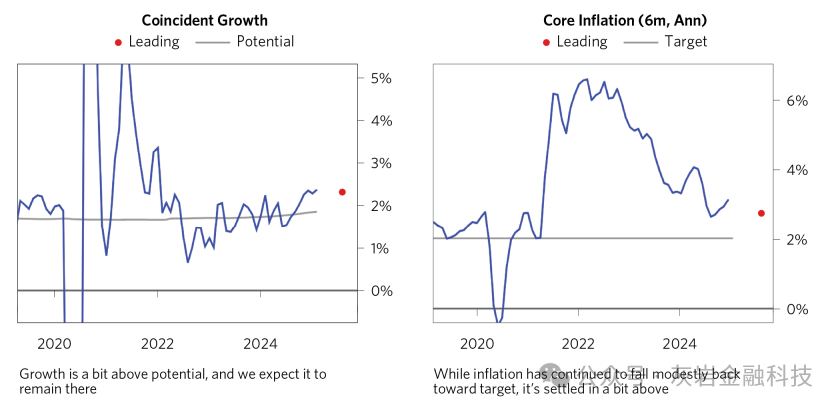

The most recent Fed meeting confirmed that policy makers see the strength of conditions warranting a pause in the easing cycle. Looking forward, we expect economic outcomes to remain on the upper end of policy makers’ goals.

As we have discussed previously, we see the current economic environment reflecting the gradual drift of economic conditions toward equilibrium and market pricing reflecting expectations of stable economic outcomes and neutral monetary policy. From here, the question for markets is whether this process has room to run, or whether the underlying moderation in conditions stalls out with the economy remaining too hot for policy makers to support assets.

Recently, we’ve seen signs that the path will be bumpier than expected: inflation has remained above target; labor markets have remained tight; and policy makers have signaled that they in turn will be more cautious about easing policy, with the Fed on Wednesday holding rates steady. Markets have responded to these developments by increasing inflation expectations, paring back the pricing of rate cuts, and driving up forward yields relative to cash. Some degree of this is healthy; it reflects asset pricing and risk premia adjusting more in line with the current and likely forward path of conditions and policy. But these developments also reverberate back into the economy: the broad-based increase in interest rates is likely to tamp down what little credit impulse was coming from the modest easing we’ve gotten so far and to weigh more broadly as a countervailing downward pressure on growth and inflation.

Looking forward, we expect this push and pull to continue: the economy is still a bit too hot relative to policy maker goals, so a significant easing isn’t currently justified, but baseline conditions are likely to remain near the cyclical sweet spot of on-target growth and inflation. Typically, this is a solid environment for holding assets and earning a roughly normal risk premia, and we expect this dynamic to remain a support. Today, however, favorable conditions are already largely reflected in market pricing, and risk premia—particularly in the US—are narrow. On the other hand, asset yields likely can’t rise much more without exerting economic pain that policy makers are unlikely to tolerate, given only modest constraints on their capacity to ease.

The charts below summarize our read of conditions in the US through this lens: key economic drivers like growth and inflation remain in the zone—but on the upper end—of equilibrium levels. And while forward interest rates have risen as markets are no longer pricing a significant further easing from here, risk premia on assets broadly still look narrow relative to cash.

美联储最近的会议证实,政策制定者认为当前的经济形势足以暂停宽松周期。展望未来,我们预计经济结果仍将处于政策制定者目标的上限。

正如我们之前所讨论的,我们认为当前的经济环境反映了

经济状况逐渐向均衡方向转变

市场定价反映了对稳定的经济结果和中性货币政策的预期。从现在开始,市场面临的问题是,这一过程是否有继续的空间,或者经济形势的潜在缓和是否会因经济过热而停滞,政策制定者无法支撑资产。

最近,我们看到一些迹象表明,这条道路将比预期更加坎坷:通胀仍高于目标;劳动力市场仍然紧张;政策制定者已暗示他们将对宽松政策更加谨慎,美联储周三维持利率不变。市场对这些事态的发展做出了反应,提高了通胀预期,削减了降息定价,并推高了远期收益率相对于现金的收益率。在一定程度上,这是健康的;它反映了资产定价和风险溢价的调整更符合当前和未来条件和政策的走向。但这些发展也对经济产生了反作用:广泛的利率上升可能会抑制迄今为止温和宽松政策带来的少量信贷冲动,并在更广泛的意义上对增长和通胀形成抵消性下行压力。

展望未来,我们预计这种推拉趋势将继续:相对于政策制定者的目标,经济仍然有点过热,因此目前没有理由大幅放松政策,但基线条件可能仍将接近周期性增长和通胀的最佳点。

通常,这是一个持有资产和获得大致正常风险溢价的稳固环境,我们预计这种动态将继续提供支撑。然而,今天有利条件已经基本反映在市场定价中,风险溢价——尤其是在美国——很窄。另一方面,资产收益率可能不会大幅上升,否则将给经济带来痛苦,而政策制定者不太可能容忍这种痛苦,因为他们的放松能力受到的制约很小。

下图总结了我们对美国状况的解读:经济增长和通胀等关键经济驱动因素仍处于均衡水平的区间(但处于上限)。

尽管远期利率已经上升,因为市场不再预期今后将有进一步的大幅宽松,但资产的风险溢价相对于现金而言总体上仍然较低。

The US Is Converging Toward (the Upper End of) Equilibrium

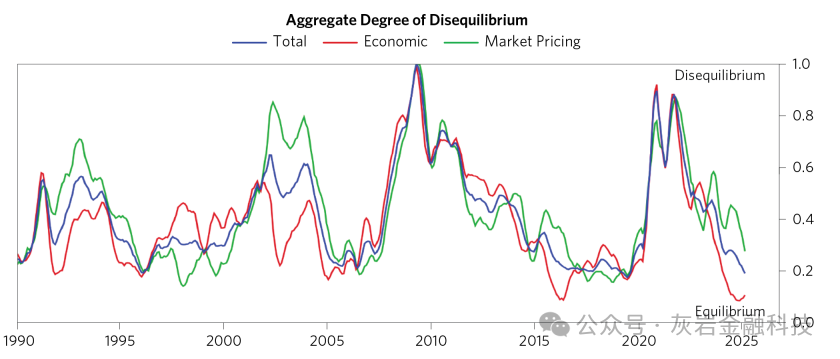

For the first few years following COVID, the US economy—like most of the developed world—was significantly outside of equilibrium. At first, conditions deteriorated due to a deflationary collapse in income and demand, but subsequently, a massive and coordinated flood of easing produced inflationary imbalances that required a rapid and steep tightening of policy in turn. The tightening crushed credit creation, which, coupled with strong productivity growth, brought spending in line with output—facilitating disinflation and enabling the shift toward easing that we’ve experienced over the past year. That has brought us toward sustainable equilibriums today.

The chart below shows our measurement of the total degree of disequilibrium in economic conditions as well as market pricing. As you can see, conditions have rapidly converged to an aggregate setup that’s as close to equilibrium as we’ve seen in recent history.

美国市场正在趋向均衡(上端)

在新冠疫情爆发后的最初几年里,美国经济与大多数发达国家一样,明显处于非均衡状态。起初,由于收入和需求的通货紧缩崩溃,情况恶化,但随后,大规模的协调宽松政策引发了通胀失衡,进而需要迅速大幅收紧政策。紧缩政策压制了信贷创造,再加上强劲的生产率增长,支出与产出保持一致——促进了通货紧缩,并促成了我们过去一年经历的宽松政策转变。这让我们今天走向了可持续的均衡。

下图显示了我们对经济状况和市场定价总体不均衡程度的测量。如您所见,经济状况已迅速趋向于我们在近代历史上最接近均衡的总体设置。

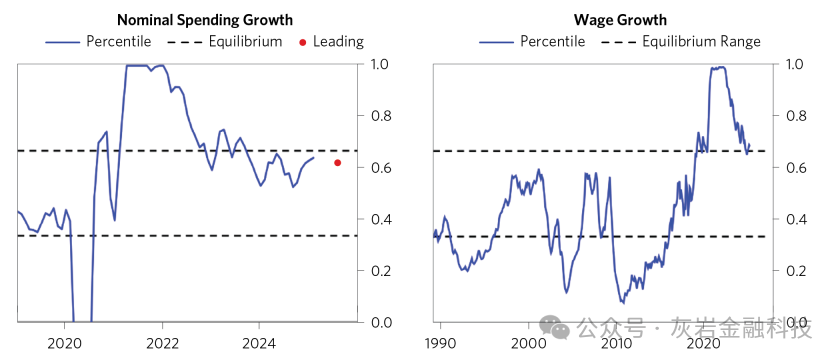

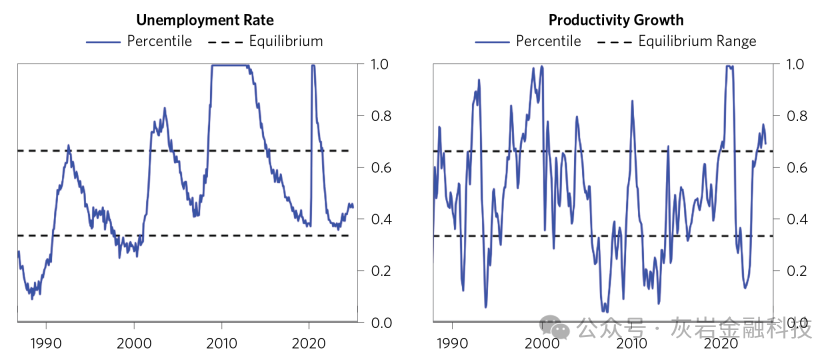

Next, we show a few of the key measures we look at to track the path to equilibrium. We show each of the measures relative to our estimate of equilibrium levels, in percentile terms versus their historical distributions, to make the relative magnitudes more comparable across concepts.

Putting together the real growth and inflation pictures, nominal spending remains strong and on the upper edge of what is likely tolerable. This spending is supported by ongoing robust income growth, which in turn is reinforced by wages and a healthy labor market. Meanwhile, the inflationary ramifications of low unemployment and high wages have been softened by the disinflationary effects of high productivity growth. Our leading measures suggest that conditions are likely to settle in at levels similar to today, without significant change pressures.

接下来,我们将展示几个追踪均衡路径的关键指标。我们将每个指标相对于我们对均衡水平的估计值(百分位数与历史分布)进行比较,以使各个概念之间的相对量级更具可比性。

结合实际增长和通胀情况,名义支出仍然强劲,处于可能容忍的上限。这种支出受到持续强劲的收入增长的支持,而收入增长又得到工资和健康的劳动力市场的强化。与此同时,低失业率和高工资的通胀影响已被高生产率增长的通货紧缩效应所缓解。我们的主要指标表明,情况可能会稳定在与今天类似的水平,而不会出现重大的变化压力。

Backward-Looking Easing Has Supported Ongoing Strength, While the Recent Market-Based Tightening Is a Drag—Netting to a Balanced Forward-Looking Picture

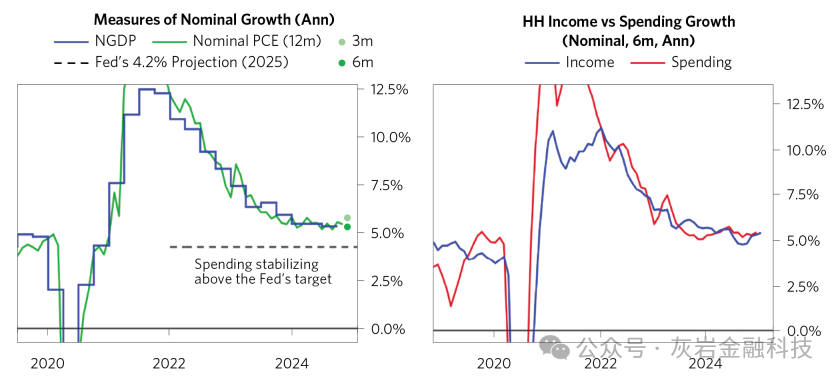

In the US, our timely estimates suggest that nominal spending is stabilizing above the Fed’s target—with a modest acceleration in the timeliest measures (e.g., three-month spending growth) after the Fed’s pivot to easing this past fall. Further, spending is rising in line with (and feeding back into) incomes, which supports a self-sustaining flywheel at today’s levels.

回顾性宽松政策支撑了持续的强劲势头,而近期的市场紧缩政策则是一个拖累——形成了一个平衡的前瞻性图景

在美国,我们及时的估计表明,名义支出正在稳定在美联储的目标之上——在去年秋天美联储转向宽松政策后,最及时的措施(例如三个月的支出增长)出现了适度加速。此外,支出与收入同步增长(并反馈到收入中),这支持了当今水平的自我维持飞轮。

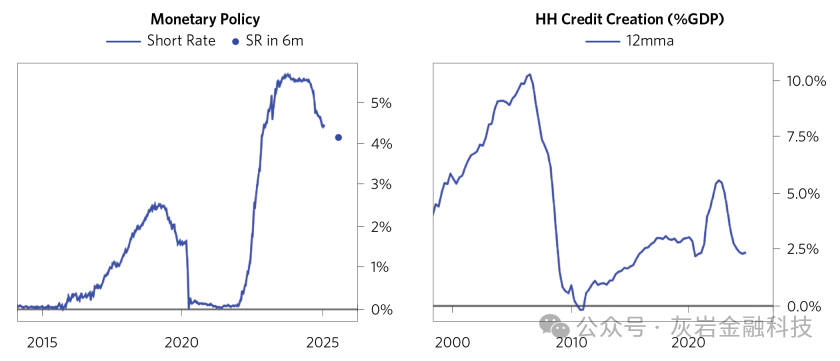

Strong incomes have continued to fuel spending without much credit creation. If the easing cycle continues, there is plenty of room for credit to bounce from today’s extremely low levels, particularly for households with strong balance sheets and low current levels of borrowing.

强劲的收入继续刺激消费,而信贷创造量却不大。如果宽松周期继续下去,信贷从目前极低的水平反弹空间很大,尤其是对于资产负债表强劲、当前借贷水平较低的家庭而言。

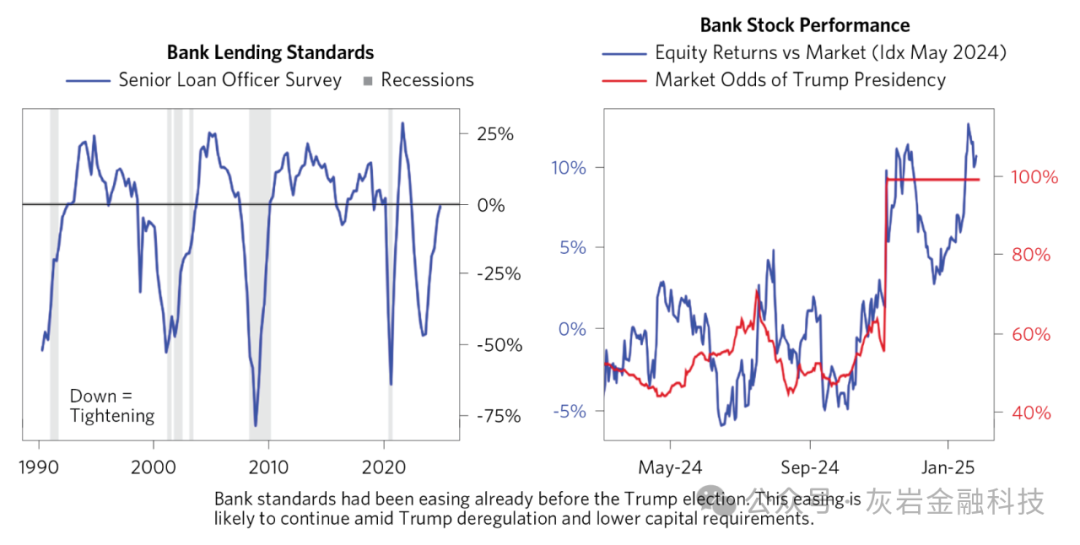

Additionally, there are signs of credit conditions easing even absent further interest rate cuts, with lending standards beginning to ease and optimism in the financial sector increasing, particularly in light of Trump’s election win.

此外,即使没有进一步降息,也有迹象表明信贷条件有所缓解,贷款标准开始放松,金融领域的乐观情绪正在增强,尤其是在特朗普赢得大选的情况下。

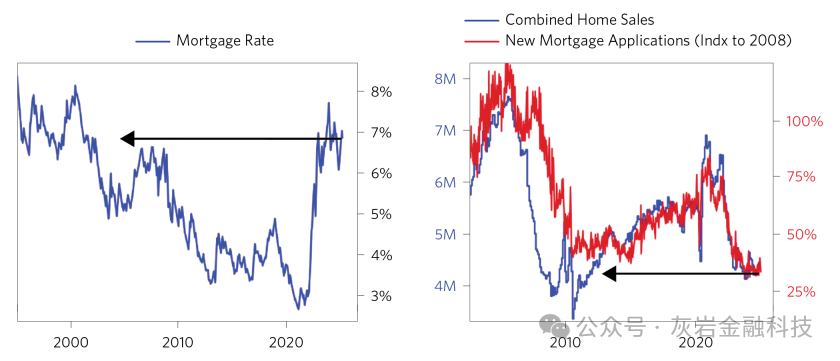

On the other hand, the recent leg up in interest rates is likely to continue to restrict borrowing. Mortgage rates are at nearly 20-year highs, and housing market activity is at its lowest point since the financial crisis.

另一方面,近期利率的上涨可能会继续限制借贷。抵押贷款利率处于近 20 年来的最高水平,房地产市场活动处于金融危机以来的最低点。

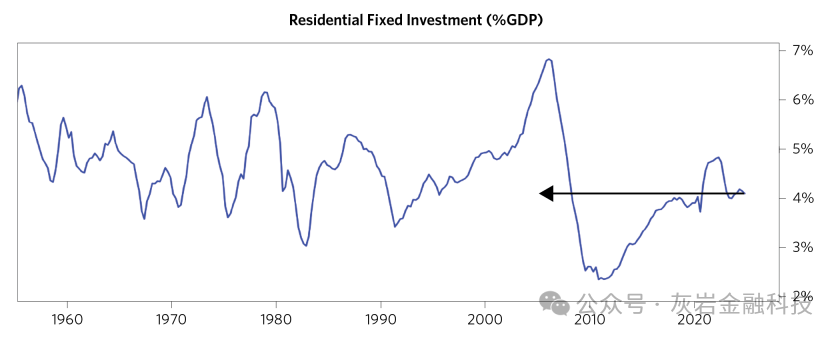

But, because the level of credit-sensitive spending, e.g., residential fixed investment, remains a small share of the overall economy relative to history, the direct effects on growth will be small.

但是,由于信贷敏感型支出(例如住宅固定投资)的水平相对于历史而言在整个经济中所占的比例仍然很小,因此对增长的直接影响也将很小。

These Pressures Are Playing Out in the Context of Still-Tight Underlying Conditions

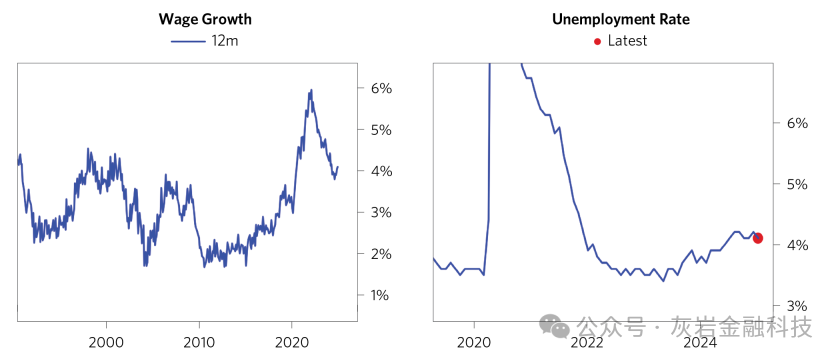

Capacity in the economy, particularly in the labor market, remains somewhat tight, with wage growth still at relatively high levels and unemployment still fairly low.

这些压力是在基本条件依然紧张的背景下产生的

经济产能,特别是劳动力市场产能,仍然有些紧张,工资增长仍然处于相对较高的水平,失业率仍然相当低。

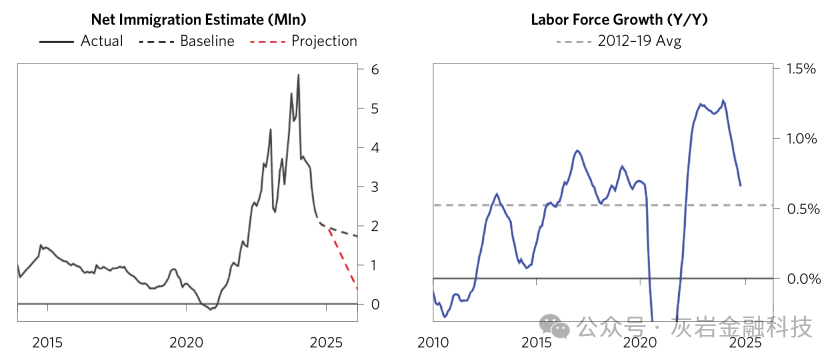

The deceleration of wages over the last few years was enabled by labor supply growth, particularly from immigration. But that is now rolling off and, with the election of President Trump, likely reversing. In turn, the level of unemployment has stopped rising as the labor force expansion has slowed and wage growth has stopped falling, with timely reads indicating a 4% or so run rate pace.

过去几年工资增速放缓的原因是劳动力供应增长,尤其是移民。但随着特朗普当选总统,劳动力供应增长正在放缓,而且很可能出现逆转。反过来,随着劳动力扩张放缓和工资增长停止下降,失业率也停止上升,及时数据显示工资增长速度约为 4%。

Stable Conditions and Ample Liquidity Are Almost Always Supportive of Assets But Are Rarely Priced In to This Extent

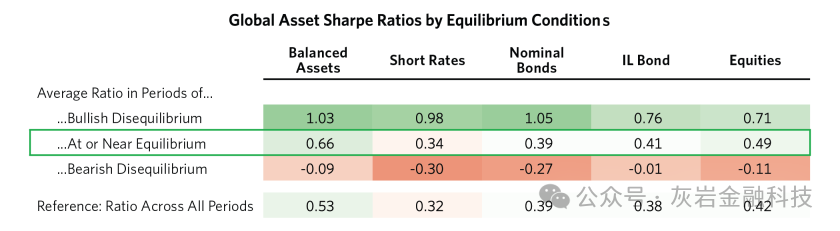

Environments like today’s, with stable conditions and policy, are generally good times for assets (for example, conditions were in a similar sweet spot for most of the 2010s), and we expect those dynamics to continue to support assets today. The table below shows global asset returns split into periods of bullish disequilibrium (high risk premia, weak conditions, easy policy), bearish disequilibrium (the opposite), and near-equilibrium periods like today. As you can see, asset returns are substantially influenced by conditions relative to equilibrium due to the confluence of what policy that environment calls for and the pricing of assets leading into the policy. Equilibrium conditions don’t call for much policy shift, are generally associated with a near-normal level of risk premia, and, as a result, have produced near-average excess returns.

稳定的环境和充足的流动性几乎总是对资产有利,但很少被定价到这种程度

像今天这样的环境,具有稳定的环境和政策,通常是资产的好时机(例如,2010 年代大部分时间的环境都处于类似的最佳状态),我们预计这些动态将继续支持今天的资产。下表显示全球资产回报分为看涨不平衡时期(高风险溢价、疲软环境、宽松政策)、看跌不平衡时期(相反)和接近平衡时期(如今天)。如您所见,资产回报受到相对于平衡的条件的重大影响,这是由于环境要求的政策与导致该政策的资产定价相融合。均衡条件不需要太多的政策转变,通常与接近正常水平的风险溢价相关,因此产生了接近平均水平的超额回报。

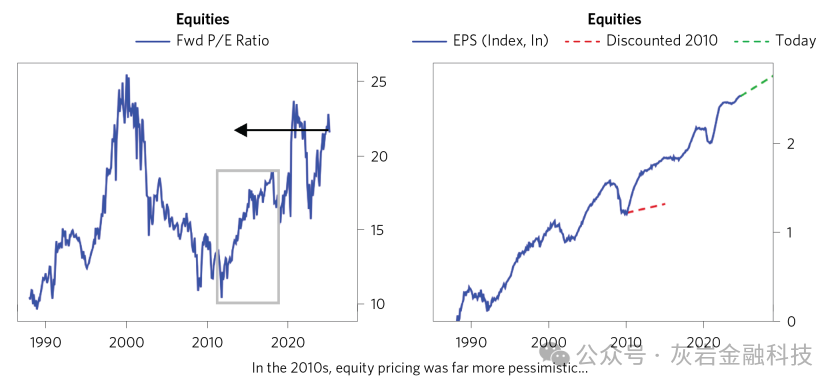

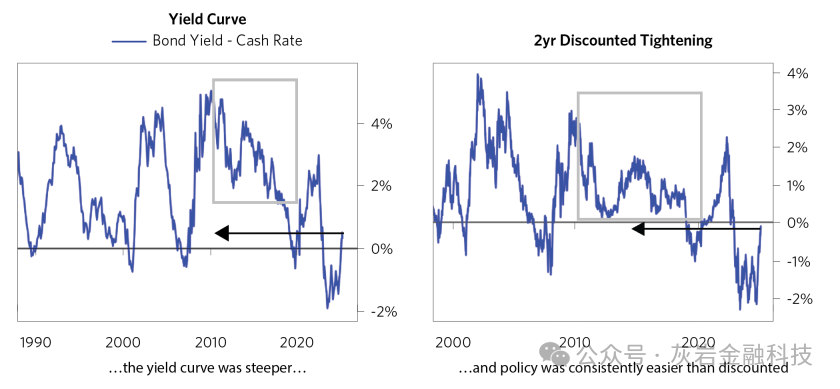

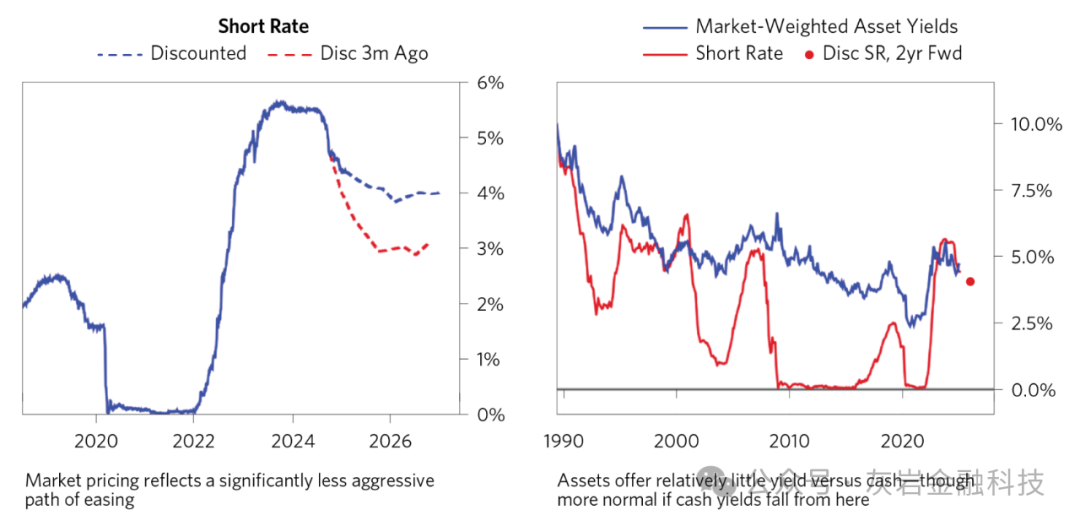

However, a favorable economic environment and policy stance today is already reflected in market pricing, and risk premia on assets have narrowed significantly relative to cash—substantially raising the hurdle needed for assets to continue to outperform. Compare, for example, current conditions to the 2010s. While the economic environment was similar—with around-target growth and inflation, and modest levels of capacity—market dynamics were much more favorable for assets: valuations were much weaker, risk curves were steeper, and policy was consistently easy relative to expectations.

然而,目前有利的经济环境和政策立场已经反映在市场定价中,资产的风险溢价相对于现金已大幅缩窄——大大提高了资产继续跑赢大盘所需的门槛。例如,将当前状况与 2010 年代进行比较。虽然经济环境相似——增长和通胀接近目标,产能水平适中——但市场动态对资产更为有利:估值要弱得多,风险曲线更陡峭,政策相对于预期而言始终宽松。

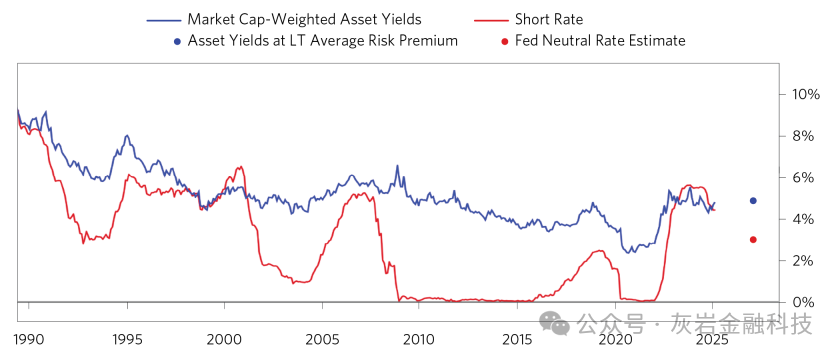

The most favorable path to restore normal risk premia in assets is to push short-term interest rates below asset yields. The chart below shows the current yield of assets in the US relative to cash, weighted by market cap. We then show the Fed’s estimate of the long-term neutral policy rate, i.e., the rate policy makers will manage toward if conditions allow. As you can see, if we get the normalization toward neutral rates that the Fed is projecting, then asset yields where they currently are will in aggregate offer a near-normal risk premium relative to that forward cash rate. But if we stabilize at a higher level of demand with tight capacity and disinflationary forces reverting, it’s unlikely policy will be able to ease as much as is discounted. In that world, asset yields likely have to rise—and prices fall—in order to create appropriate risk premia relative to cash. In our view, the market action over the past few months in part reflects this dynamic, as forward yields have risen in concert with expectations that a significant easing will be more difficult for policy makers to achieve.

恢复资产正常风险溢价的最有利途径是将短期利率推低至资产收益率以下。下图显示了美国资产相对于现金的当前收益率,以市值加权。然后,我们展示了美联储对长期中性政策利率的估计,即政策制定者在条件允许的情况下将努力实现的利率。

如您所见,如果我们实现美联储预测的中性利率正常化,那么资产收益率目前所处的位置将总体上提供相对于远期现金利率接近正常的风险溢价。但如果我们在更高的需求水平上稳定下来,产能紧张,通货紧缩力量回归,政策不太可能像预期的那样放松。在这种情况下,资产收益率可能必须上升——价格下跌——才能创造相对于现金的适当风险溢价。我们认为,过去几个月的市场走势在一定程度上反映了这种动态,因为远期收益率的上升与人们对政策制定者更难实现大幅宽松的预期一致。

附录(AI整理):

附录:关键概念解释

经济均衡

经济均衡是指经济各项指标处于相对稳定和可持续的状态。就像温度计的读数,既不太热也不太冷。在这种状态下,经济增长、就业、通货膨胀等指标都处于健康水平,不需要政策制定者采取重大干预措施。

货币政策

货币政策是中央银行(在美国是美联储)用来管理经济的工具。最主要的工具是调整利率:

- 提高利率(收紧):让借钱更贵,减缓经济活动和通货膨胀

- 降低利率(宽松):让借钱更便宜,刺激经济活动

通货膨胀

通货膨胀是物价总体上涨的现象。美联储的目标是保持通货膨胀率在2%左右。太高的通胀会降低人们的购买力,太低的通胀可能表示经济活力不足。

市场相关概念:

风险溢价

风险溢价是投资者为承担风险而要求的额外回报。举个例子,如果把钱存在银行(几乎无风险)能得到3%的利息,那么投资股票这样的风险资产,投资者会期望获得更高的回报,比如6%。这多出来的3%就是风险溢价。

资产收益率

资产收益率是投资某项资产预期能获得的回报率。比如:

- 债券收益率:债券每年支付的利息除以债券价格

- 股票收益率:公司利润与股票价格的比率(市盈率的倒数)

市场定价

市场定价反映了投资者对未来的预期。例如:

- 如果投资者预期经济会变好,股票价格往往会上涨

- 如果预期通胀会上升,债券收益率通常会上升(债券价格下跌)

为什么经济"过热"很重要?

经济过热意味着:

- 需求超过经济的供给能力

- 可能推高通货膨胀

- 迫使中央银行保持较高利率

劳动力市场紧张是什么意思?

劳动力市场紧张表现为:

- 失业率低

- 企业难以招到员工

- 工资快速上涨

这种情况虽然对工人有利,但可能加剧通货膨胀压力。

信贷创造与经济的关系

信贷创造是指银行向企业和个人发放贷款的过程:

- 更多的贷款意味着更多的消费和投资

- 但过度的信贷扩张可能造成资产泡沫

- 信贷收缩则可能导致经济放缓

文章核心观点解读

桥水的分析师认为:

1. 经济状况正在向均衡状态靠近,但仍然美股仍然偏热

- 就像汽车正在减速,但速度仍然略快

2. 市场已经对良好的经济状况做出反应

- 资产价格已经反映了这些利好因素

- 意味着未来收益可能不会太高

3. 政策制定者面临两难

- 如果经济持续偏热,可能无法像市场期待的那样大幅降息

- 但如果利率保持过高,可能对经济造成伤害

4. 展望未来

- 经济可能会在较高但可控的水平上稳定下来

- 但资产价格上涨的空间可能有限

- 投资者需要对风险回报有更实际的预期

5. 对经济的实际影响

对普通人来说,这意味着:

1. 存款利率可能会继续保持在相对较高的水平

2. 房贷等借贷成本可能不会很快显著下降

3. 股市可能不会像过去几年那样带来丰厚回报

4. 就业市场可能会继续保持相对稳定

5. 通货膨胀虽然在下降,但可能会在高于历史平均水平的位置徘徊一段时间

这份报告提醒我们,经济正在寻找新的平衡点,这个过程需要时间,期间可能会有波动,但总体方向是向着更可持续的状态发展。

精彩评论