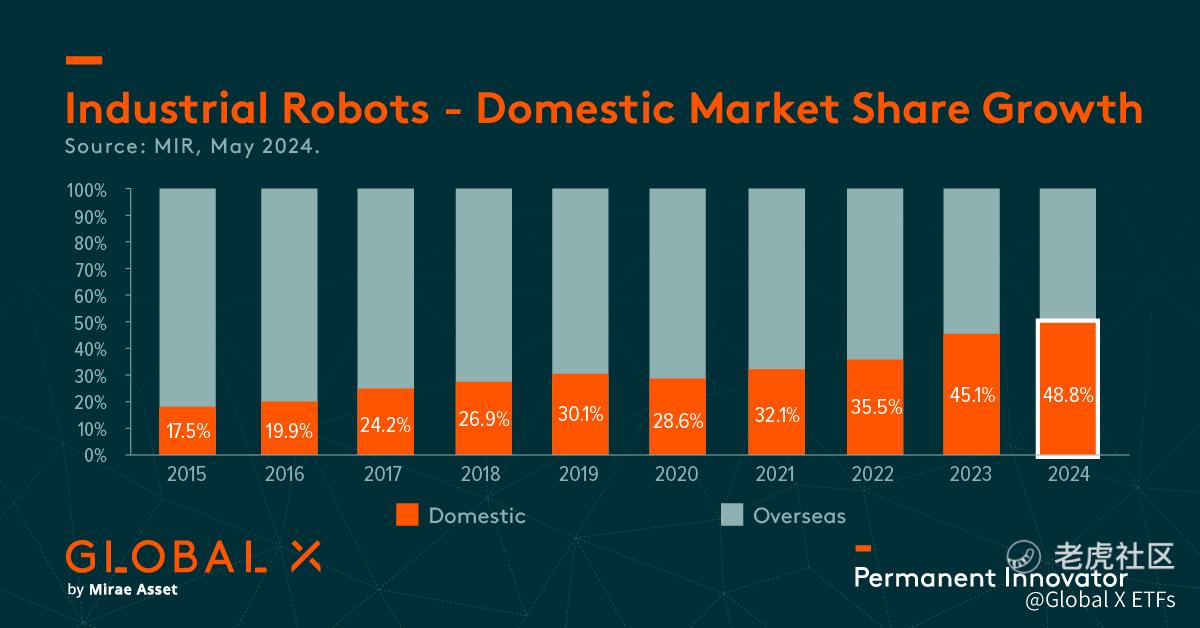

[For Hong Kong Investors Only] In 2024 Q1, domestic manufacturers in China achieved a record-breaking market share of 48.8%. Companies like Estun and Inovance made it to the top 4 for the first time. This growth was driven by strong demand in industries such as home appliances, 3C, and automotive electronics. Despite sluggish demand in areas like lithium batteries and photovoltaics (solar energy), the overall outlook for industrial robotics in China remains optimistic. Market Intelligence Resource (MIR) predicts a stable growth rate of 4.2% in 2024, with even stronger momentum in the following years. This trend highlights the irreversible achievements made by domestic manufacturers and the shift towards import substitution. Exciting times lie ahead for the Chinese robotics industry! 🤖🚀 #RoboticsIndustry #China #DomesticManufacturers #MarketGrowth

Source: Macquarie Research, as of May 6, 2024.

💡 Learn more about the Global X China Robotics and AI ETF (2807) $GX中国机智(02807)$ and risk disclosure details: https://www.globalxetfs.com.hk/campaign/ai-etfs/

💡 Learn more about the Global X Hang Seng TECH ETF (2837) $GX恒生科技(02837)$ and risk disclosure details: https://www.globalxetfs.com.hk/campaign/hang-seng-tech-etf/

#Chinarobotics #ChinaAI #ChinaThematicGrowthETFs #hangsengtechETF#GlobalXETFs #GlobalXETFsHongKong #GlobalX #ETFs #HKETFs #BeyondOrdinaryETFs #BeyondOrdinaryETFs #ETF Investing #ETFInvesting

-

This material is intended for Hong Kong investors only. It is not a solicitation, offer, or recommendation to buy or sell any security or other financial instrument. Investment involves risks. Past performance information presented is not indicative of future performance. Investing in the funds may expose to risks (if applicable) including general investment risk, equity market risk, sector/market concentration risk, active / passive investment management risk, tracking error risk, trading risk, risk in investing financial derivative instruments, securities lending risk, distributions paid out of capital or effectively out of capital risk. Investors should refer to the Fund's prospectus for details, including the risk factors. Issuer: Mirae Asset Global Investments (Hong Kong) Limited. This material has not been reviewed by the Securities and Futures Commission. Copyright © 2024 Mirae Asset Global Investments. All rights reserved.

精彩评论