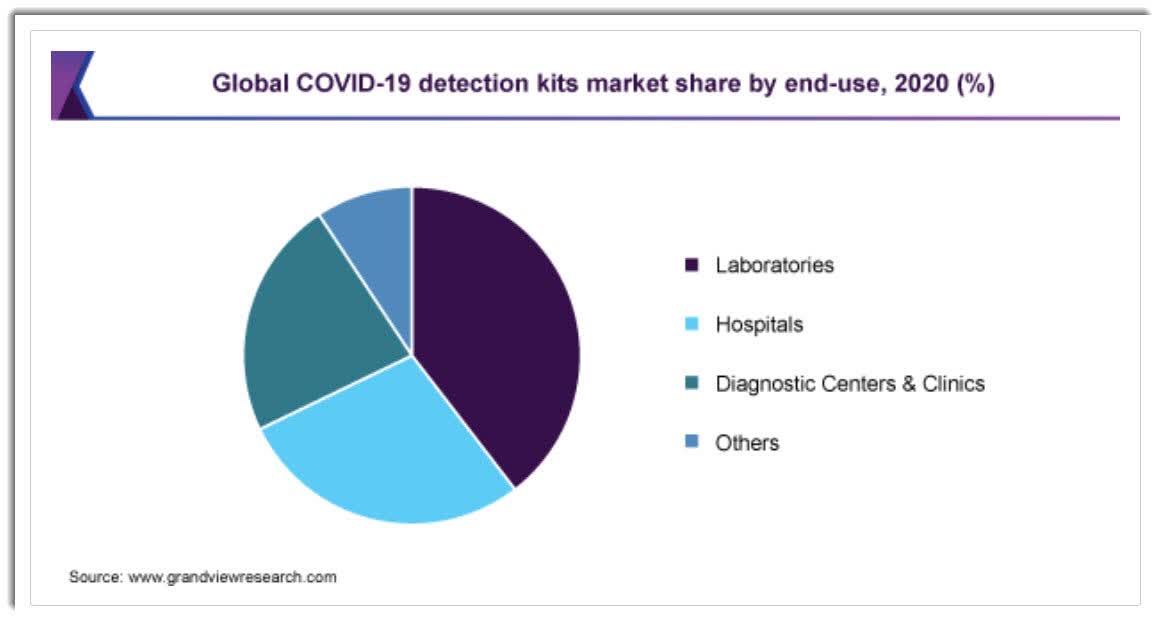

According to a 2020 marketresearch reportby Grand View Research, the global market for COVID-19 detection kits was an estimated $3.28 billion in 2020 and is expected to reach $5 billion by 2027.

This represents a forecast CAGR of 5.05% from 2021 to 2027.

The main drivers for this expected growth are a strong growth in demand for testing services of all types on a global basis.

Also, below is a chart showing the market share of use of detection kits by end-user type:

(Source)

Major competitive or other industry participants include:

Abbott Laboratories(NYSE:ABT)

Becton, Dickinson(NYSE:BDX)

bioMerieux(OTCPK:BMXMF)

Bio-Rad Laboratories(NYSE:BIO)

Danaher(NYSE:DHR)

Ellume Limited

Everly Health

Roche(OTCQX:RHHBY)(OTCQX:RHHBF)

Fluidigm(NASDAQ:FLDM)

GenMark Diagnostics(NASDAQ:GNMK)

Others

Financial Performance

Cue’s recent financial results can be summarized as follows:

Sharply growing top line revenue

Increasing gross profit and variable gross margin

A swing to operating profit and net income

Variable cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

Total Revenue |

||

Period |

Total Revenue |

% Variance vs. Prior |

Six Mos. Ended June 30, 2021 |

$ 201,922,000 |

3971.0% |

2020 |

$ 22,953,000 |

246.4% |

2019 |

$ 6,626,000 |

|

Gross Profit (Loss) |

||

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

Six Mos. Ended June 30, 2021 |

$ 116,745,000 |

2253.7% |

2020 |

$ 8,002,000 |

20.8% |

2019 |

$ 6,626,000 |

|

Gross Margin |

||

Period |

Gross Margin |

|

Six Mos. Ended June 30, 2021 |

57.82% |

|

2020 |

34.86% |

|

2019 |

100.00% |

|

Operating Profit (Loss) |

||

Period |

Operating Profit (Loss) |

Operating Margin |

Six Mos. Ended June 30, 2021 |

$ 79,463,000 |

39.4% |

2020 |

$ (45,126,000) |

-196.6% |

2019 |

$ (20,767,000) |

-313.4% |

Net Income (Loss) |

||

Period |

Net Income (Loss) |

|

Six Mos. Ended June 30, 2021 |

$ 32,840,000 |

|

2020 |

$ (47,352,000) |

|

2019 |

$ (20,606,000) |

|

Cash Flow From Operations |

||

Period |

Cash Flow From Operations |

|

Six Mos. Ended June 30, 2021 |

$ (37,812,000) |

|

2020 |

$ 92,655,000 |

|

2019 |

$ (12,996,000) |

As of June 30, 2021, Cue had $246.3 million in cash and $516.3 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2021, was negative ($60 million).

Valuation Metrics

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] |

Amount |

Market Capitalization at IPO |

$2,299,981,232 |

Enterprise Value |

$1,874,455,232 |

Price / Sales |

10.46 |

EV / Revenue |

8.52 |

EV / EBITDA |

35.46 |

Earnings Per Share |

$0.03 |

Float To Outstanding Shares Ratio |

8.70% |

Proposed IPO Midpoint Price per Share |

$16.00 |

Net Free Cash Flow |

-$59,920,000 |

Free Cash Flow Yield Per Share |

-2.61% |

Revenue Growth Rate |

3971.01% |

As a reference, a potential partial and imperfect public comparable to Cue would be Bio-Rad (BIO); below is a comparison of their primary valuation metrics:

Metric |

Bio-Rad (BIO) |

Cue Health (HLTH) |

Variance |

Price / Sales |

8.15 |

10.46 |

28.3% |

EV / Revenue |

7.82 |

8.52 |

9.0% |

EV / EBITDA |

31.66 |

35.46 |

12.0% |

Earnings Per Share |

$134.05 |

$0.03 |

-100.0% |

Revenue Growth Rate |

25.6% |

3971.01% |

15436.03% |

(Glossary Of Terms) |

Commentary

Cue is seeking public investment capital to further scale its commercialization operations as well as continue its R & D efforts.

The company’s financials show sharply growing top line revenue, strong growth in gross profit and variable gross margin, a swing to operating profit and net income and highly fluctuating cash flow from or use in operations

Free cash flow for the twelve months ended June 30, 2021, was an eye-popping negative ($60 million).

Sales and Marketing expenses as a percentage of total revenue have fluctuated as revenues have increased dramatically; its Sales and Marketing efficiency rate was an extremely high 100.5x in the most recent reporting period.

The market opportunity for COVID-19 and related test kit platforms is large and will likely grow at a high rate of growth over the coming years as countries around the world seek to bolster their testing capabilities in the wake of the recent global pandemic.

Goldman Sachs is the lead left underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 39.9% since their IPO. This is a mid-tier performance for all major underwriters during the period.

The primary risk to the firm now is that it is essentially a one-product company, so its revenue base is heavily concentrated.

As for valuation, compared to partial competitor Bio-Rad Laboratories, the IPO is reasonably valued on a revenue multiple, although Cue is growing at a much higher rate of growth from a much lower revenue base, so the comparison is strained at best.

Given Cue’s growth trajectory, profitability and reasonable IPO valuation, the IPO is worth consideration.