$Trade Desk Inc.(TTD)$Probably most people just skimmed through trade desk q2 earnings call. I was thinking why not do an in-depth and revisit into trade desk q2 earnings since q3 earnings is coming.

“We continue to innovate more quickly & effectively than our competition. We have very strong momentum & expect the winds to stay at our backs going forward.” — CEO and Co-Founder, Jeff green.

1. Demand

The Trade Desk’s internal guide called for $259 to $262 million in quarterly revenue. Analyst expectations were for $258 million in quarterly revenue.

It posted $279.9 million in sales beating the high point of its internal guide by 6.8% and analyst expectations by 8.5%.

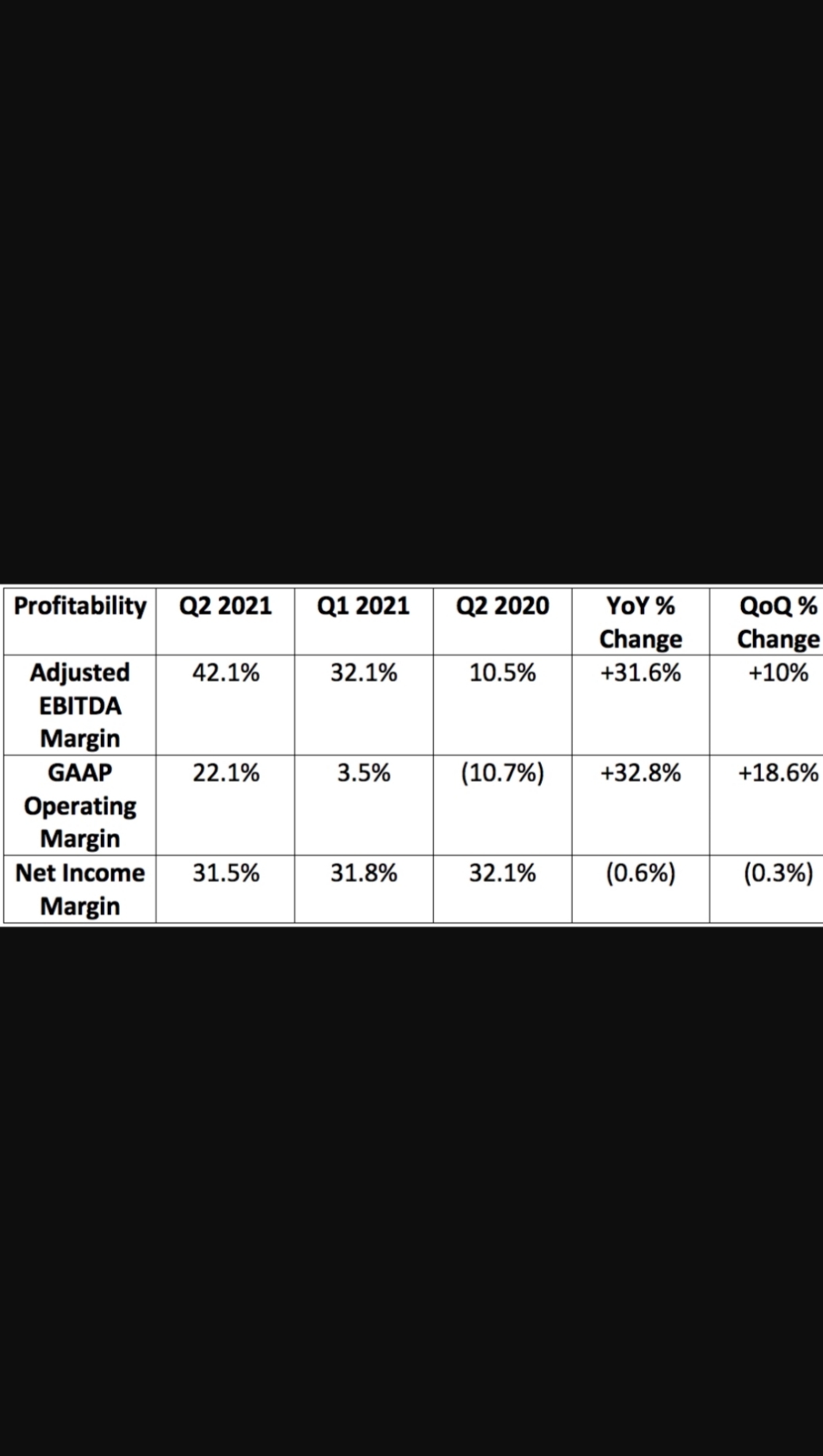

2. Profitability

The Trade Desk’s internal guide called for at least $84 million in adjusted EBITDA. It posted $117.9 million, surpassing that minimum by 40.4%.

Analysts expected The Trade Desk to earn $0.13 per share for the quarter. It earned $0.18 per share thus beating expectations by 38.4%.

The quarterly EBITDA margin was boosted by temporarily lower operating costs due to virtual living (The Trade Desk avoided travel and live event costs).

3. Next Quarter Guidance

The Trade Desk guided to at least $282 million in sales. At a minimum, this would beat analyst expectations by 2.5%. The Trade Desk has a strong history of comfortably surpassing the at least estimates it provides. This rate represents 30.5% year over year growth or 38% when excluding the impact of political spend in 2020.

The company also guided to $100 million in Adjusted EBITDA.

4. Management Commentary

a. Jeff Green

“CTV as a percent of our business continues to grow very rapidly and is by far our fastest growing channel. CTV growth significantly outpaced our total growth in the quarter.” — Green

Walmart will launch its new demand-side platform (DSP) using The Trade Desk’s Solimar in the 2nd half of the year; it will be fully integrated by Q4. The Trade Desk will collect its standard 15% platform fee within this partnership.

“We’ve gotten unanimously positive feedback on Solimar. — Green

“UID2 adoption momentum has accelerated since Google announced its 2 year delay of the phasing out of 3rd party cookies.” — Green

A “major global food company” is now working to shift 25% of its ad-budget to CTV with The Trade Desk by next year.

“We were leading in Australia and the United States heading into the pandemic. We are now seeing amazing results in Germany, England , France and Spain as well.” — Green

So far in 2021, The Trade Desk’s clients spending $1 million+ annually on CTV has already more than doubled year over year. Clients spending $100,000+ on CTV also has already more than doubled year over year. Total CTV clients on The Trade Desk’s platform grew 50% year over year to over 10,000 strong.

The Trade Desk now reaches 87 million households via CTV. This is larger than the maximum reach of linear TV.

CTV revenue in Europe more than 10Xed during the quarter. A deepening partnership with Sky Media in Europe gives The Trade Desk access to the majority of CTV ad-impressions across the continent.

AVod CTV growth continues to greatly outpace SVod CTV growth.

CTV revenue in India was up more than 10-fold during the quarter. (brand new market)

Industries slower to recover from the pandemic (hospitality and travel) are now aggressively picking up marketing spend to capture recovering demand. Pent-up ad-demand has not yet fully unwound.

For the first time in the history of programmatic advertising, the up-front season featured every major broadcaster including programmatic spend in their packages. Linear pricing is rising even as its efficacy falls due to its scarcity as the shift to programmatic accelerates. This is creating an even larger programmatic, data-driven advantage.

2 programmatic case studies:

Ford’s CTV campaign with The Trade Desk led to 48% growth in incremental households reached.

A “large pharma” programmatic campaign with The Trade Desk led to 51% growth in incremental households reached and a 4X improvement in cost per household impression.

Green discussed how the open internet is vital to maintaining a direct to consumer brand connection as well as access to consumer data. Walled gardens are increasingly seen as an obstacle in the way of maintaining this relationship. This continues to power the move away from walled gardens and to The Trade Desk’s open internet approach.

“Based on the current pace of adoption, the majority of impressions on our platform will be purchased using Solimar by next year.” — Green

Solimar allows users to directly connect their ad-spend to specific outcomes which is why behemoths like Walmart and Home Depot signed on.

UID2 is well on its way to reaching critical scale and recently was embraced by 3 of the World’s largest ad-agencies such as IPG.

“UID2 will be a currency the advertising world will have to accept much like a retailer accepts Visa. We are at an inflection point where parties can’t afford to not be part of it.” — Green

b. Blake Grayson

Video, audio and display all doubled year over year.

A breakdown of revenues by segment:

Mobile = “low 40% range” of total revenue

Video (including CTV) = “high 30% range” of total revenue

Display = 15% of total revenue

Audio = 5% of total revenue

CTV doubled its relative share of total spend in Europe year over year.

5. Business Highlights

Recent(ish) UID 2.0 adopters highlighted:

IPG (Interpublic Group)

AMC Networks

Omnicom Group

Snowflake

Maven (owner of Sports Illustrated, The Spun, etc.)

Accolade highlights:

Top 100 Software Company of 2021 by The Software Report

Adweek Readers’ Choice Best of Tech Awards for Demand Side Platform and Innovator of the Year

Included on the Forbes Global 2000 List

FORTUNE 2021 Best Medium Workplace for 5 straight years

The company has $704 million in cash & equivalents + net short-term investments on its balance sheet with 0 debt. It can be as aggressive as it wants to be in pursuing future organic or inorganic opportunities.

“I've been positively surprised by the advancements The Trade Desk has made vs. digital platforms. Their focus on advertiser needs for advanced targeting and inventory management are setting them apart from YouTube and the rest of the marketplace.” — Mondelez VP of Consumer Experience Jon Halvorson

6. My own conclusion

This was another fantastic quarter for Jeff Green and The Trade Desk. Demand and unit economics continue to be very strong with excellent forward guidance as well. Solimar and UID2 momentum is exceeding all expectations. Great results.

精彩评论