鲍威尔:你们应该都知道我们要干什么了吧。

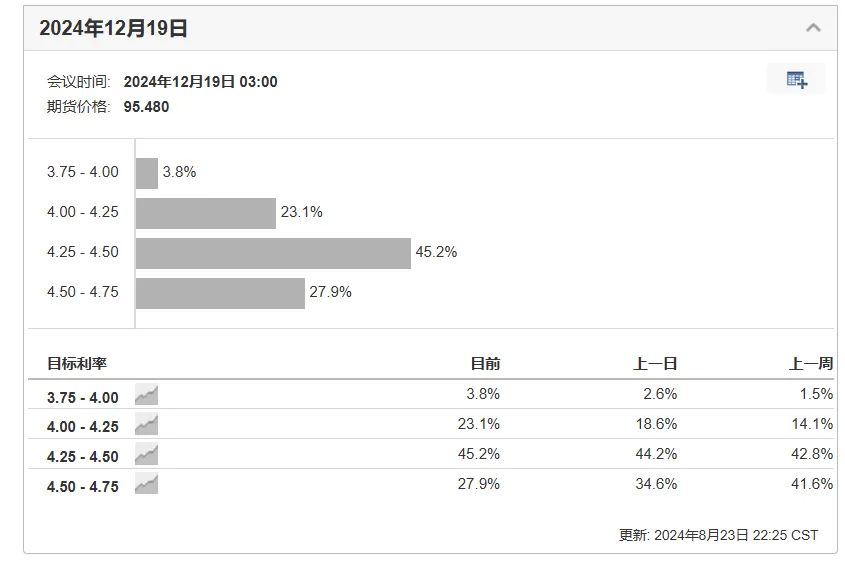

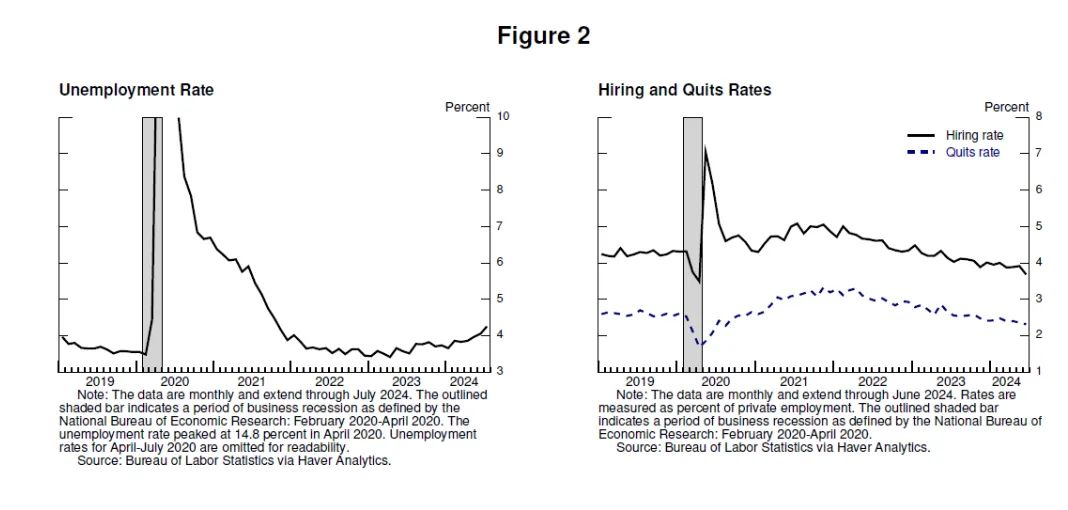

鲍威尔在杰克逊霍尔会议上指出,劳动力市场疲软,通货膨胀下降,现在是时候降息了,防止劳动力市场进一步的疲软,经济的萎缩等;失业率上升是因为放缓招聘而非裁员,就业市场不太可能再次点燃通胀,降息的时机和步伐将取决于数据、前景以及风险的平衡,政策利率水平为应对风险提供了“充足的空间”,包括劳动力市场出现进一步不利的疲软;整体来看,鲍威尔比他的同僚更加鸽派,其他美联储官员讲话相对其鹰派,包括不应过度重视非农,通胀偏高,经济偏强,有条不紊降息(每次25bp)等,这无疑加大了交易员对大幅降息的押注,目前对9月降息50bp的押注有所升温,概率约为1/3,对年内降息的预期仍是最接近100bp;黄金,美股,美债上涨,美元下跌,市场又开始回到了降息狂欢之中,和两年前的杰克逊霍尔完全相反,当时黑色八分钟引起了暴跌,美联储传声筒Nick Timiraos在社交媒体发文称,今日的讲话表明鲍威尔的转向政策已经完成,鲍威尔在讲话中表现出了全面的鸽派,两年前他还在同一时期表示,美联储将接受经济衰退作为恢复通胀的代价。

整体来看,鲍威尔的这次发言相当鸽派,比笔者的最鸽派预测还要鸽派,已经处于彻底投降的状态,面对疲软的非农,较低的通胀,鲍威尔没有考虑到诸如零售,PMI等较强数据,而选择开场安抚市场,就差直接宣布降息25bp了,不过考虑到9月FOMC之前还有非农,CPI,PCE等数据,而目前来看这份非农读数可能偏强,引发市场预期大拐弯,所以笔者认为,目前还是不宜过度鸽派解读鲍威尔讲话,可以鸽一点,比如降息75bp,但我对一次降息50bp反正没什么信心。即使鲍威尔放鸽,但目前笔者对美联储降息的预期其实还是没怎么强化,就今年来看,75bp有可能,但100bp个人觉得还是不太可能,如果真要一次50bp降息,那么又要走衰退交易了。

摘录一段鲍威尔的讲话,关于通货膨胀和失业率方面的。

How did inflation fall without a sharp rise in unemployment above its estimated natural rate?

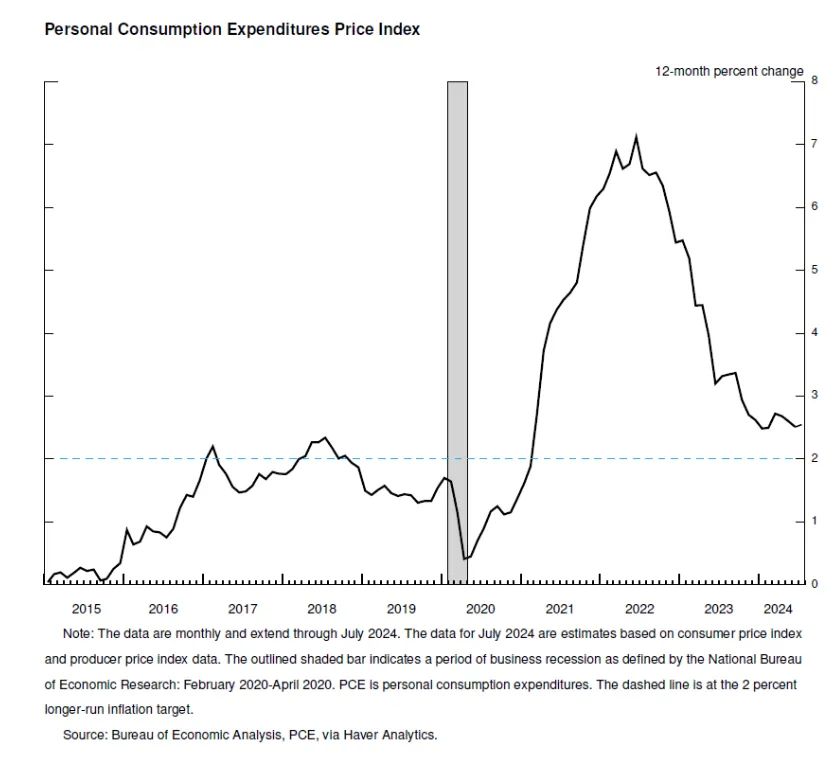

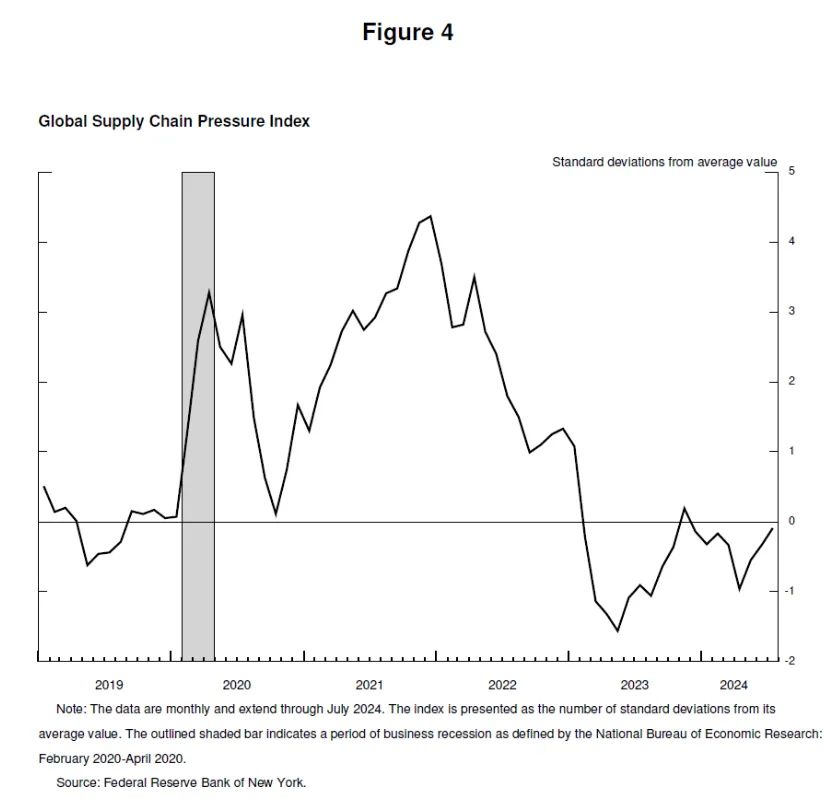

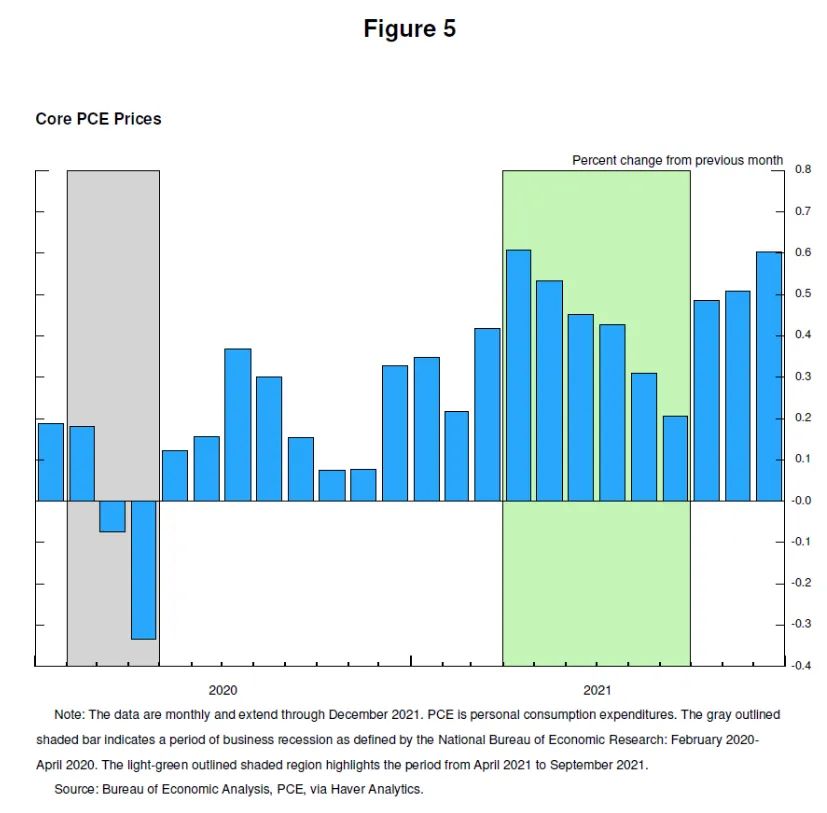

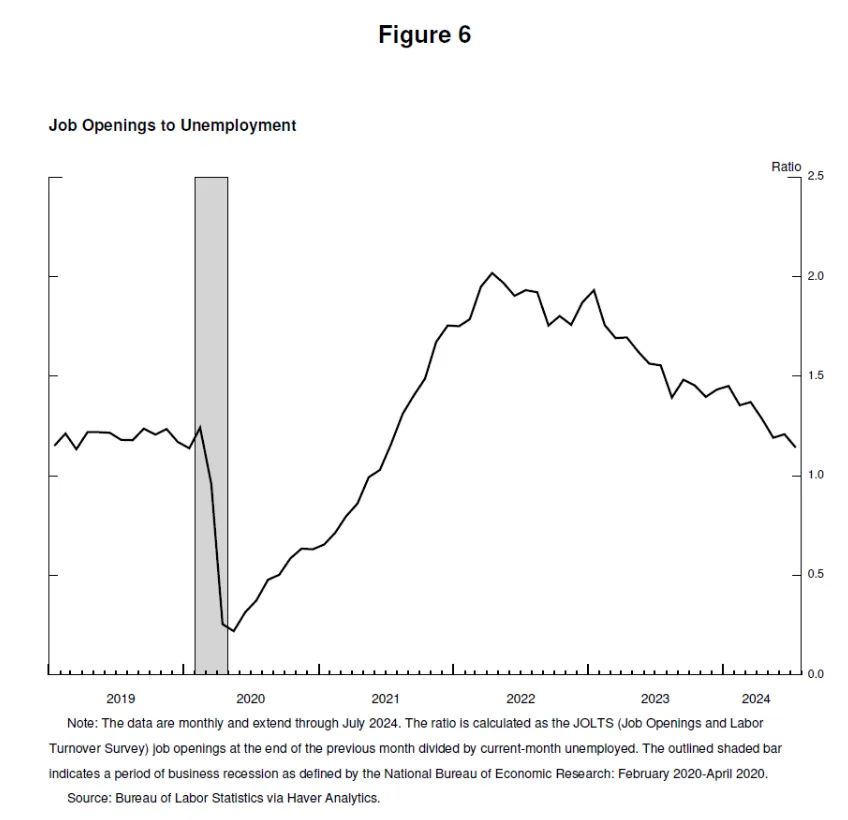

Pandemic-related distortions to supply and demand, as well as severe shocks to energy and commodity markets, were important drivers of high inflation, and their reversal has been a key part of the story of its decline. The unwinding of these factors took much longer than expected but ultimately played a large role in the subsequent disinflation. Our restrictive monetary policy contributed to a moderation in aggregate demand, which combined with improvements in aggregate supply to reduce inflationary pressures while allowing growth to continue at a healthy pace. As labor demand also moderated, the historically high level of vacancies relative to unemployment has normalized primarily through a decline in vacancies, without sizable and disruptive layoffs, bringing the labor market to a state where it is no longer a source of inflationary pressures.

A word on the critical importance of inflation expectations. Standard economic models have long reflected the view that inflation will return to its objective when product and labor markets are balanced—without the need for economic slack—so long as inflation expectations are anchored at our objective. That's what the models said, but the stability of longer-run inflation expectations since the 2000s had not been tested by a persistent burst of high inflation. It was far from assured that the inflation anchor would hold. Concerns over de-anchoring contributed to the view that disinflation would require slack in the economy and specifically in the labor market. An important takeaway from recent experience is that anchored inflation expectations, reinforced by vigorous central bank actions, can facilitate disinflation without the need for slack.

This narrative attributes much of the increase in inflation to an extraordinary collision between overheated and temporarily distorted demand and constrained supply. While researchers differ in their approaches and, to some extent, in their conclusions, a consensus seems to be emerging, which I see as attributing most of the rise in inflation to this collision. All told, the healing from pandemic distortions, our efforts to moderate aggregate demand, and the anchoring of expectations have worked together to put inflation on what increasingly appears to be a sustainable path to our 2 percent objective.

Disinflation while preserving labor market strength is only possible with anchored inflation expectations, which reflect the public's confidence that the central bank will bring about 2 percent inflation over time. That confidence has been built over decades and reinforced by our actions.

通货膨胀下降为何没有导致失业率大幅上升?

疫情期间供应和需求的扭曲,以及能源和商品市场的严重冲击,是通货膨胀居高不下的主要驱动因素,这些因素的逆转是通货膨胀下降的关键。这些因素的消退比预期要长得多,但最终在随后的通货紧缩中发挥了重要作用。我们严格的货币政策促使总需求温和下降,再加上总供给的改善,共同减轻了通货膨胀压力,同时允许经济以健康的速度继续增长。随着劳动力需求也趋于缓和,历史上职位空缺与失业率之间的巨大差距,主要通过职位空缺减少实现正常化,而不是出现大规模的破坏性裁员,将劳动力市场带入了不再成为通货膨胀压力来源的状态。

关于通货膨胀预期的关键重要性,需要说明一下。标准经济模型长期以来一直反映了一种观点,即只要通货膨胀预期锚定在我们的目标水平上,即使在产品和劳动力市场达到平衡时,通货膨胀也会回归到我们的目标水平——无需经济出现疲软。这就是模型所说的话,但自 21 世纪以来,长期通货膨胀预期的稳定性并未经受住持续高通货膨胀的考验。通货膨胀锚点是否能保持稳定远非板上钉钉。人们对通货膨胀锚点失锚的担忧,加剧了通货紧缩需要经济疲软,尤其是劳动力市场疲软的观点。从最近的经验中得出的一个重要启示是,锚定的通货膨胀预期,在央行强有力的行动的支撑下,能够促进通货紧缩,而无需经济出现疲软。

这种叙述将通货膨胀的大幅上升主要归因于过热和暂时扭曲的需求与供应受限之间的非同寻常的碰撞。虽然研究人员在方法和结论上有所不同,但在一定程度上,似乎正在形成一种共识,即认为通货膨胀的大幅上升主要归因于这种碰撞。15 总而言之,从疫情扭曲中恢复,我们抑制总需求的努力,以及对预期的锚定,共同作用使通货膨胀走上了越来越明显地朝着我们的 2% 目标水平持续下降的轨道。

在保持劳动力市场强劲的情况下实现通货紧缩,只有在通货膨胀预期锚定的情况下才能实现,这反映了公众对央行将随着时间的推移实现 2% 的通货膨胀的信心。这种信心已经建立了几十年,并得到我们行动的强化。

耐心等待更多经济数据,还有英伟达财报,我个人还是对降息持谨慎态度。

风险提示及免责声明

市场有风险,投资需谨慎。本文不构成个人投资建议,也未考虑到个别用户特殊的投资目标、财务状况或需要。用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。

精彩评论