- Reflation panic sparks global stock rout.

- Tech rout is set to continue with Nasdaq 100 futures falling more than 1%.

- Most of Blockchain stocks fell over 10%.

- Tesla plunge over 6%.

- FAAMG dipped, Apple fell about 3%.

- Pipeline shuttered by cyberattack to restore service by end of the week.

(May 11) Stock-index futures pointed to further losses for equities on Tuesday, with inflation worries seen keeping pressure on previously highflying tech stocks.

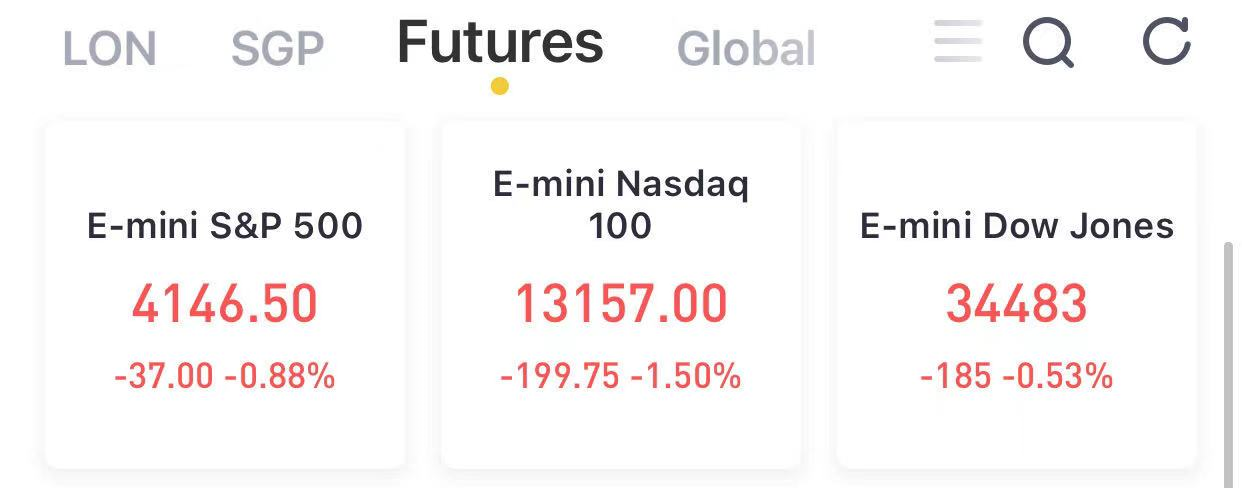

At 7:52 a.m. ET, Dow E-minis were fell 185 points, or 0.53%, S&P 500 E-minis were down 37 points, or 0.88% and Nasdaq 100 E-minis were down 199.75 points, or 1.50%.

On Monday, a tech-led selloff sent the Nasdaq Composite down 2.6% to its lowest close since March 31, while the S&P 500 slumped 1%. The Dow gave up a gain of more than 300 points that had taken it to an all-time high above 35,000 to end the day down 34.94 points, or 0.1%.

What’s driving the market?

Further pressure on Big Tech shares appeared in store, with shares of Facebook Inc. Apple Inc. ,Amazon.com Inc. ,Netflix Inc. ,Microsoft Corp. and Google parent Alphabet Inc. down more than 1% in premarket activity.

Apple fell about 3%, iPhone 12 Production Sees Over 50% Slump At Apple Supplier Foxconn's Factory In India With COVID-19.

Tesla shares fell nearly 4% in premarket trading as Reuters reported the electric car maker and bellwether growth play halted plans to expand its Shanghai plant into an export hub.

Most of Blockchain stocks fell over 10%.

“There isn’t a clear catalyst behind this purge,” said Marios Hadjikyriacos, investment analyst at XM, in a note. “It seems to be a combination of inflation fears making a comeback and some market participants moving higher along the value spectrum, cutting their exposure to anything with a stretched valuation.”

The fact that the selloff has been mostly concentrated in tech and growth stocks, however, is encouraging in terms of the overall market outlook, Hadjikyriacos said, because it indicates investors haven’t lost faith in the economic outlook but are moving away from “more speculative” positions, which could even calm some “bubble concerns, considering what is being sold.”

Investors continue to focus on the labor market after a much smaller-than-expected rise in nonfarm payrolls in March was reported on Friday.

The National Federation of Independent Business said Tuesday its monthly survey founda record 44%of small businesses said job openings went unfilled in April.

Data on U.S. March job openings is due at 10 a.m. Eastern.

Investors will also hear from several Federal Reserve officials on Tuesday, including New York Fed President John Williams, Fed Gov. Lael Brainard, San Francisco President Mary Daly, Atlanta Fed Raphael Bostic, Philadelphia Fed President Patrick Harker, and Minneapolis Fed President Neel Kashkari.

Stocks making the biggest moves in the premarket: Virgin Galactic, Callaway Golf, Palantir & more

1) Virgin Galactic(SPCE) – Virgin Galactic shares tanked 19.9% in premarket action. The companylost 55 cents per sharefor its latest quarter, more than double the 27 cents a share loss that analysts were anticipating. Billionaire Richard Branson's space flight company also said it is evaluating a timeline for its next test flight, citing the need to analyze wear-and-tear issues for its Eve mothership.

2) Callaway Golf(ELY) – Callaway rallied 7.5% in premarket trading after it surged well past the 14 cents a share consensus estimate, with quarterly earnings of 62 cents per share. The golf equipment and apparel maker's revenue was also well above forecasts, with Callaway saying demand for its products has been "unprecedented" as the pandemic recedes.

3) L Brands(LB) – The retailer has decided tospin off its Victoria's Secret operationrather than sell it. L Brands will split into two separate public companies, Victoria's Secret and Bath & Body Works. The move comes after bids for Victoria's Secret were short of what L Brands had expected. The plans were first reported in The New York Times' Deal book. L Brands shares fell 1.9% in premarket trading.

4) Palantir Technologies(PLTR) – The data analytics company matched Wall Street forecasts withquarterly profit of 4 cents per share, while revenue topped estimates. It also said it expected annual revenue growth of 30% or more through 2025. Shares dropped 6.6% in premarket action.

5) Hanesbrands(HBI) – The apparel maker earned 39 cents per share for its latest quarter, beating the 26 cents a share consensus estimate. Revenue came in slightly above analysts' forecasts, however its current-quarter and full-year forecast both fell short of expectations. Its stock tumbled 11.3% in the premarket. Hanesbrands also announced a three-year plan designed to boost sales and profit margins.

6) Perrigo(PRGO) – The maker of consumer self-care products saw its stock fall 3% in premarket trading after quarterly profit and revenue fell short of Wall Street consensus. Perrigo reaffirmed its prior full-year forecast and noted the tough comparisons to a year ago when consumers stocked up on products as the pandemic took hold.

7) RealReal(REAL) – The luxury goods consignment retailer matched Street forecasts with a quarterly loss of 49 cents per share, with revenue beating estimates. Research firm BTIG acknowledged the company's solid first quarter in a new analyst report, but downgraded the stock to "neutral" from "buy" based on a lack of forward catalysts. The stock tumbled 6.4% in the premarket.

8) Roblox(RBLX) – Roblox reported a 161% increase in quarterly bookings in the gaming platform company'sfirst report since going public. Roblox's gaming activity surged amid the pandemic as more people played games like "Jailbreak" and "MeepCity," and spent more of the company's "Robux" digital currency for in-game purchases. Shares rose 2% in premarket trading.

9) Novavax(NVAX) – Novavax shares tumbled 11.9% in the premarket after the drugmaker pushed back its timetable for seeking Covid vaccine approvals. Novavax now said itwon't apply for regulatory approvalin the U.S., U.K. and Europe until the third quarter, and it also pushed back its timeline for full production to the fourth quarter from the third quarter.

10) Simon Property(SPG) – Simon Propertyreported quarterly earnings of $1.36 per share, beating consensus forecasts by 40 cents, while the mall operator's revenue was slightly above estimates. Simon also cut its full-year forecast, however, and said occupancy levels would not return to 2019 levels until 2022 at the earliest. Its shares fell 3.6% in premarket trading.

11) 3D Systems(DDD) – 3D Systems earned 17 cents per share for its latest quarter, blowing past the 2 cents a share consensus estimate. The 3D printer maker's revenue also exceeded Wall Street predictions. 3D Systems said it improved its profit margins through expense controls. Its shares surged 9.2% in the premarket.

12) Norton LifeLock(NLOK) – Norton LifeLock shares rose 2.5% in premarket action after it beat estimates on both the top and bottom lines for its latest quarter. The cybersecurity company also announced a $1.5 billion increase in its share repurchase program.