2023/7/21:

Yesterday, both the NASDAQ Composite Index and the S&P 500 experienced significant declines. The reason behind this was that both indices encountered the 450% resistance levels, leading to the downward movement.

昨天纳斯达克指数和标准普尔500大跌,为什么呢?因为它俩都面临着450阻力位。

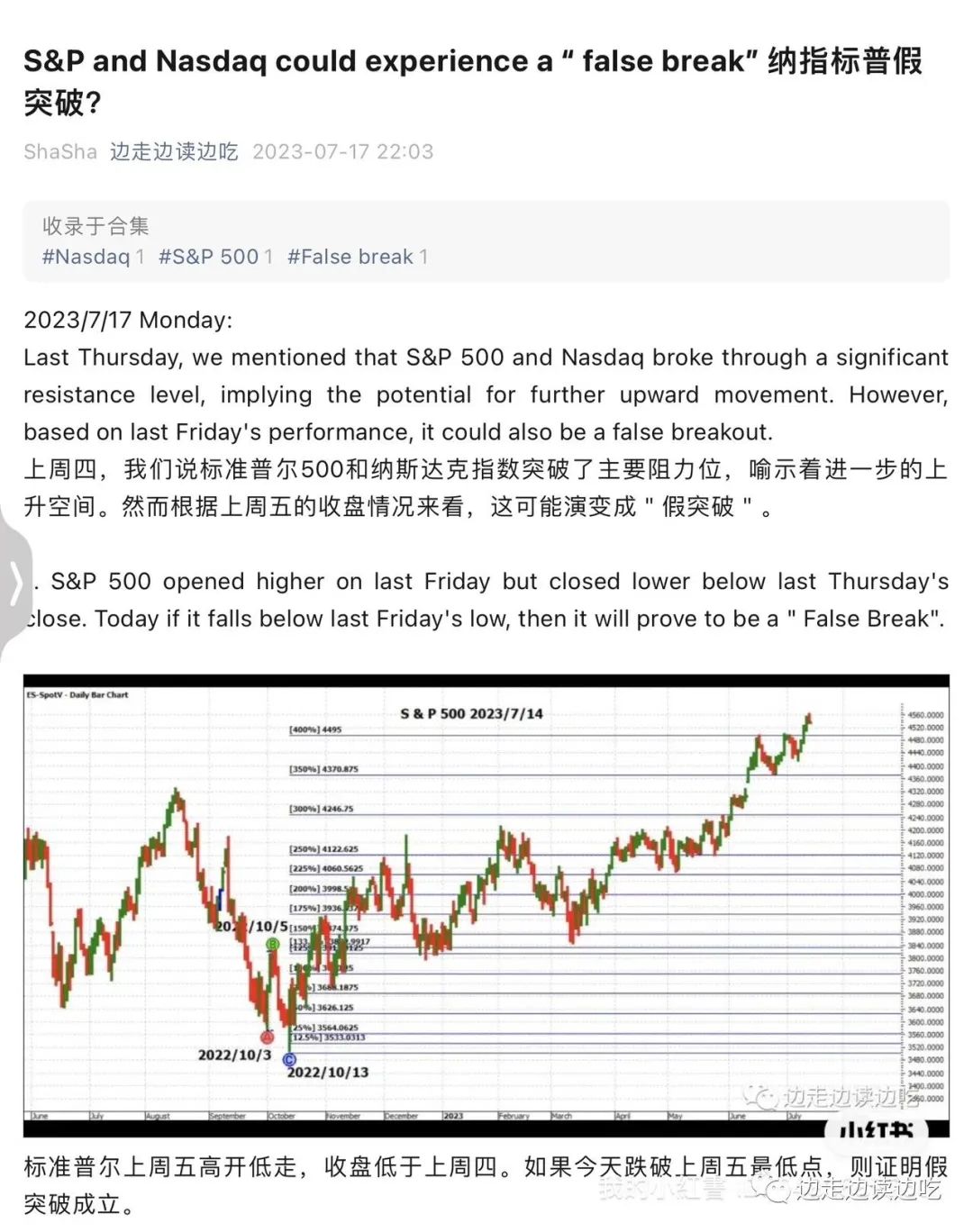

1.On Monday of this week, we discussed the possibility of the NASDAQ Composite Index and the S&P 500 facing false breakouts.

本周一我们讨论过:纳斯达克指数和标准普尔500可能面临假突破。

--------

----------

2.However, the NASDAQ and the S&P 500 still managed to rise to the 450% resistance levels before experiencing a decline.

不过,纳斯达克和标准普尔还是升到了450%阻力位才下跌。

纳斯达克:

标准普尔500 :

3. The S&P 500 is facing a dual pressure of resistance from its previous high points and the 450% resistance level.

Below chart:

→The green line in the chart represents the 450% resistance level, which aligns closely with the previous high point on 29/03/2022, creating a dual pressure situation.

→The pink line represents the 500% resistance level, which is also in line with the head and shoulders formation of the historical high point.

→Since attempting to reach the historical high at 500% resistance level seems to require considerable effort, it might be wiser to retreat and experience a decline at the 450% resistance level first.

标准普尔500面临前期高点压力和450%阻力位的双重压力。

下图绿线表示450%阻力位与前期高点2022/3/29基本持平,形成双重压力。

粉色线表示500%阻力位也与历史高点头肩顶的肩顶持平。

既然500%要冲刺历史高位太费力,不如在450%阻力位先跌为敬。

4. The NASDAQ Composite Index is about to face a double-top pressure at its historical high point.

→ The pink line in the chart represents the 500% resistance level for the NASDAQ, which essentially aligns with the double-top pressure from the historical highest points on 22/11/2021, and 28/12/2021. In other words, since there are thriple pressure to overcome in reaching the 500% resistance level, it might be wiser to stop the ascent at the 450% resistance level.

纳斯达克指数即将面临历史高位的双顶压力。

下图粉色线表示纳斯达克的500%阻力位是与历史最高点2021/11/22 和2021/12/28的双顶压力基本重合,也就是说,既然升到500%有三重压力,不如在450%阻力位就此打住。

精彩评论

分析图表后,我认为标准普尔500将在450%阻力位经历短暂回调后,再次启程向前哈哈

感觉纳斯达克面临的双顶压力有些吓人,或许在450%的阻力处止步是个明智的选择

面对450%阻力位的挑战,我相信纳斯达克会突破极限,继续创造历史新高

在看到历史高点与450%阻力层双重压力时,我决定保守一些,

标准普尔500的双重压力确实让人担心