Nio has a future, but not the share price. (Note: I used to hold NIO stock, but now I have closed my position. Now I don't hold NIO stock. See the article "Clearing NIO stock, ending the first US stock market")

This article has been brewing in my mind for a long time a few days ago, but the school has been taking the final exam, and I have no chance to write it out. After all, it is much more important to avoid failing the final exam. But in order to make my point in advance, I posted a preview of this article. As a result, NIO is preparing to issue $1.3 billion (over $200 billion) of convertible senior notes in these two days, which just confirms my idea. Ha, ha, ha.

There is no doubt that NIO is the new energy leader in China at present. It is precisely because of its potential that I bought it fully. But now it has been cashed. In December 2020, Nio delivered 7,007 vehicles, a record high, with a total of 43,728 vehicles delivered throughout the year. The numbers are truly impressive, and the dismal 707 deliveries in that month will never be seen again. Who could have predicted that 2020 would be the most brilliant year for NIO under the shadow of the new crown epidemic at the beginning of 2020?

How about NIO? Good, good is great. But share price 2021 won't happen again. I repeat my point again. Back when I bought the stock of NIO, it seemed that NIO only had ES8 model, the stock price was 4 to 5 dollars, and the market value hovered around 5 billion dollars. At that time, I wondered how could such a company with such potential be worth less than a video website (BILI)? At that time, the share capital was only about more than 1 billion. The story in the future is that NIO is in danger and starts financing to save itself. Before, I met a snow ball friend to discuss how much NIO has raised, but according to what I saw, the value seems not quite right, so let's review it again. The earliest financing was a $650 million convertible bond issued by Nio on January 31, 2019, with a share price of $6.70 at that time. Before the issuance, Nio's share capital was about 1.026 billion shares.The second issue of $200 million convertible bonds on September 5, 2019, Li Bin and Tencent each subscribe $100 million, in two tranches, the share price is 2.98 and 3.12 dollars respectively. The third was a $100 million convertible note issue on February 6, 2020, which matures on February 4, 2021, at a conversion price of $3.07. The fourth time is on February 14, 2020 to issue another $100 million convertible bond on February 19 completed. The fifth round closed on March 5, 2020 for $235 million. So far, Nio has raised $435 million of convertible bonds in the first quarter of 2020. The fatal problem is that the stock price is so low, Nio's market capitalization is not even $5 billion, to complete such a large amount of financing. But not NIO will die [crying].

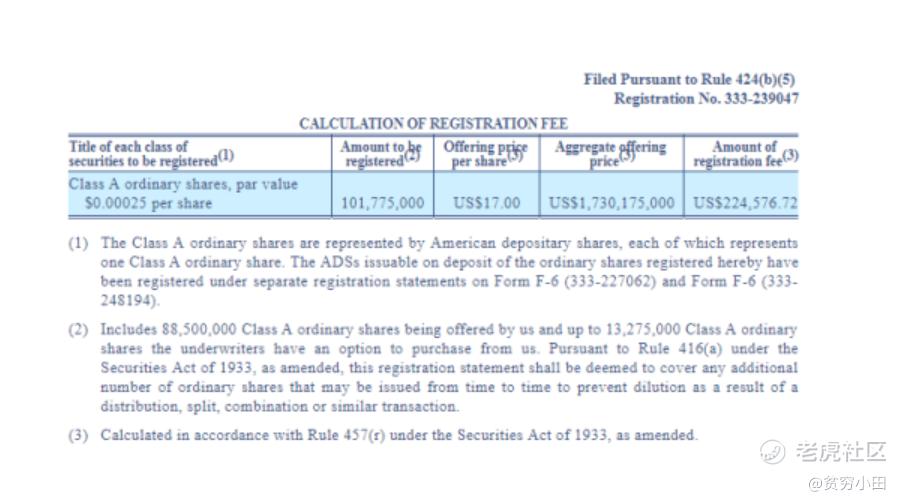

Then there is the familiar Hefei investment. The financing framework is like this, the financing of NIO's main asset: NIO China. Overall, the 24.1% equity of NIO China has raised Hefei State capital of 7 billion yuan. However, NIO later bought back 8.6% of the shares of NIO China, increasing its stake to 84.5%. In the seventh financing, NIO issued 82.8 million additional shares (including overallotment) of ADS at a price of $5.95 per share, raising a total of $490 million. The eighth financing is to issue 101.77 million additional shares (including overallotment) at the price of $17 per share to raise $1.73 billion from ADS. The ninth financing is to issue 78.2 million additional shares (including overallotment) at 39 dollars per share to raise 3.05 billion dollars from ADS. The tenth was the most recent $15 (including overallotment) convertible bond issue. (I don't know if it worked out.)

After counting the 10 financing rounds after Nio's listing, its share capital increased dramatically from 1.026 billion shares to 1.569 billion shares at present. The huge increase in share capital brought a lot of cash, but it also made Nio's share capital bloated. Its stock price was only over 60 dollars, and its market value exceeded 100 billion. As for the founder, Li Bin, his control is decreasing with the increase of financing. However, I heard recently that he will retire after a few years of his tenure and donate half of his shares to establish a foundation to protect the rights and interests of car owners. The CEO is then voted by NIO users (the narrative may be a little inaccurate, welcome to add). That way Li won't have to worry about control. And Nio through so many financing, cash reserves will be a good support for the next development. At present, NIO's development in 2-3 years is full of hope and infinite vitality. But I don't think the share price will improve much. The higher the stock price, the more aggressive the IPO, regardless of the control of the founder, you want to buy the stock, right? NIO directly printed to you, how much you want to give. In addition, Nio is a company invested by Tencent and is the largest shareholder. So Nio's market capitalization has a smallpox version. The biggest company Tencent has invested in is Meituan: $233.5 billion. I think it's hard for NIO to beat Meituan.

If Nio performs well in 2021 and can deliver 100,000 vehicles in 2021, then the valuation of Nio at the end of the year is as high as $150 billion and the stock price is $95.69. This share price can only be less but not more, because it is not sure when NIO will carry out additional issuance.

Most people who own NIO make money, but human nature is greedy! Holding NIO can earn dozens of times the most, earn two or three times is very common. But still feel not enough, want more, think NIO stock price can go to $100 or even $125, I can only say that there is no limit to human greed. So what outcome awaits? I'll review this article at the end of 2021.$蔚来(NIO)$ $老虎证券(TIGR)$ $哔哩哔哩(BILI)$

精彩评论

B站看station B 都要裂开了[捂脸]我看完我也裂开了[捂脸]