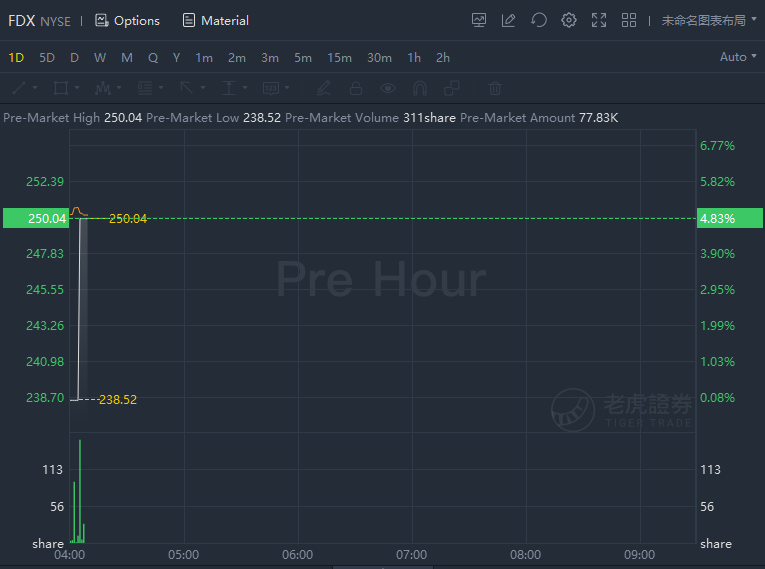

FedEx jumped nearly 5% in premarket trading on earnings beat, outlook hike, $5 billion share buyback plan.

Revenue rose to $23.5 billion to $20.56 billion in the year-ago quarter.

Analysts surveyed by FactSet had forecast $4.28 a share on revenue of $22.41 billion.

Excluding year-end mark-to-market accounting adjustments for retirement plans and other charges, FedEx said it forecast earnings of $20.50 to $21.50 a share, up from a previous $19.75 to $21 a share, for the year.

Analysts estimate earnings of $4.41 a share on revenue of $22.97 billion for the third quarter, and $19.75 a share on revenue of $91.09 billion for the year.

FedEx also said its board authorized a new $5 billion share buyback program, with $1.5 billion of that under an "accelerated" program. The company said the new program is in addition to the 2.3 million shares still authorized from its previous plan, or $548.6 million in authorization based on Thursday's closing price.

The company said it already bought back about $750 million in shares fiscal year-to-date, and ended the quarter with $6.8 billion in cash. The company also forecast capital spending of $7.2 billion.

Back in September, FedEx said it was hiking shipping rates in 2022.