The Pre-Market look a little green and it might change. If you bought in the dips, but stocks are still away from your target profit, what can you do to get some profit.

I will usually sell options to benefit from the mixed market. Option selling helps me generate realized profit as the investment portfolio grows over time with Unrealised profit.

Many people claim selling option is dangerous, but this is untrue if you already have the underlying stocks or cash.

Sell Cash Secured Put

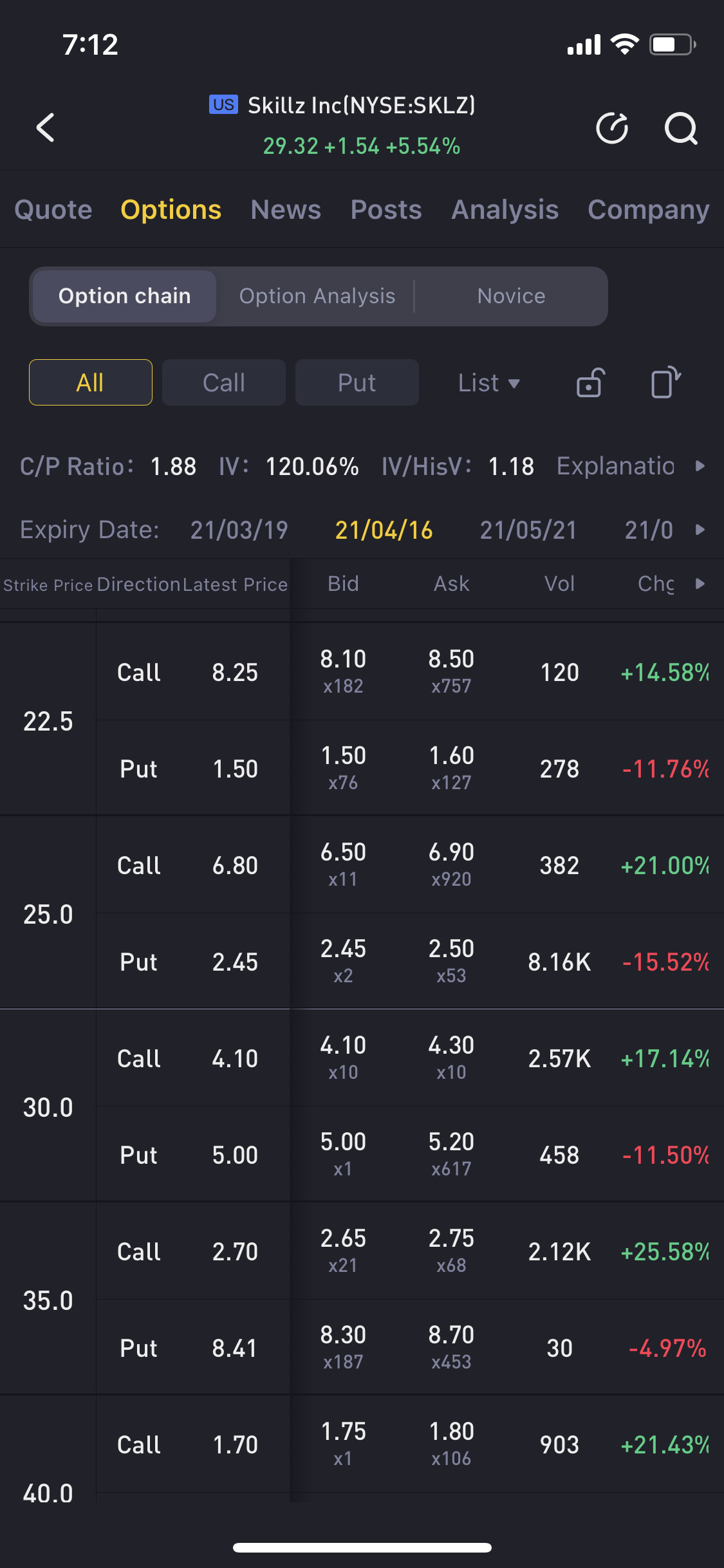

With enough buying power, if Iike to purchase $Skillz Inc(SKLZ)$ at $22.5, I can sell a PUT Option. With enough cash on hand, if SKLZ drops below my strike price, I am happy to buy in at $22.5. I also get to deduct the premium so that lowered my purchase price. If it didn’t go below my strike price, I get to keep the premium on expiration.

1 option = 100 shares in the US market. During a dip, it will be beneficial to sell PUT for a higher premium.

Sell Covered Option

With 100 shares of $Palantir Technologies Inc.(PLTR)$, I can sell 1x call option at $35. If the stocks get above my strike of $35 the 100 shares will be sold at $35. Since I already get it at a lower price, I think this is a reasonable target price. If it didn’t hit my target price by expiration, I will earn the premium. Selling a call option with an underlying stock on hand is called a Covered Call Option.

To earn a higher premium, during a market spike will help with selling call option.

Note: Tiger doesn’t handle the buying power for the covered option yet. Best to keep available buying power with cash to prevent random execution.

$Tiger Brokers(TIGR)$ has nice UI to show the PNL at different price for option trading. But please start small if this is your first time.[得意]

精彩评论