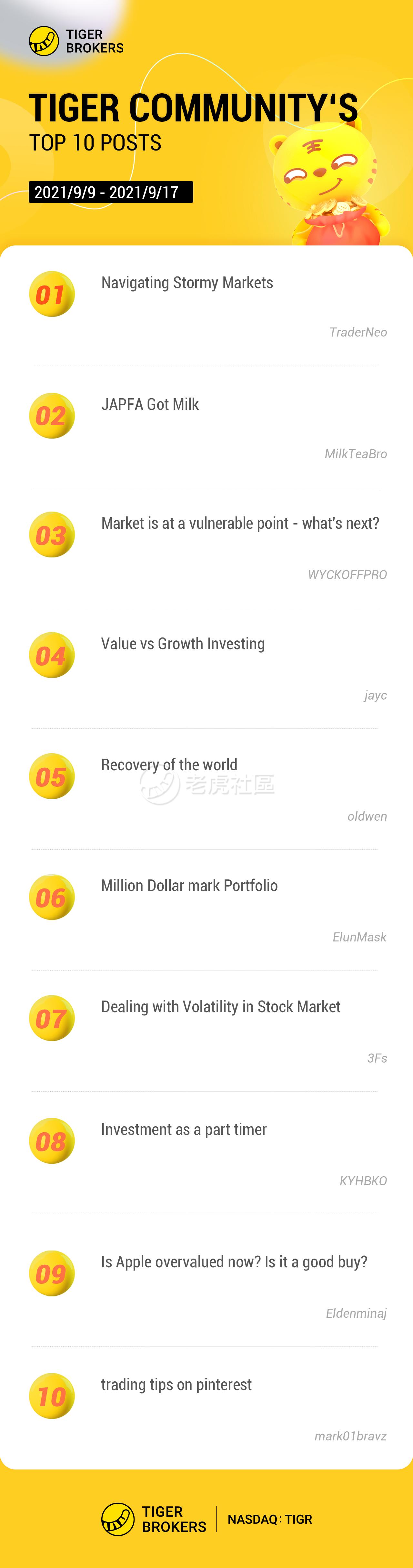

Roarrr!!!

Dear Tigers 🐯,

Welcome to our column: Posts of the Week! 🚀🚀🚀🚀🚀🚀🚀🚀

This is our fourth issue of this column.

An updated tip :)

We have extended the list with 10 posts and if tigers want their posts to be chosen, you can @Tiger Stars in the article or the comment to earn more exposure because we will evaluate those posts that @Tiger Stars with priority.

A quick wrap-up of this week

For this week,

1. @TraderNeo @MilkTeaBro @WYCKOFFPRO have mentioned Tiger Stars in their articles and all their informative posts have been successfully selected! congratulations!! We welcome and encourage more tigers to @ us!!

2. @oldwen has started a fresh new column to discuss how COVID-19 will affect different sectors of the economy and how people can tailor their investment portfolio differently. Welcome to visit his page for further reading xoxo

3. We also start to categorize the selected 10 posts into 4 subdivisions. Let's take a closer look at those brilliant posts and welcome to leave your comments below! ❤️

Market trends and industry news:

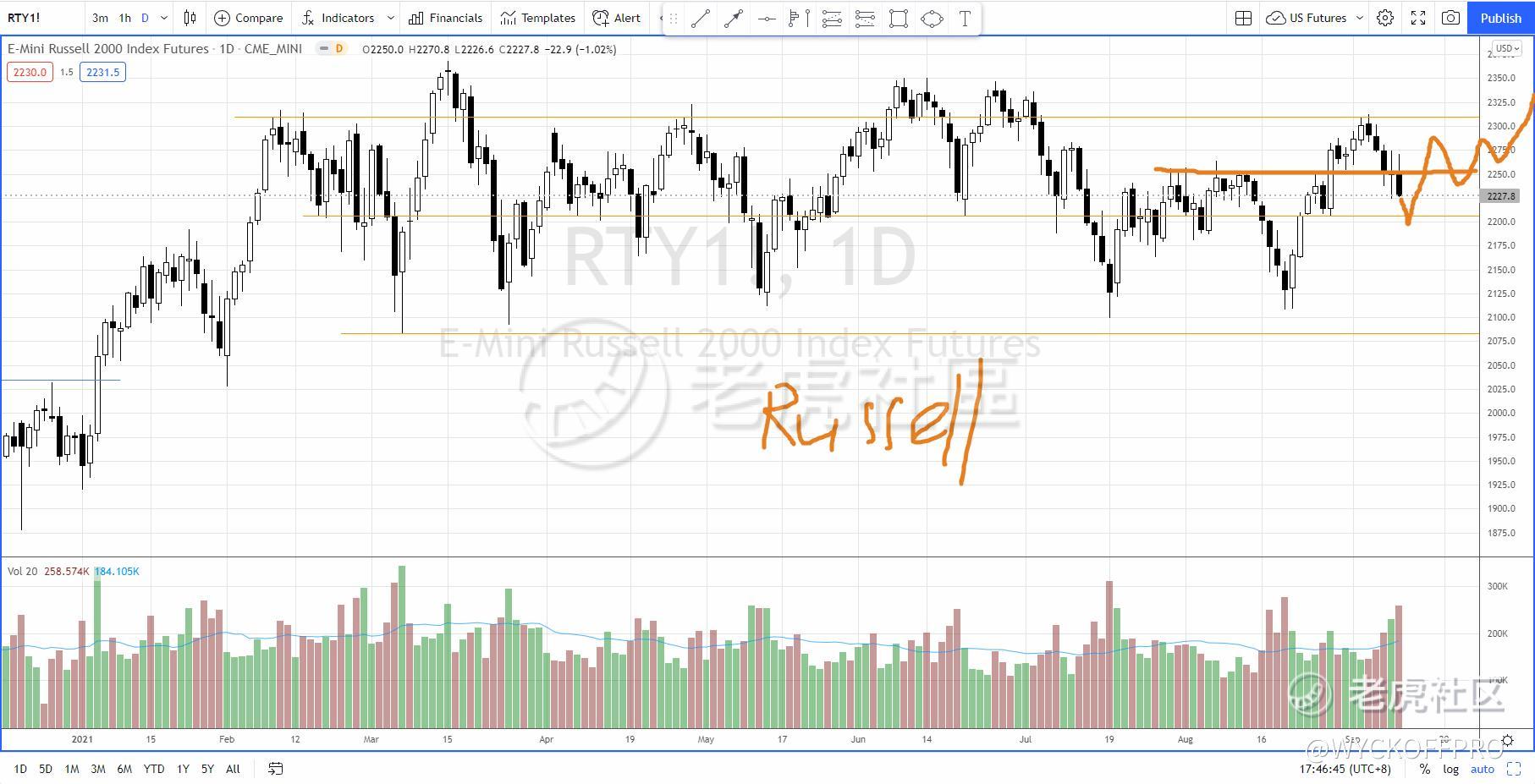

1. Market is at a vulnerable point - what's next?

tiger:@WYCKOFFPRO

...For S&P500 a bullish reversal case, we could expect a panic wash out and reverse from here. Else, S&P 500 should test lower support at 4360. Should this happen, short term trading range can be expected...For Russell 2000, it is not the time yet to break above the resistance level at 2310. For a short term bullish case, the support at 2200 needs to hold and we can expect multiple attempts to breakout of the immediate resistance level at 2310 (refer to the chart below).

2. Recovery of the world

tiger:@oldwen

...In this new series of posts, i will be giving my opinions on how it will affect different sectors of the economy and how you can tailor your investment portfolio differently.we have seen a dramatic rise in the consumption of goods. Following the recovery and travel being normalised once again, i see this pent up demand significantly affecting the service industry. In conclusion, recovery stocks might be something to consider as the world recovers.

Tigerpedia:

3. Value vs Growth Investing

tiger:@jayc

...Value investing is done by searching for companies trading for relatively cheap valuations based on some financial ratios and key metrics .Growth investing seeks stocks that capitalise on stellar growth in financials that help them capture market's attention and produce exceptional returns.

4. Dealing with Volatility in Stock Market

tiger:@3Fs

...It can be difficult for many investors who have not experienced volatility to continue to invest with confidence when the markets are volatile. At one moment, they are reeling the excitement of the upswing and then the next thing they let fear dominate them on the downswing.

5. Navigating Stormy Markets

tiger:@TraderNeo

...First, I try to make sense on the likely factors that are causing the weak week for the broader markets. Second, I consider how powerful the run up has been for the market indexes. Third, I will consider freeing up some capital by taking some profits or cut losses on selective winning stocks/ETFs.Lastly, I will consider this: GDP for 2Q was 6.5% which is well below expectations of 8.4% estimate which reinforced my believe that we are not at peak growth yet. This translates to more room for markets to climb or finish year 2021 strongly. Not surprising how analysts are hiking up S&P500 year-end target.

Personal investing experience:

6. Million Dollar mark Portfolio

tiger:@ElunMask

...It's a similarity seen in both new and more experienced investors, and it's one thing large investors such as Kevin O'Leary from Shark Tank speaks about. According to him, the first million is brutal, the first five are equally hard, and after your ten, it essentially takes care of itself because of the amount of capital "force" you have at your fingertips and can deploy.

7. Investment as a part timer

tiger:@KYHBKO

...I have been meddling with investment since 2019. Started this as a newbie, I made many mistakes - pressed sell when it was meant to buy, using excessive leverage, investing in stocks without proper research, allowing my emotions to take over my entry and exit plan … … all these are necessary “school fees” that we pay so that we can be more successful overtime. (And I am still paying some of these recurring fees)

Stock opportunities:

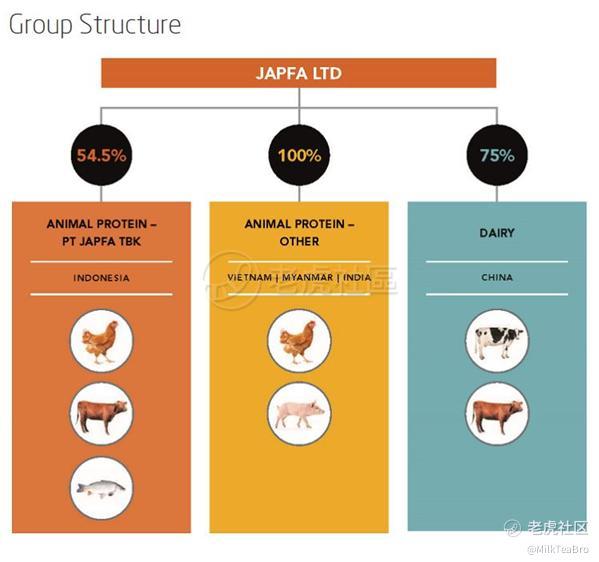

8. JAPFA Got Milk

tiger:@MilkTeaBro

...JAPFA employ over 40,000 people across an integrated network of modern farming, processing and distribution facilities in Indonesia, China, Vietnam, India and Myanmar. JAPFA specialize in producing quality dairy, protein staples (poultry, beef, swine & aquaculture) and packaged food that nourish millions of people.

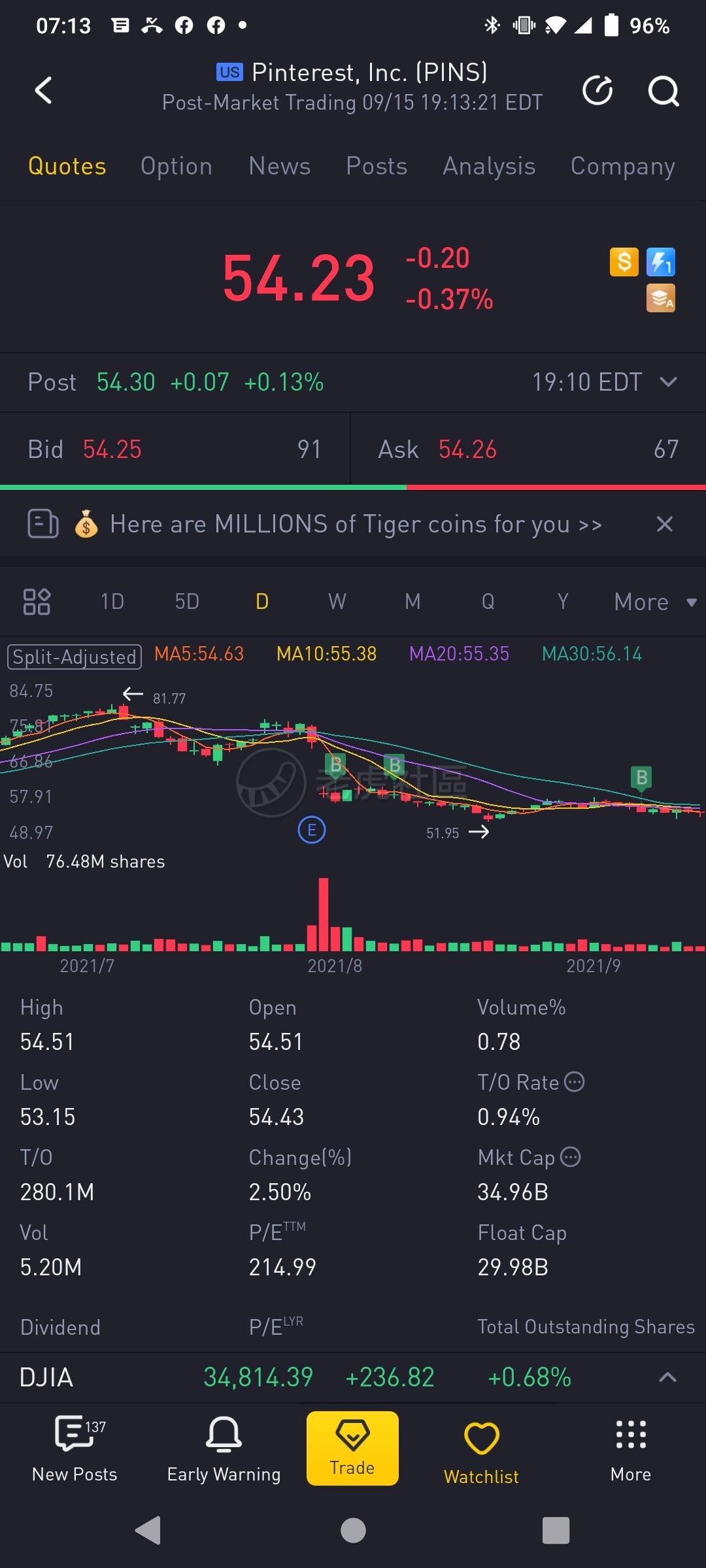

9. trading tips on pinterest

tiger:@mark01bravz

...In my opinion, given that Pinterest have their partnership with not just $Shopify but $target as well, it might be posed for a major run up after or before its q3 earnings. Now it is believed that Pinterest is kind of revamping their platform into whatever you see you can buy. This is a huge step ahead.

10. Is Apple overvalued now? Is it a good buy?

tiger:@Eldenminaj

...My key Takeaways:-Apple is a great company, with a strong fundamental Moat. The greatest in the world in fact. -I would buy, as I can foresee Apple taking more market share in the coming years. (Expected to take 40% of market share by 2024)-With new rollouts and new projects in apple, more revenue is expected to be brought it in the voming years.

Conservative Valuation: 150-160 (Fairly Valued)

Aggresive Valuation: 200-260 (Undervalued)

Congratulations to all these tigers! 👏👏👏

How can I get selected?

1、Write in-depth posts as many as you can, sharing insights on stocks and markets with others.

2. The posts should be ORIGINAL.

3. Posts with more than 500 characters are to be given priority.

4. Posts with any content that undermine the community experience will NOT be selected, like misinformation, rumors, Insults, harassment, threats, derogatory languages, etc.

NOTES:

1. Tiger coins will be sent within 5 working days after the results are announced.

2. This column will be upgraded in the future with more rewards

精彩评论