Lets talk about a grossly overvalued company today:

Here are my key takeaways:

●Based on FY2020 Free cash Flow Valuation, 6.8% Discount Rate and Growth Rate of 15%, Tesla stock is worth USD 133.80 (483% Overvalued).

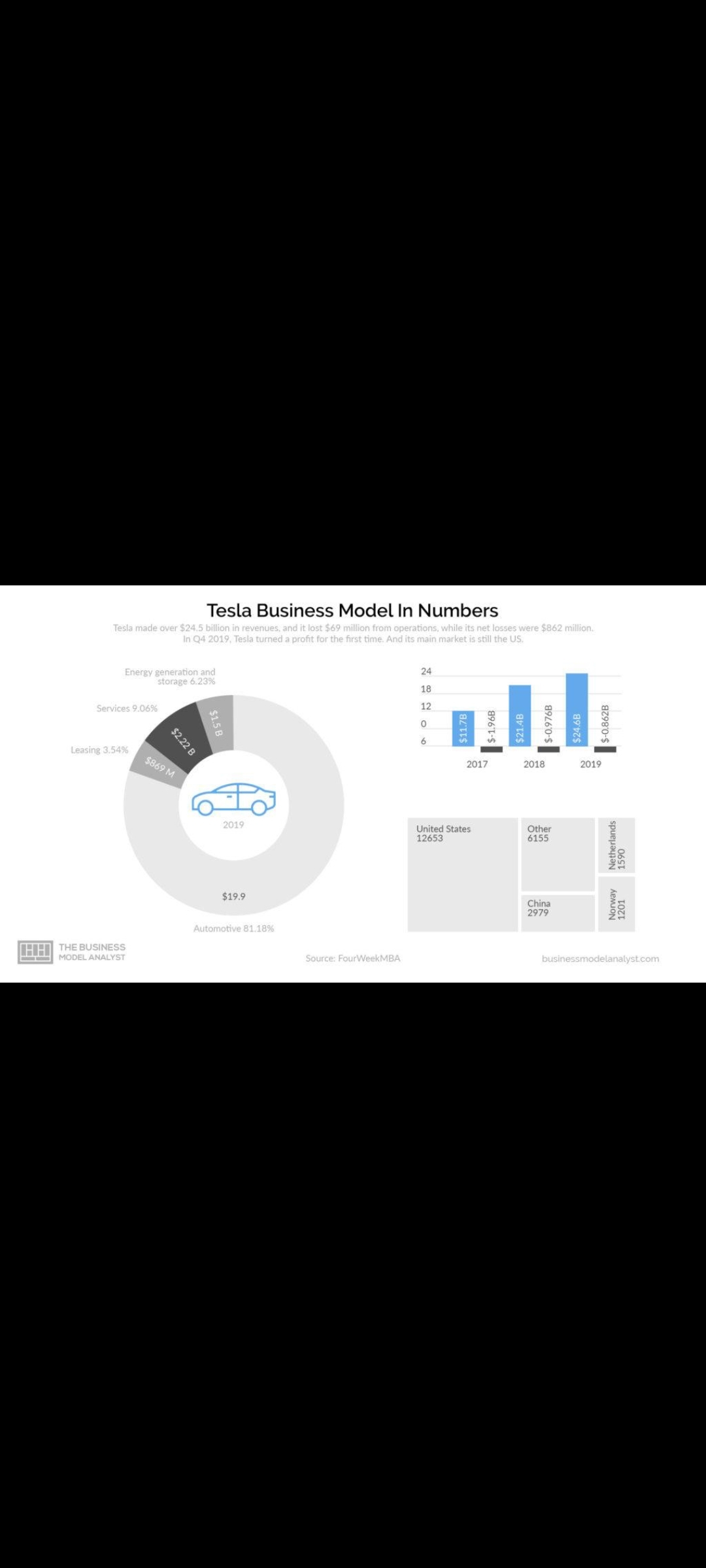

●Tesla has been running at a net loss since 2014. The only year it closed with a positive profit was 2020. The EPS for 2020 was 2.23, which means PE ratio is 350!!

●Tesla has been actively diluting shareholders since 2014. Average Basic Outstanding Shares grew at a CAGR rate of 6.97% for the past 6 years.

●Tesla Revenue mainly comes from selling "Green Credits" to other automative makers, and not because they profit from selling cars.

●With alot of automakers going green, lesser car companies are buying energy credits from Tesla, my prediction is that if Tesla is still unable to profit from selling cars, the company will eventually lead to crazy losses and bankcruptcy.

BOTTOM LINE?

Tesla is EXTREMELY overvalued and the business is a load of crap. Buy into Tesla and your portfolio will go down the drain the moment a bear market strikes. You are better off investing in a low-cost S&P500 Index fund, which will outperform Elon Musk's company.

精彩评论