Do you intend to invest in Real Estate Investment Trust (“REIT”)? How do you decide on which REIT to invest in? Here are some ideas!

Disclaimer: I am not advocating any REITs here and I am not an expert investor or trader.

A. Looking at the Straits Time Index (“STI”)

There are currently 42 listed REITS in Singapore and seven of them are components of the Straits Time Index (“STI”). The STI is a list of Singapore largest public companies, and the seven REITs below constitute 14.80% (as of September 2021) of the index:

7 Singapore REITS (“S-REITS”) in the STI

- Ascendas Real Estate Investment Trust (AREIT)

- CapitaLand Integrated Commercial Trust (CICT)

- Frasers Logistics & Commercial Trust (FLCT)

- Keppel DC Reit (KDC REIT)

- Mapletree Commercial Trust (MCT)

- Mapletree Industrial Trust (MIT)

- Mapletree Logistics Trust (MIT)

The largest REITs by market capitalisation are CICT, AREIT and MLT, respectively.

B. Value

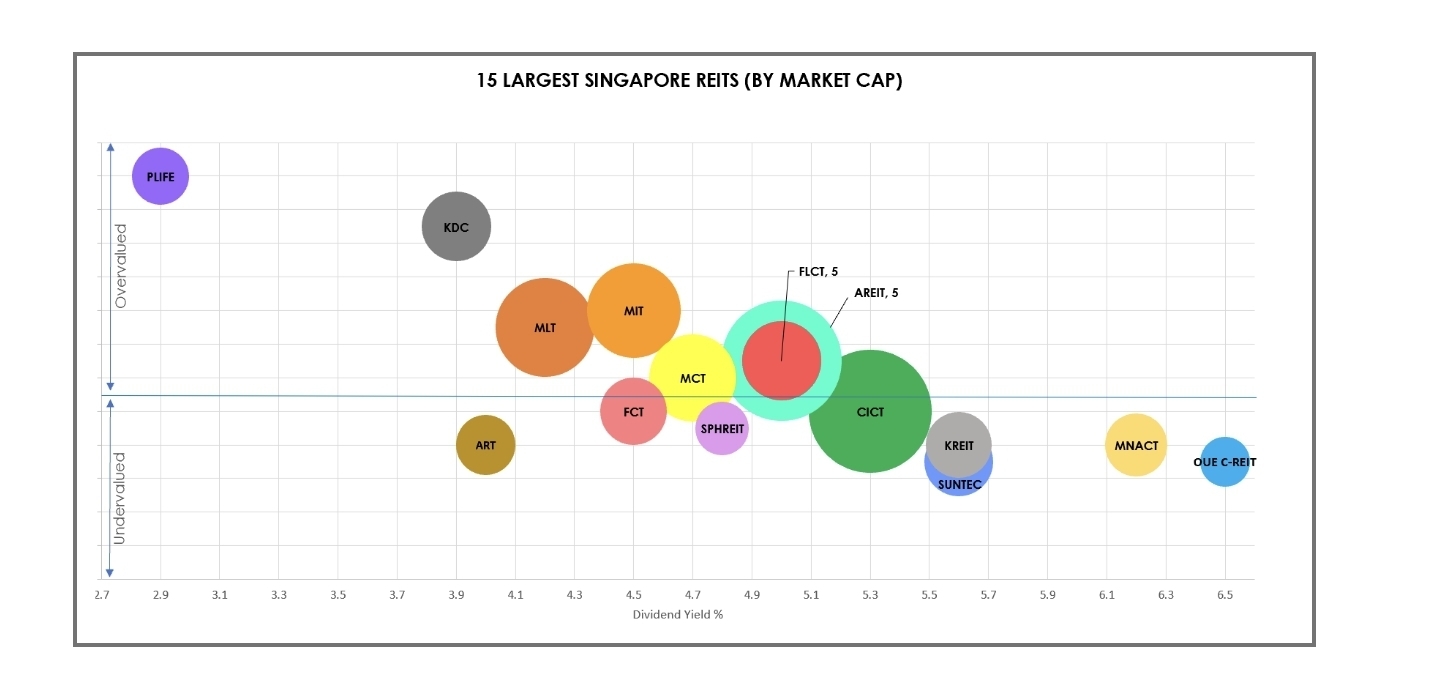

The size of the bubbles in the chart below corresponds with market capitalisation of each REIT. Interestingly, Parkway Life REIT is the has the least dividend yield and is highly overvalued. On the other hand, Mapletree North Commercial Trust (“MNACT”) and OUE Commercial REIT (“OUE C-REIT”) are two REITs that REITs that are undervalued but have more than 6% dividend yield.

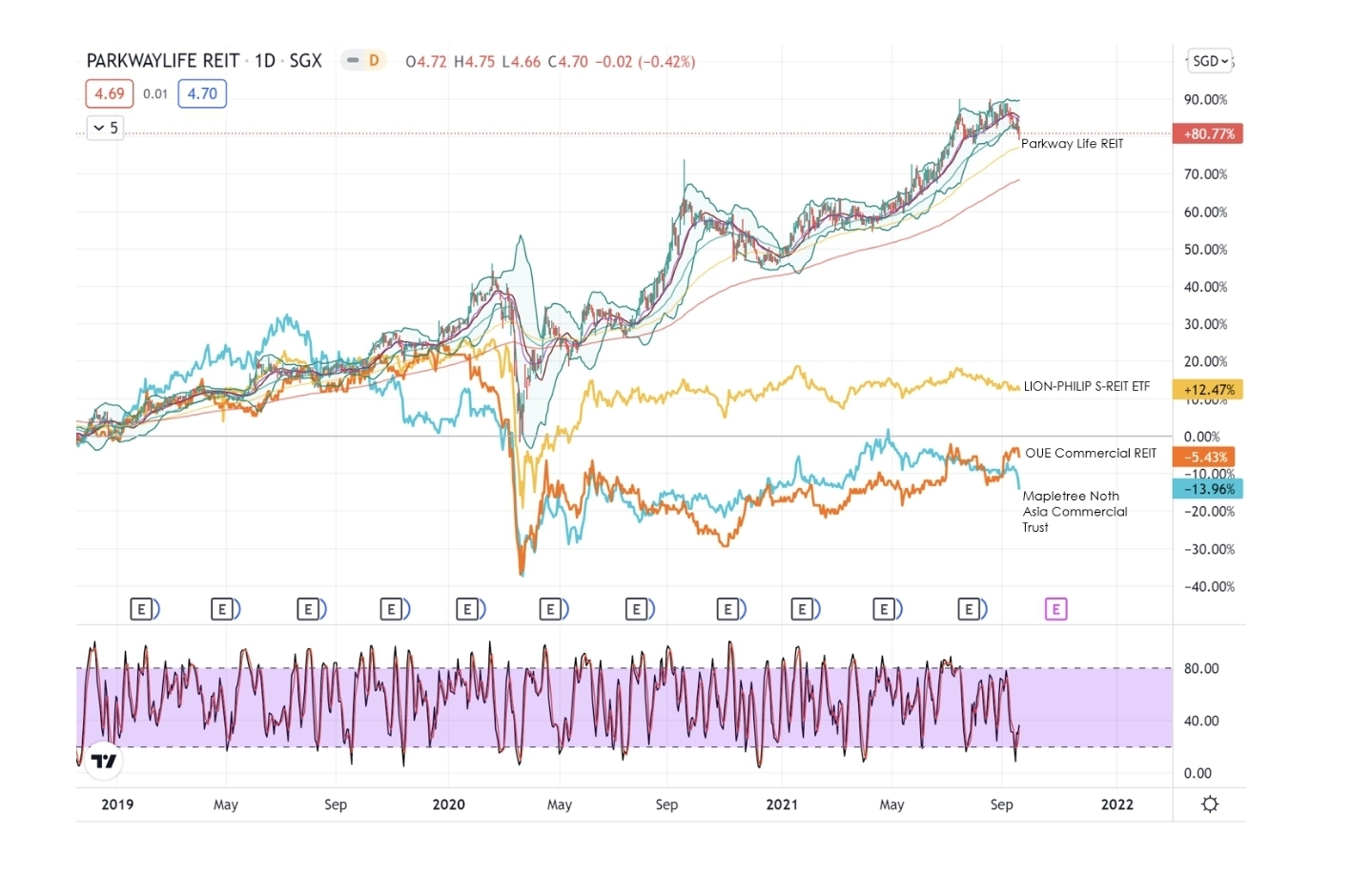

Dividend yeild percentage seems to correspond to share price performances. For example, Parkway Life REIT has been rewarding unitholders via share price growth despite the lower dividend yield. On the other hand, MNACT and OUR C-REIT have stable share prices but higher dividend yeilds. Interestingly, Frasers Logistics & Commericial Trust (not plotted below), is somewhere between Parkway Life Reit and the Lion-Philip S-REITS Etf.

It is like growth vs dividend stock here. Perhaps, we can reassess our portfolio composition and decide on an approach that best suits us.

C. Types of REITs

When it comes to investing in REITs, you may have varying preferences based on your perception of the current COVID-19 situation and economic recovery. Personally, I prefer to invest in healthcare and industrial REITs because I believe they are pandemic-proof and more resilient to economic downturn.

Industrial

Industrial REITs invest in industrial properties such as warehouses, manufacturing and logistics facilities, data centres, or industrial parks. Example: Ascendas Real Estate Investment Trust.

Commercial

Commercial REITs invest in office buildings. Example: Mapletree Commercial Trust.

Healthcare

Healthcare REITs invest in income-producing real estate and real estate-related assets used primarily for healthcare and healthcare-related purposes. In short, these REITs focus on hospitals, nursing homes and medical centres. Example: Parkway Life REIT

Retail

Retail REITs invest in shopping malls. For example, Northpoint City North Wing and Waterway point (40% interest) are some of the malls owned by Frasers Centrepoint Trust.

Are you a REITs collector? Let me know in the comments below! Happy investing! ![[爱你]](https://c1.itigergrowtha.com/community/assets/media/emoji_037_aini.19b204fe.png)

Note: This is my opinion for sharing purpose only. Investors should exercise caution and do your own due diligence before deciding whether to buy or sell any shares. I am not an expert.

精彩评论