Tesla's growth plans $Tesla Motors(TSLA)$

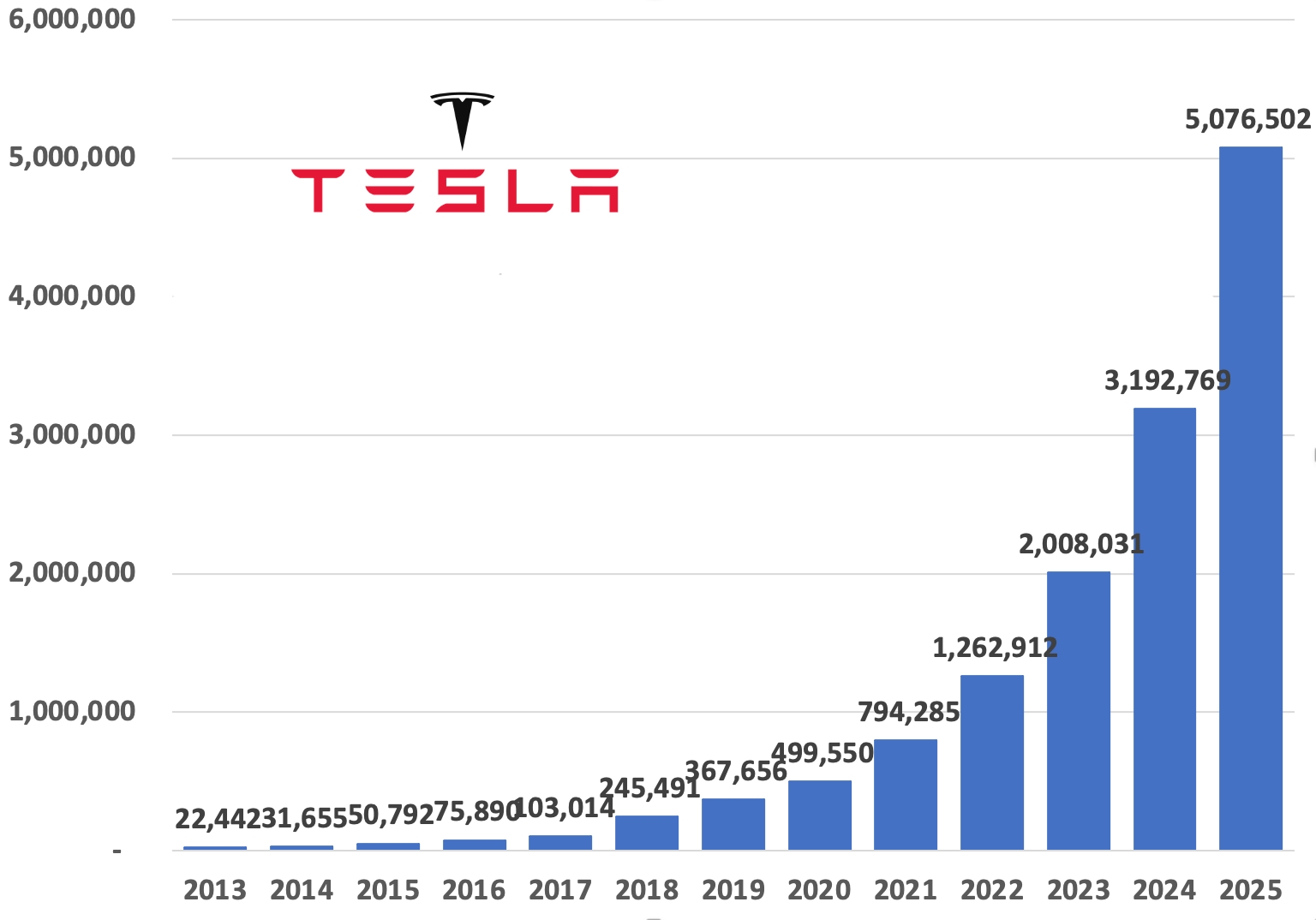

In the third quarter, Tesla's revenue grew 57% year over year. Tesla $Tesla Motors(TSLA)$ management said the company expects to grow its EV deliveries at an average annual rate of 50% over a multi-year horizon. In 2020, the company delivered nearly 500,000 vehicles. Based on its expected growth rate, the company could be delivering 28 million cars annually 10 years from now. So let's assume that its growth slows down to an average of 20% annually after five years. By doing so, Tesla could still be selling roughly 9.5 million EVs annually by 2030.

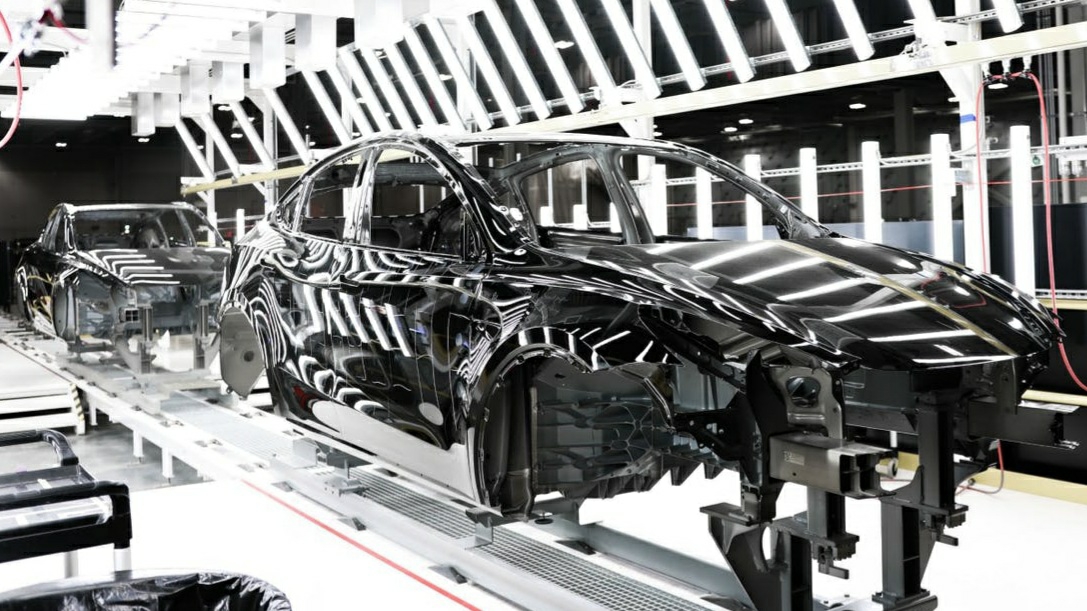

To sell that many EVs, Tesla needs to first produce them. The company currently has a production capacity of roughly 1 million cars per year. It is constructing two new Gigafactories, one in Berlin and the other in Texas. Beyond that, the company plans to launch new models including its Cybertruck, Semi, and Roadster. Tesla plans to construct at least two new Gigafactories beyond what's already announced in the coming years, though their locations are not yet decided. So, there is a lot of work, and growth, ahead for Tesla in the next decade.

💸Key growth avenues💸

Tesla's long-term growth won't solely be coming from selling EVs. The company has established itself as a disruptor, and it could continue living up to that image in the years to come. There are several other potential growth avenues for Tesla.

First, the company is focused on advancing its autopilot and Full Self-Driving (FSD) features. To attract the best AI talent, Tesla hosted an AI day event in August. Notably, attracting the best talent is key for Tesla to lead on the FSD front. Several automakers and technology companies are working to make autonomous driving a reality, and most have the financial resources to achieve that objective. Technological know-how could well separate the winner here. Tesla is also expanding its FSD beta testing to more drivers; that should help smooth the rollout of its FSD functionality.

Second, continuous improvements in vehicle software and battery packs are required for Tesla to maintain its edge in EVs and FSD, and the company is focusing on these aspects, too. Energy storage and solar deployments are other potential growth areas for Tesla; the company has been progressing well in both segments.

Finally, Tesla is focusing on auto insurance as a growth opportunity. Obviously, the company plans to do this differently than traditional insurance companies. Tesla plans to use its vast driver data for things such as braking, turning, unsafe following, forward collision warnings, and so on to predict the probability of a collision and offer custom premium rates based on that.

🆙🆙🆙Investor takeaway

All in all, there is a lot to look forward to from Tesla in the coming decade and beyond. As the company progresses on these fronts, its stock could rise further from here on. The stock may not generate the outsized returns that it did in the past couple of years as a lot of growth is already priced in. Yet, I think it is well-placed to generate market-beating returns in the coming several years.🚀

精彩评论