各位好,如果你有某个内容想要我写,可以在评论里留下留言。

如果你学到新知识或思维有所改变,可以给我点赞,好评或在你的朋友圈分享给其他人阅读这篇文章。多谢支持!

Do you contantly think and worry about inflation whenever you make a purchase? If yes, you can also drop me a comment and share how did you overcome it.

Being aware of the existance of this economical phenomenon and finding ways to overcome inflation in our daily life is something that all of us should spend a little time to think about.

Take this hypothetical example where you are able to buy three hamburgers with just $4.99. However, with the effect of inflation, it eroded your purchasing power and that same amount can only buy you one hamburger instead. Sucks right haha😣

1. Have You Wondered Why Things Are Getting More Expensive?

I believe you have came across the phase where a dollar today is worth less than what it will be in the future?

That is the invisible power of inflation my friend! 😕

Inflation is the reduction in monetary value of your money, with the rising prices of goods and services.

We have no control or ways to stop inflation. However, we have the ability and knowledge to overcome this through for instance, investing at a rate higher than the inflation rate to offset this phenomenon.

Meaning if the inflation rate is at 1% and if my money is able to generate returns of just 1.1%, my purchasing power (+0.1%) will remain the same as before. Cool right, you get the idea haha 😂

2. What Is Singapore’s Inflation Rate Like?

- Inflation is measured by the annual percentage change in the Consumer Price Index (CPI) (Mas.gov.sg)

- Usually I would gather the latest CPI data from the Singstat website under the‘Singapore Consumer Price Index’ which is governed under the Department of Singapore Statistics.

There are a few types of inflation rates. Out of all, the most important one I see as the benchmark will be the Monetary Authority of Singapore (MAS) Core Inflation indicator.

Core inflation rateis the measure that excludes the components of “Accommodation” and “Private Transport”. These are excludes as they tend to be significantly influenced by supply side administrative policies and are volatile. By doing so, this value shows the generalized price changes that are driven by underlying demand conditions. (Mas.gov.sg).

3. How Is Core Inflation Computed?

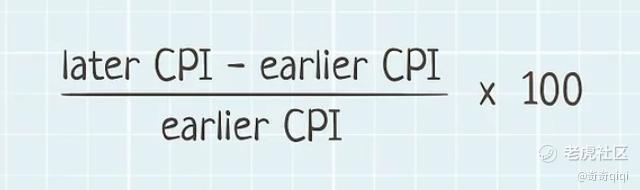

This is a basic formula to compute inflation rate. eg. hypothetical assume that the CPI for 2019 August is 105.757 and the CPI for 2018 August is 104.742.

The rate of inflation from 2018 to 2019 August would have been (105.757–104.242)/104.242*100 = 1.45%

Meaning to ensure that your money does not lose its purchasing power overtime, you’ll have to so-call find creative ways to make your money grow at a minimum rate of 1.45% or more per xxx time period to counter this impact. Make sense right? 😁

This is just an example, go and determine the core inflation rate yourself.

Once you know what is this value, you will definitely stop looking at investments that give you interest rates per annum that is lower than your calculated core inflation rate.

Based on MAS core inflation published for August 2021, it stands at +1.1%year on year now. Anything that generates a return lesser than 1.1% will lead to a smaller purchasing power with the same amount of cash on-hand. You can read the link to find out more.

https://www.mas.gov.sg/-/media/MAS/EPG/CPD/2021/Inflation202108.pdf

4. Situations Where I Tried To Overcome Inflation

- High Savings Account

Placing your money in a high savings bank account such as DBS Multiplier, OCBC 360 account, UOB One savings account etc. Interest rates here are definitely higher than your normal savings account (only 0.05% per annum). However with the economy downturn, banks are also slashing the interest rates. siobs siobs….😞

- Cash Management Account

There are multiple accounts out there but for now I am only using Stashaway Simple. The risk will be higher than high savings bank accounts as the your money will be invested into a portfolio of funds.

- Robo-Advisors

This is a good alternative if you are ready to set aside some cash to invest into this. I have experience using Stashaway and Syfe and both were really not bad for me.

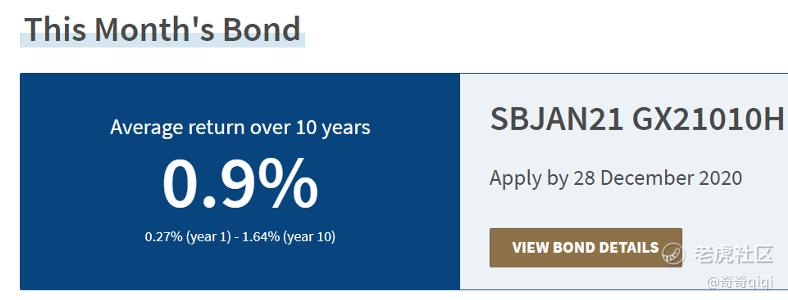

- Bonds

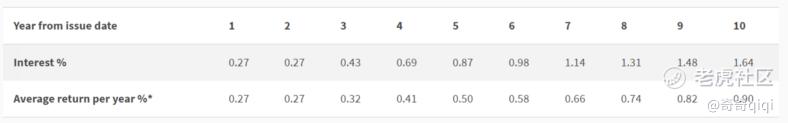

I used to do this but I stopped as the interest rate is just too low. Moreover, the pandemic has resulted in the interest rates dropping to a level which I didn't see the point in buying into this.

- CPF (applicable in Singapore only)

A national compulsory savings scheme which consists of three sub accounts mainly the Ordinary (OA), Special (SA) and Medisave (MA) accounts. Each account has its own properties and interest rates per annum. You can find out more directly from the CPF website as their policies will keep changing ever now and then.

- Stocks

Stocks are a higher risk higher return kind of investment strategy which I am currently pursuing. Always remember to learn and understand what you are doing before investing into the stock market. 😃 There are different types such as ETFs, dividend and growth stocks each with different properties and purpose. You need to know what works best for you and focus on that. Always do your homework and research to be sure of what you want to do when you enter into a trade / order.

This is not financial advice. Just to provide some context for understanding and learning purposes.

Examples of divided stocks eg. DBS Bank. $星展集团控股(D05.SI)$

Examples of ETFs eg. STI index. $Nikko AM STI ETF(G3B.SI)$

Examples of growth stocks eg. Tesla $特斯拉(TSLA)$

- Stock Options

Options is a double-edge sword type of investments where it can accelerate your returns if done well and significantly erode your profits if it is done incorrectly. Please as a word of caution, always buy / sell options with a clear plan and strategy in mind. This is to reduce your risk of time decay and chance of losing money.

- Cryptocurrency

This has the highest risk as no central governments in the world has accepted this except for El Salvador currently. But even so, El Salvador only recognied Bticon as a legal tender meaning the other cryptos like Etherium, Cardano etc are stil not recognised and it is still seen as speculative to invest in this. There are a few ways to earn besides buy and hold strategy such as staking, liqudity mining, NFTs etc. No matter what, this space is huge, growing still and there are also alot of scammers out there waiting to do rug pulls on uninformed investors. Thus, remember to do your research and find out more before you start buy some coins.

- Side Hustle and Others

This can be anything from selling stuffs on Carousell / ebay to generate additional source of income etc. There are many ways to go about overcoming inflation. No harm trying out the different strategies and see which method works best and its sustainable for you in the long run! 😁

Originally published at https://medium.com/the-investors-handbook/invest-to-hedge-against-inflation-f8acce1e837e?sk=7a11e3614c9b49a63305a4796ba6b742

精彩评论