各位好! 如果你有某种内容想要我写,可以留下留言。多谢支持!😃

In this post, join me as I unravel and share some light on a Singapore stock calledParkway Life REITs (C2PU). Personally, I used to hold this stock for about 1.5 years since Covid started. I bought it quite cheap during the market collapse period. Here I share some points on their recent financial performance and technical analysis

Disclaimer: All information stated here is only for illustration and educational purposes. It's not financial advice to buy or sell any financial products. Please perform your own due diligence before investing as always.

Why is this my favourite stock?

The answer is simple. I want to invest in a REITs type of stock in Singapore to generate consistent returns via dividends. When the price of REITs goes up or down, I can sleep well at night as I am not bothered by the constant fluctuation of stock prices. All I need to do is to make sure that I receive its dividend during the payout period and I will be happy. 😀

Dividends are not taxed in Singapore so that is another good thing to know. I did cover the pros and cons of dividend stocks in one of my previous articles. Can click here to view it if you have not done so. How To Pick An Investing Tool (Part 2/3)

What do Parkway Life REITs do?

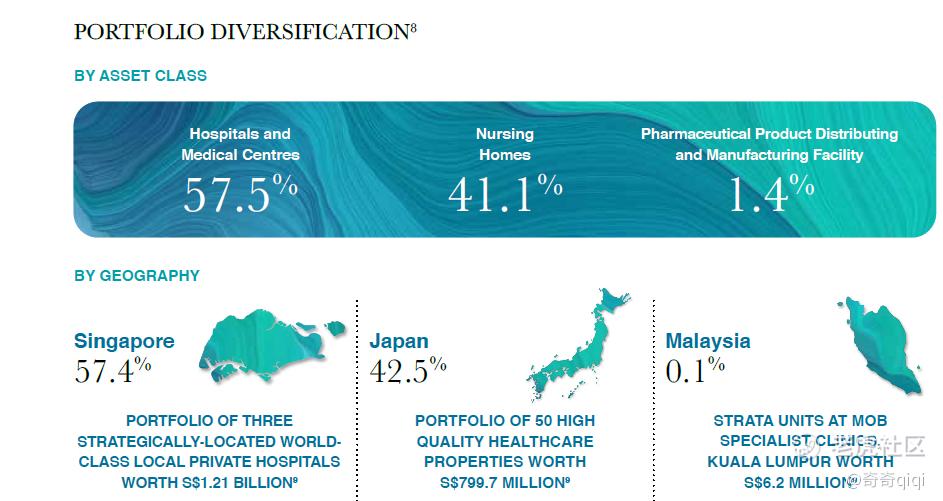

Parkway Life is one of the largest listed healthcare REITs in the Asia region. They have successfully expanded and currently managed as of 30 Sept 2021, 55 different hospitals and healthcare medical centers in Singapore and Malaysia. They also have over 50 assets in Japan.

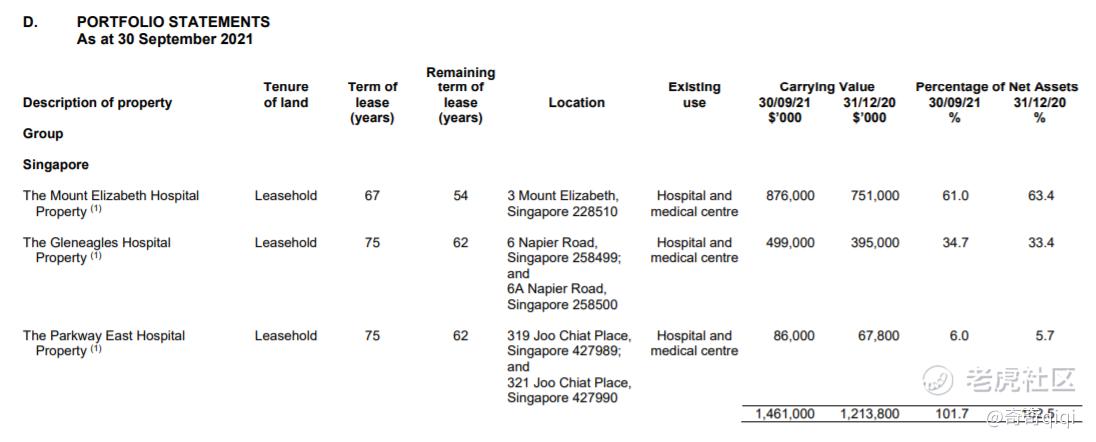

The 3 most popular hospitals in Singapore are Mount Elizabeth, Gleneagles, and Parkway East. All of which I have never been to before. 😄

The remaining leases for the hospitals are still long at 54 years at the very minimum with the carrying value increasing from the previous year.

Basic Stock Information

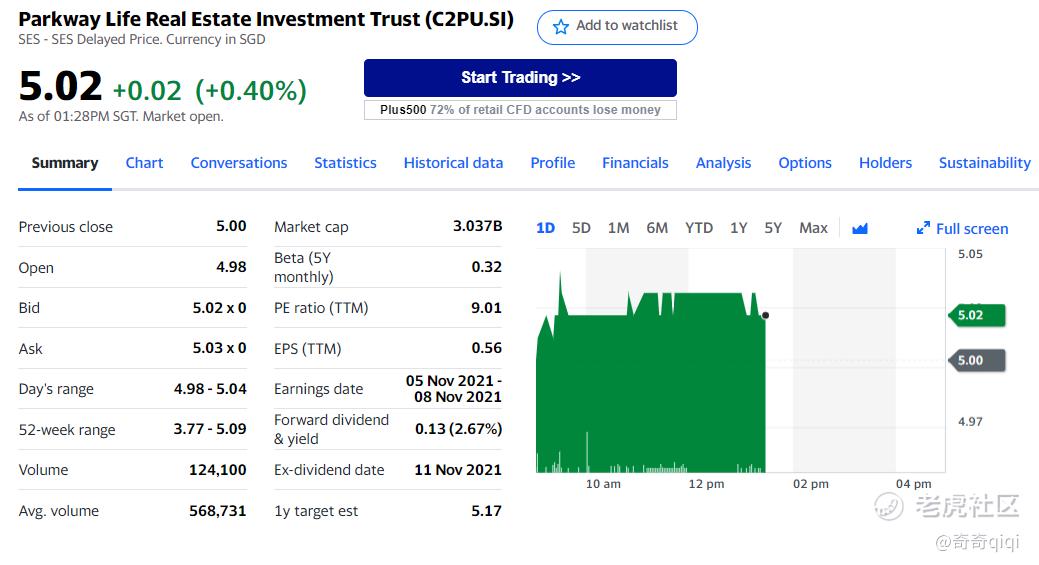

Listed on the Singapore stock exchange as a ticker symbol C2PU.

Looking at the data from Yahoo Finance, its price on 8th Dec 2021 is around 5.02 SGD per share. Not to forget that SG stocks need to buy in lots of 100 shares each. 1 lot is 100 shares and that is a total of 502 SGD excluding brokerage processing fees etc.

Beta value 0.32: the price is more resistant to price fluctuations and less volatile in the short term. This has its pro and cons. If you just focus on getting your returns via dividends, then a stable price is beneficial but there will be no capital appreciation from the price.

Market Cap of 3.037B: is in the top 50 list of listed companies in Singapore.

Price for the past 52 weeks: 3.77 to 5.09 SGD. Price movement is small but it is on the uptrend now.

Other factors: Profit Margin: 279%. Operating Margin: 79%

Net Income: Maintain at current levels with not much difference across the past 4 quarters.

Cash Flow: It is still positive and it looks to be getting better with more inflow from operating activities.

The company is still in a stable and healthy position at the moment.

The unit price hit a record high which was boosted by the inclusion of the REIT in the FTSE EPRA NAREIT Global Developed Index.

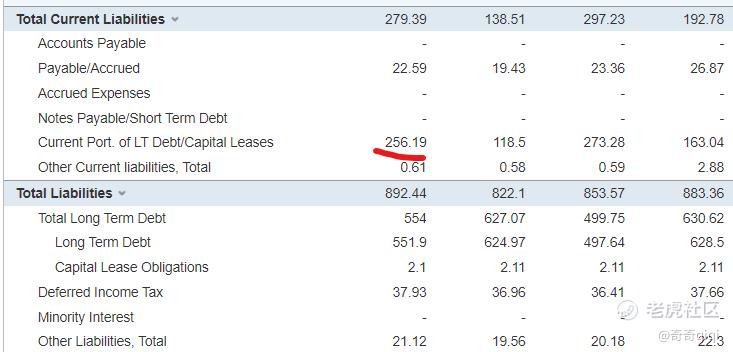

The only outstanding part that I saw was the rise in the 'Current portion of Long Term dept/capital leases'. The company did more loans/ borrowing for business-related purposes. This is something that the company will need to monitor and keep in check to ensure that they can pay it off in the 12 monthly periods.

There was a drop in Long Term debt to 551.9 in the last quarter which is good news.

This will help to calm and maintain the level of confidence for investors.

Dividend Payouts

This is the most exciting part for investors as to how much can we receive in dividends. For dividends, it is about 2.81% for the year 2021. Dividends are given out every quarter.

From the Q3 review:

This will be music to the ears of investors. Distribution per unit (DPU) has increased.

DPU =The number of dividends a REIT investor receives for every unit he has in the REIT

Technical Analysis

I like this company as they not only give dividends, the price also appreciates for the past 1 year as shown. It has a healthy up and down price fluctuation cycle. But always remember to DCA and never enter at the all-time high.

Comparision

C2PU- price for the past 52 weeks: 3.77 to 5.09 SGD. That is a 35% rise in price. $百汇生命产业信托(C2PU.SI)$

D05- DBS bank's price for the past 52 weeks: 24.71 - 32.70 SGD. That is only a 32.3% rise in price. $星展集团控股(D05.SI)$

G3B - STI index's price for the past 52 weeks: 2.87 - 3.34 SGD. That is only a 16.3% rise in price. $Nikko AM STI ETF(G3B.SI)$

The price appreciation for ParkwayLife is really outstanding beating the likes of DBS and the exchange index.

Healthcare is an essential sector. With an aging population and the rise in new diseases not to forget about Covid, this will remain a strong pillar of support for our society.

Even during COVID in March 2020, ParkwayLife was able to rebound back to its pre-COVID stock price by August 2020 which took about 5 months. Up till today, it continues to be trading at a higher high with the 20 and 50 EMA always above the 200 EMA line.

From the above, it is obvious that ParkwayLife has strong fundamentals in their business and the price is an indicator of it. In my opinion, there are a lot of potentials if you are hunting for dividend and REITs related stock for your portfolio. As always, please do your own research and build your own conviction before you buy. This is just a dossier report. 😃

Originally published at https://marcusseetoh.medium.com/

精彩评论