各位好! 如果你有某种内容想要我写,可以留下留言。

如果你学到新知识或思维有所改变,可以给我点赞,好评或在你的朋友圈分享给其他人阅读这篇文章。多谢支持!

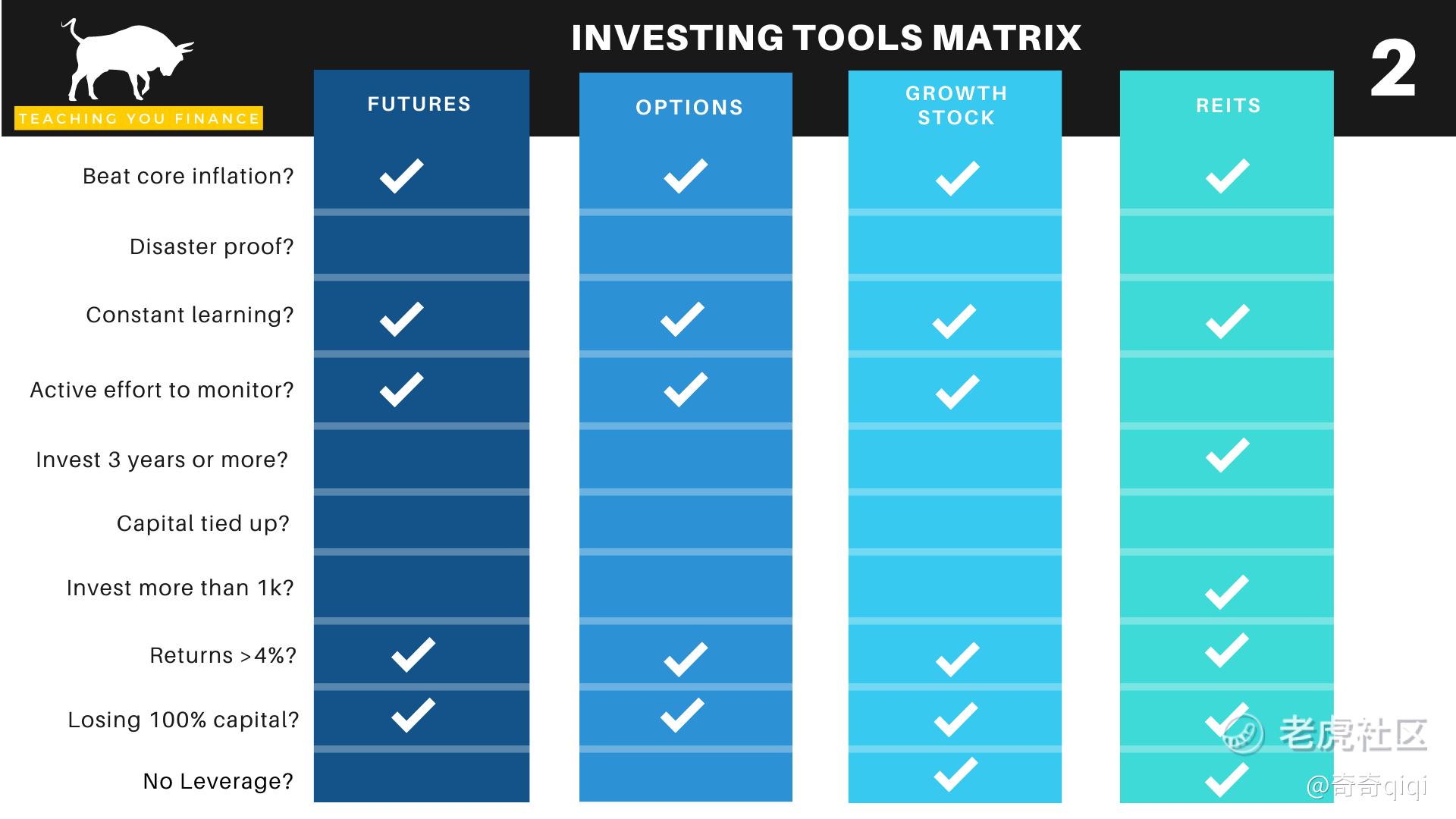

Sharing some of the more prominent asset classes for investment. This is part two of a three part series. In the previous post I introduced the first 4 types of investing tools in my matrix. If you have not read it yet,click here to find out more. 😂 How to pick an investing tool - Part 1

The following investing tools that I have indicated below will require you to put in more effort, calculated risk and knowledge to effectively utilize them to produce their intended returns.

BE PREPARED TO WORK HARD, TAKE ACTION AND GET SOME GAINS! 😃

5. Futures

Futures is an ultra high risk investment product. Please do not try this for any kind of beginners. 😪 I REPEAT, please avoid at all cost if you have little experience with stock picking, doing the fundamental & technical analysis of stocks.

I tried this when I bought into Crypto Futures. This can earn alot if you know what you are doing as it uses a high risk feature called ‘Leveraging’. I am not going to go in-depth into this for now hahahaha.

Leveraging is a double edge sword with unlimited profits and losses.It allows you to purchase more units with a smaller sum invested eg. a margin of x20 / x40 / x60 etc of your invested amount. If your investment has achieved positive results, your returns will also be higher due to the leverage.

Shares of Stock A is currently priced at $3.00 and you intend to buy 5,000 contracts of Stock A using Futures at the Ask price of $3.00. Assuming you set the margin for Stock A at 10%, then the initial margin you have to put up will be10% x $3.00 x 5000 = $1,500.

If you were to buy the same shares of company A using normal stocks on cash market, you would be required to put up $3.00 x 5000 = $15,000.

In this situation, you have leveraged 10 times.This effectively frees up your capital instead of putting in so much money to buy the shares.(Philips CFD, 2021)

However, leveraging can also cause you to lose more than 100% of your invested sum of money. If your investment turns sour, you can lose more based on your chosen leverage margin of x20/ x40/ x60 etc. It can one shot wipe out all your investment balances at one go if you didn’t put any stop loss in your investment.

I burned my fingers trading this and it wiped out my entire Future’s account balance to zero in a blink of an eye. 😭

This is one of the reason why leveraging is so dangerous and risky in my view. Look at BTC chart on the 28 October 2021. The price of BTC was moving upwards from the 58K USD mark to the 61k USD mark. Out of nowhere in a matter of just 7 minutes long, there was a flash crash where the price of BTC suddenly dropped from 61K USD to 57K USD.

This effectively wiped out many retail traders’ Stop Loss orders. Most likely a big whale/institution has the power to do such a move. Imagine you are leveraging and this happened to you. Your whole entire Futures portfolio could get wiped out to zero USD left in your account. When you open your own Futures account to see zero balance left and it is definitely not a happy experience that anyone wants to encounter.

6. Options

I am referring to Stock Options trading where it gives you the ability to exercise your ‘rights’ not the obligation to own stocks during a limited time period.

This requires you to monitor your options regularly and its not suitable for those who wants to trade passively.

Best to be proficient in both fundamental analysis to calculate the stock’s fair value and technical analysis to read the price candlestick chart. Candlestick reading is a must to trade rationally.

You cannot purchase Options in the Singapore market.

This allows you to buy the options of stocks (not owning their shares) at cheaper prices compared to buying the actual stock of the company using the ‘leveraging’ feature as well.

There are two types of option methods. First is to buy Call/Put options and the second is to sell Call/Put options

For buying Call/Put options, you can make money at any direction in the stock market. If this is done correctly, you can achieve higher returns (eg. 0% to 500% returns) compared to purchasing the stock itself as each option lot represents 100 shares. You have the rights to 100 shares and this magnifies your returns while your losses will be limited to your premiums (principal sum) paid to own the options. (unlimited profits and losses limited to your premiums paid)

Just to show an example of earning 6,198 USD (444% returns) in profits for buying one lot of call option with a premium cost of 1,395 USD and closing the option at 7,600 USD.

Does this look familiar to you? This call option was bought in the Tiger Broker app 😊

For selling Call/Put options, this has higher risk and please avoid trading this if you don’t own 100 shares of that particular stocks. You will gain a fixed amount of premium as profits.Sell put options: you will have the obligation to buy the shares if the market price surpasses your strike price. Sell call options: you will have the obligation to sell the shares if the market price surpasses your strike price. (limited profits and unlimited losses)

7. Growth Stocks

Growth stocks or super growth stocks are not your average stocks in the market. They are labelled as ‘growth’ for a reason. 😁

They must possess some form of economical moat or their business models have disrupted the existing way businesses are run in order to gain that monstrous growth.

Best to know how to calculate the stocks’s fair value to know when to buy stocks at discounted prices. However, its not a mandatory requirement to buy at ‘discounted prices’ as their prices will always rise in the longer term.‘Time in the market is better than timing the market’. HAHAHA 😂

Growth stocks are not immune to bear markets but due to their superior economical moat, they are able to bounce back quicker than others during bear markets.

FAANG (Facebook, Apple, Amazon, Netflix, Google) is just one example in our daily life where we use eg. Facebook, WhatsApp and Instagram etc to connect with others and place advertisements to reach out to potential buyers in the internet just to name one. *Facebook just changed their name to Meta.

These kind of stocks usually do not issue any form of dividends to shareholders (some do) as the company is focus on gaining market share and grow further. You will earn the capital gains when the share price goes up and this will usually take months to see the fruits of your labour.

As there are no leverage, you have to pay alot more just to own the shares of the company compared to Futures & Options trading.

8. REITS (Real Estate Investment Trusts)

REITs are companies that own different kinds of real estates and properties. You can purchase their stocks on the stock market. The bigger players in Singapore are CapitaLand Integrated Commercial Trusts & Acendas etc.

There are many types of REITs such as Retail, Office, Industrial, Residential, Hospitality and Healthcare etc.

Usually REITs stock prices will not fluctuate much and will remain stagnate unlike growth stocks. One who owns REITs will profit from the dividend payouts and not from the capital gains. Thus, REITs stock owners will not be bothered when the stock prices go up or down in the short term.

REITs are not disaster-proof and their revenues were severely affected during the border closure / circuit breaker in year 2020 where retail malls were forced to shut and people were informed to work from home instead.

One main traits of Singapore REITs is they must payout 90%of their taxable income back to their shareholders every year. This gives us a stream of steady income annually.

Only dividends earned from Singapore REITs are not taxable for Singaporeans. 😊 If you purchase REITs from the overseas market, please be aware that there are withholding taxes to pay depending on which country you purchase from.

REITs is a capital intensive investment as you have to own alot of their stocks to enjoy the economies of scale in the dividend payout.

For example, if the dividend yield of a REIT is 4% annually, holding just 200 shares will just give you a mere 8 SGD return which is not significant but it will still beat the core inflation rate and prevent your cash from losing its value if you understand where I am coming from. 😀

Originally published at https://medium.com/the-investors-handbook/investing-tools-matrix-part-2-3-c241c8f37e81?sk=bf94a71fddf05faee9668d06a84ae5d5

Stay tuned for part 3!

精彩评论