$Meta Platforms, Inc.(FB)$has suffered much losses recently after a weaker than expected guidance. Though the quarter's revenue fell short (estimated $29.57B versus actual of $29.01B), the EPS was better than expected (estimated $3.19 vs actual $3.22).

Some notable concerns have been raised:

Quarter's daily user is lesser than estimated, arriving at 1.929B versus estimate of 1.93B

Reality Lab (which is researching and creating the various A/R, V/R hardware) conctinued to suffer losses since 2019. This is an important pivot for Meta and currently, there are no signs that Meta is in the lead in any metaverse domain as yet.

Europe's privacy issues (extract from their SEC submission):

The tech giant took issue with European privacy regulations that, it said, complicate its platforms’ functionality and ad products. Specifically, the rules prohibit cross-border transfers of user data, so Meta can’t process Europeans’ information in its U.S.-based servers.

“If we are unable to transfer data between and among countries and regions in which we operate, or if we are restricted from sharing data among our products and services, it could affect our ability to provide our services, the manner in which we provide our services or our ability to target ads,” the company wrote in the report, filed last week. “If a new transatlantic data transfer framework is not adopted and we are unable to continue to rely on SCCs (standard contractual clauses) or rely upon other alternative means of data transfers from Europe to the United States, we will likely be unable to offer a number of our most significant products and services, including Facebook and Instagram, in Europe,” the filing read.

Meta is hopeful that Europe and US would be able to work things but this can be a lengthy process that would cause volatility in the prices. Failing to make this work could see Facebook out of Europe. Meta acknowledged v threats to its business from privacy regulations to heightening scrutiny over alleged anticompetitive practices.

Here, they expressed their concerns about Metaverse - a statement that reflected more uncertainty than confidence:

“In addition, we have limited experience with consumer hardware products and virtual and augmented reality technology, which may enable other companies to compete more effectively than us,” it continued. “We may be unsuccessful in our research and product development efforts, including if we are unable to develop relationships with key participants in the metaverse or develop products that operate effectively with metaverse technologies, products, systems, networks or standards.”

Next $Apple(AAPL)$pulled the rug under Meta when their products limit Facebook's access to user information. This is expeted to costs Facebook $10 billion in revenue losss.

From the 1 Day chart above, there is not confirmation yet in the reversal of the downtrend.

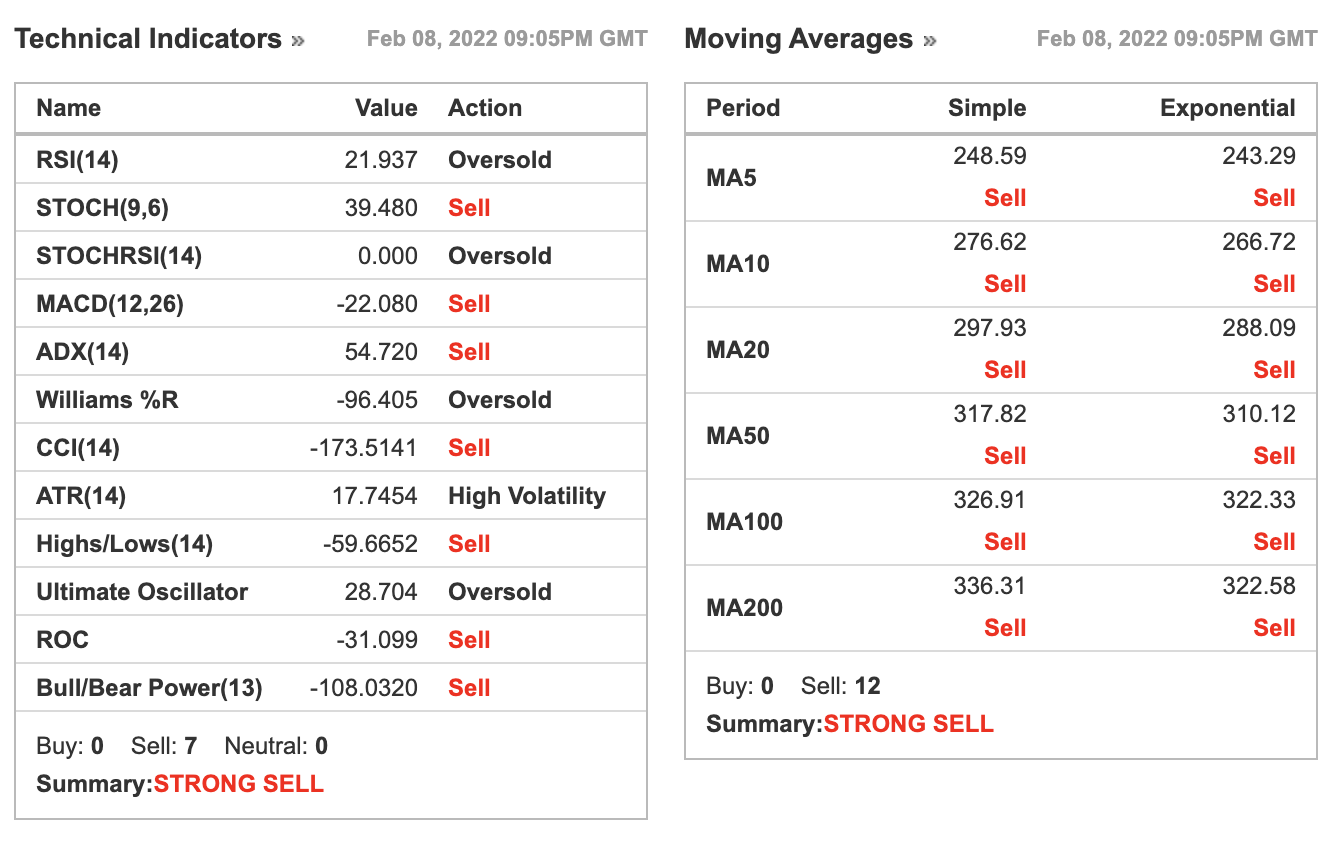

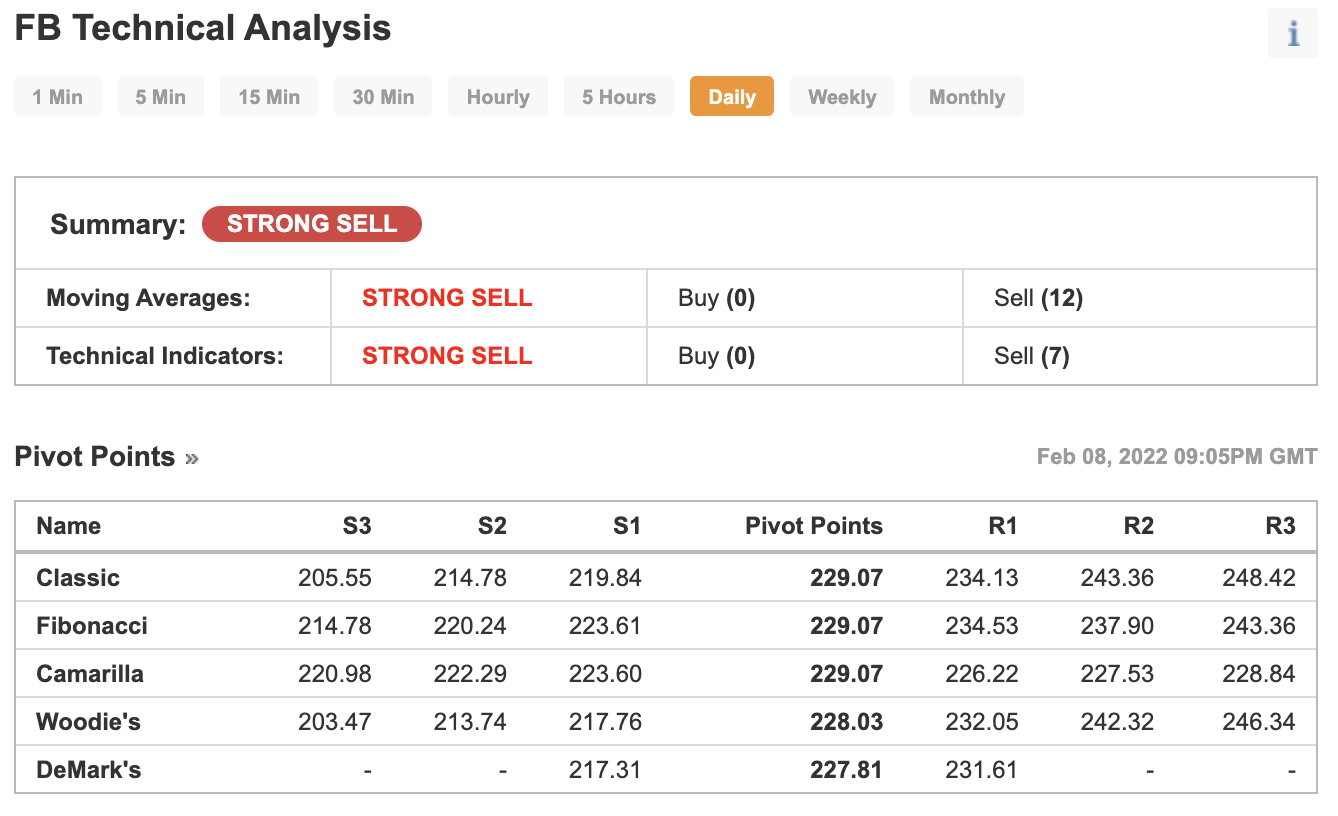

The following 2 charts are extracted from investing.com:

Using the 1 Day chart, both technical indicators and moving average still indicated strong sell for Meta.

From 1 Day chart, there are some key support levels of $220 and $214. If these are breached, there is a chance for Meta to go to low $200.

While the stock is oversold, it is best to watch from the sidelines as there is much volalitility ahead. If any of us wish to trade, some analysts recommended only short trades for Meta.

精彩评论