[For Hong Kong Investors Only] China's recent Labor Day holiday brought encouraging news for the economy. The surge in overall spending surpassed pre-pandemic levels and served as a testament to a recovery underway. Travelers embarked on 295 million trips within the Chinese mainland, marking a 7.6% year-on-year increase and a striking 28.2% jump from 2019.

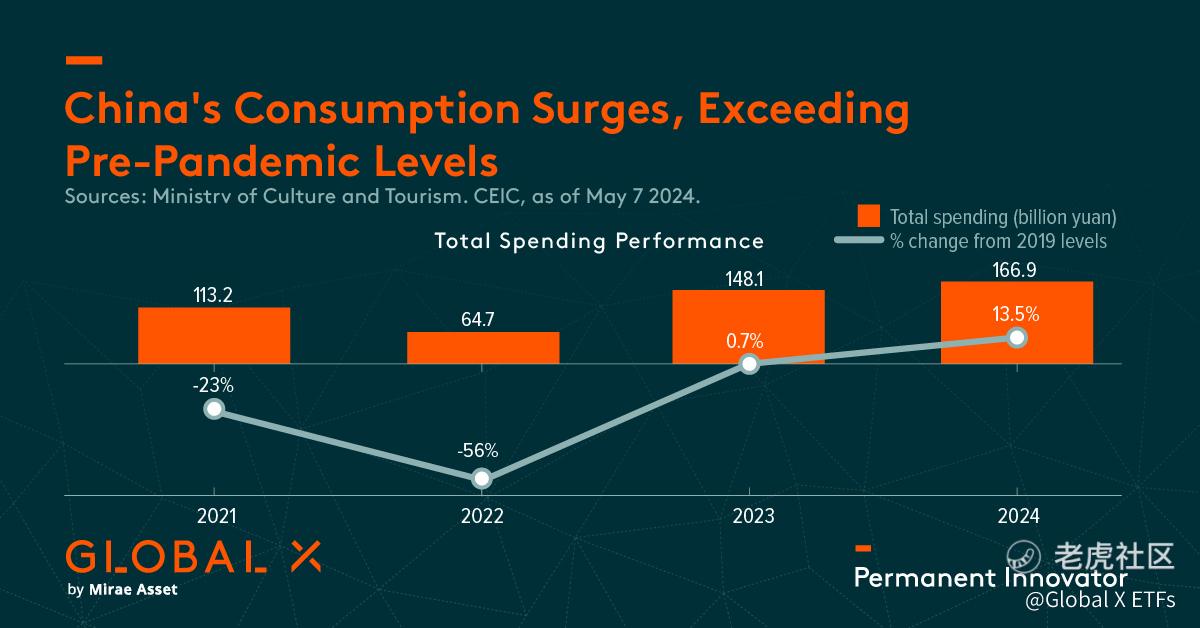

While per capita spending remained lackluster due to the country's uneven economic recovery, amidst this backdrop lies a potential growth opportunity waiting to be harnessed. With a total expenditure of nearly 166.9 billion yuan ($23.5 billion), up 12.7% from the previous year and 13.5% higher than 2019, the holiday demonstrated the potential for further development.

Consider investing in the Global X China Consumer Brand ETF (2806) $GX中国消费(02806)$ , you can position yourself to capitalize on the continued development and prosperity of China's dynamic consumer landscape.

Source: Caixin, as of May 7, 2024.

💡 Learn more about the Global X China Consumer Brand ETF (2806) and detailed risk disclosures: https://www.globalxetfs.com.hk/campaign/china-consumer-brand-etf/

#ChinaConsumperbrand #chinaspending #laborday #Thematic #ETF #GlobalXETFsHongKong #GlobalX

-

This material is intended for Hong Kong investors only. It is not a solicitation, offer, or recommendation to buy or sell any security or other financial instrument. Investment involves risks. Past performance information presented is not indicative of future performance. Investing in the funds may expose to risks (if applicable) including general investment risk, equity market risk, sector/market concentration risk, active / passive investment management risk, tracking error risk, trading risk, risk in investing financial derivative instruments, securities lending risk, distributions paid out of capital or effectively out of capital risk. Investors should refer to the Fund's prospectus for details, including the risk factors. Issuer: Mirae Asset Global Investments (Hong Kong) Limited. This material has not been reviewed by the Securities and Futures Commission. Copyright © 2024 Mirae Asset Global Investments. All rights reserved.

精彩评论