各位好,如果你有某种内容想要我写,可以留下留言。

如果你学到新知识或思维有所改变,可以给我点赞,好评或在你的朋友圈分享给其他人阅读这篇文章。多谢支持!

Here, I share some tips to preserve your investment capital and slowly grow with concentration.

Before I get any hated comments for my above statement, putting your eggs into the same basket is applicable and rational in instances where:

- you have lesser capital for investment

- you have been investing with less than 6 months experience

- you have a long term horizon to invest for the future

Diversification strategy is meant for intermediate and advanced level investors where they have already outgrown and maximized their returns for the first individual / single basket of investment and are ready to add more baskets of investments and grow their wealth further.

Before going further, you have to ask yourself if investing is really something for you first. Click here to find out more about the 11 factors that I shared. Are You Ready to Invest?

The following that I am going to share below I believe are topics that people will rarely say or share on social media and online.

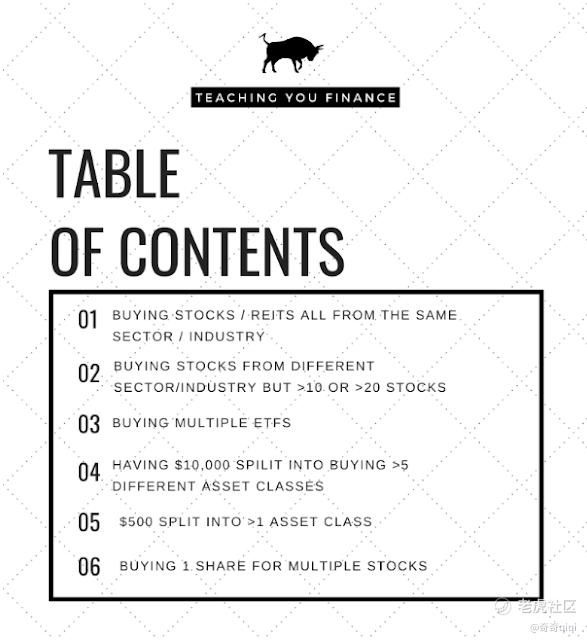

1. Buying Stocks / REITs All From The Same Sector / Industry

Imagine spending your money to buy 10 shares of SHOP $Shopify Inc(SHOP)$ , 10 shares of AMZN $亚马逊(AMZN)$ and 10 shares of BABA $阿里巴巴(BABA)$ shares. Or buy 10 shares of TSLA and 10 shares of NIO at the same time.

What do the above cases have all in common? They are all from the same industry!

The first case is all are in the E-commence space while the second case is all are in the EV space. If the EV market has a downtrend or when a market sector rotation happens, you will see both your TSLA and NIO prices to go down at the same time.

For Singaporeans, a simple case will be buying into 100 shares (1 lot) of OCBC, 100 shares of DBS and 100 shares of UOB. All three are big banks in the financial sector in Singapore. Unless you have huge amount of free money to spend to buy all three at once, why will you want to buy all three while you are trying to build up your portfolio from scratch? 😂

I personally bought both OCBC and DBS at the same time last year. Now thinking back, I felt I should either go all in for OCBC or DBS instead of trying to get a bit of both and so call ‘over diversify’ in this case. Yes, you might be thinking along the lines where both OCBC and DBS are different companies but they are still in the same financial sector. When the pandemic happened last year, both are affected at the same time if you get where I am coming from.

2. Buying Stocks From Different Sector / Industry (But >10 or >20 Stocks)

Imagine you buy 5 shares each for the following companies: FB, BABA, TSLA, MSFT, NIO, GOOG, FVRR, JD, QQQ, SPY, ARKK, ARKG etc

The issue here is do you really think you have the time to really put in effort to read up on their financial performances and monitor their stock performances of each company that you bought shares of the above? The answer is clearly ‘No’.

If you have a 9am to 9pm full-time job or have family commitments etc, you definitely do not have the time to manage your this portfolio of 12 stocks. There are some in this list that are speculative in nature, some are tech, some are ETF, some are overlapping stocks etc.

At the end of the day, you will start to lose track of the performances of this portfolio and will not make the right decisions which is to get the maximum return from your portfolio.

Basically I made this mistake very early in my investment journey where I bought I think 10+ different individual REITs company stocks. It was super difficult to monitor each and every one of them unless I am a full time investor looking at charts every day but this was not the case. Diversification will lead to your own demise and this is more evident as a young investor who is still finding your feet.

Best to focus on a handful xxx amount of stocks that you know you can manage on your own, rather than buying so many and losing count of your investments. Remember, quality is more important than quantity!

3. Buying Multiple ETFs / Robo-Advisors

Guys, always focus on quality than quantity in investing!

Thought of buying abit of each of the following ETFs: ARKK, ARKG, ARKF, ARKW?

or how about buying VTI and VYM?

My friend, chances are that you have bought into ETFs that have some of the same companies in both of the ETFs and its overlapping each other. Overlapping ETFs are the ones that we want to avoid.

This is the same for Robo-Advisors. There are many mushrooming in the market now such as Stashaway, Syfe, UOBAM, Endowus, Moneyowl, DBS / OCBC Robo etc.

In the past, I was using three Robo-Advisors at the same time and I made the decision to cut down to two instead as having so many which is not beneficial at all. From two I cut back to one and now I exited 100% from Robo-Advisors.

How I did the cut was to pull out the list of assets that both Robo are investing my money in. I went to compare their returns over 10 years and chose to keep that Robo that gave the higher return and the one I felt had the higher potential to go further in the future.

4. Having $10,000 Split Into Buying >5 Different Asset Classes

Let say you are just starting out to invest and you have set aside $10k for this after factoring in emergency funds and savings etc.

SG example 😁

- $2000 to invest in MCT shares (MapleTree REITs)

- $2000 to invest in G3B shares (STI ETF)

- $2000 to invest in SSB (Gov Bonds)

- $2000 to invest in Syfe Cash+ (Cash Management)

- $2000 to invest in Syfe Equity 100 (Robo-Advisor)

First look at this, you might think that this is a good diversification method as you spread out your risk into 5 different asset classes.

You might want to relook at this, think again and ask yourself questions.

Why only allocate $2k so little into Bonds that needs to be held for 10 / 20 years before expiry to gain the full bond coupon payouts? 10 years is a long time and to just put in $2k really does not make any sense at all.

Why put $2K into Cash+? Why not $4k into SSB or $4k all into Cash+?

If I am young and able to take some risks why not put $6K directly into Syfe Equity 100 to maximise my returns in one area instead of splitting evenly into Bonds, Cash Management etc

Do you get where I coming from? 😀

$10,000 is not alot of money and to over diversify into 5 different asset classes with each asset class only given $2k. In reality, how much returns can that asset generate with that smaller amount of fund allocation?

Not only that, 5 different assets means you have to monitor 5 different things at one time.Its not very productive and it consumes your time which can be used to watch more Netflix for some hahahaha. 😂

Another example.

If you want to purchase Cryptocurrencies with $10,000, how will you do it?

A:$5,000 into BTC and $5000 into ETH

B:$10,000 into BTC only or ETH only

I will do it method B hands down. Focus on one coin and maximise its returns. $10,000 is a small sum of money, to split it into more than 1 coin in my opinion is not the most wise choice to do so unless its $100,000 then it will be a different story.

5. $500 Split Into >1 Asset Class

This is the same as point 4.

If the amount to invest is so small eg. $500, I will discourage you to split into 2x $250 or 5x $100 to invest. The amount is just too little for each investment and there will be no economies of scale in returns.

I believe some of you will do this at some point in your journey at the beginning as this was what I did when I first started out due to not knowing the unknowns out there and trying to do this to make some cautious baby steps.😁

6. Buying 1 Share For Multiple Stocks

This will link back to my pointers for 4 and 5.

Not knowing the unknowns and trying to make baby steps by buying 1 or 2 shares of different companies to diversify your risks.

Means having the mentality to just buy 1 share of eg. TSLA and if something goes wrong, its just 1 share…..

Number 1: you are buying too little shares per company. If the company share price increases, you don’t earn much capital gains (no economies of scale).

Number 2: Of course when the company share price drops, you don’t lose too much and this makes you feel better.

Its obvious that number 2 is the key driver that make you purchase stocks in this manner. Understanding the company and why you buy their stocks by reading their fundamental analysis and entering the market at a price that you are comfortable with using technical analysis is the key to overcoming this problem.

There are no right or wrong. Is just from my experience, for now I am more focus on doing concentration in buying stocks rather than to buy many stocks at smaller amounts.

Nevertheless after going through the list above,please do your own due diligence before investing as always.

Can comment and share with me below on whether your current portfolio is tilted more towards concentration or diversification?

Originally published at https://medium.com/the-investors-handbook/scenarios-not-to-over-diversify-your-portfolio-b7cdb13f20?sk=f70713cdaa511fa05071d2a233cee2a5

精彩评论