达里奥做空美国股市?

别扯了,标题党的话你也信!

Headlines are seldom what they seem

by Kevin Muir

Last Friday, the Wall Street Journal hit the send button on a controversial article highlighting the monstrous S&P 500 and Eurostoxx put option position that had been amassed by the world's largest hedge fund - Bridgewater Associates.

上周五华尔街时报刊登了一篇引起争议的文章,文中写到全球最大的对冲基金桥水公司大举建仓标准普尔500指数和欧洲股票指数的看跌期权。

Bearish traders were quick to point out that even if the fund was not net short stocks, buying put options in this size was certainly not a bullish sign.

消息一出,持空头观点的交易员立马指出即使该基金没有净做空股票,但如此大量地买入看跌期权显然不是看多美股的信号。

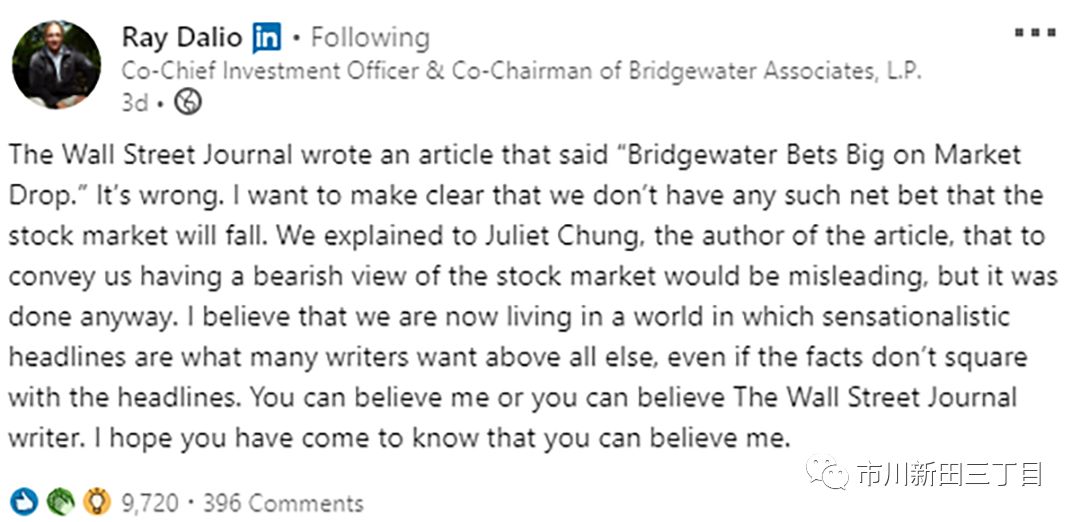

Even when Bridgewater founder Ray Dalio took to LinkedIn (I know, LinkedIn?) to refute the article, it offered little comfort to these half-empty folks.

甚至桥水公司的创始人达里奥在社交媒体领英上对该文观点的反驳,也没有让这帮半瓶醋们回过神来。

I wasn't going to even mention this development until my pal Barton_Options brought up a great point that I had completely missed.

我原本没打算对该事态的发展发表啥意见,但在我哥们提出一个我以前完全没注意到的高见后,我改变了主意。

Bridegwater's main strategy is something called Risk Parity. This investment philosophy believes in weighting asset classes by volatility. Why treat stocks and bonds the same when stocks are significantly more volatile than bonds? It makes more sense to create a portfolio where asset classes are adjusted to equalize volatility.

桥水公司的核心投资策略是一种被称为风险平价的东西。该投资策略认为应该根据资产波动率的变动而对资产配置的比率进行调整。为什么要在股票的波动率远超债券的情况下对股票和债券的投资一视同仁?更靠谱的做法应该是构建这样一个投资组合,其中各类资产的配置比率要根据各自波动率的敞口总量相等的原则进行动态调整。

When the volatility of an asset class declines, the rules dictate that Bridgewater buys more of that asset. Remember - the less volatile, the more of that asset you need to equal the other assets in the portfolio.

当某类资产的波动率出现下跌,桥水公司会根据该原则买入更多的该类资产。记住:投资组合中某项资产的波动率越低,该资产需要买入的数量就越多,这样才能使该资产的波动率敞口总量与投资组合中其他资产的波动率敞口总量保持平衡。

Well, what has the volatility of stocks been doing over the past couple of quarters when Bridgewater has been buying put options?

好了,就在过去几个季度里当桥水公司陆续买入股票看跌期权的时候,美国股票市场的波动率是如何变化的呢?

Volatility has been falling! Therefore, it is actually more logical that Bridgewater has been buying stocks as opposed to betting on them falling.

美国股市的波动率一直在下跌!因此,真正的逻辑其实应该是这样的:桥水公司一直在买入美国股票而不是赌美股下跌。

If you think about a declining volatility environment, it is actually a terrific time to buy a put-protected long position. Yeah sure your puts end up costing more than recent-realized-volatility on a backwards-looking-theoretical basis, but they are still cheap in an absolute sense.

好好想想当前美股波动率持续走低的市场大势就会知道,现在其实是建立看跌期权保护的股票做多仓位的大好时机。事后回过头来看有一点是肯定的,买入股票看跌期权时的隐含波动率水平最终有可能比最新的实际波动率要高,但从绝对水平的角度来看,仍然很低。

My bet is that Ray Dalio's Bridgewater is far from bearish on stocks. It would make more sense that they are actually relatively overweight equities, but are using put options to limit the downside on their levered long equity position.

我猜达里奥的桥水公司根本没有做空美国股市的想法,更合理的判断应该是:他们实际上是在投资组合中加了杠杆超配美股,但与此同时也买入一些看跌期权以防范股票多头仓位的下跌风险。

Be careful with trading off financial news headlines. More often than not, it's not at all what it seems...

对财经媒体要多长点心眼,他们发的头条消息和事实驴唇不对马嘴的情况已经不是一次两次了。。。

风险平价策略的应用

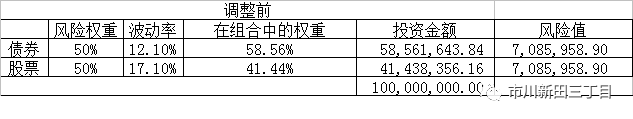

假设一个投资组合由股票和债券构成,股票和债券的风险权重均为50%。其中债券的波动率为12.1%;股票的波动率为17.1%,那么股票和债券投资占比分别是多少?

公式如下:

股票资产在投资组合中的占比=1- (债券的风险值) / (组合的总风险值) = 1-12.1%/(12.1+17.1%) = 58.56%

债券资产在投资组合中的占比=100%-股票投资在组合中的占比=1-(股票的风险值) / (组合的总风险值) = 1-17.1%/(12.1+17.1%) = 41.44%

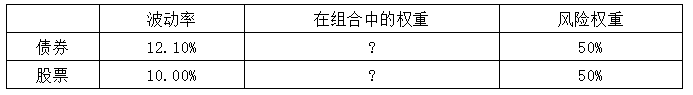

假设过了一段时间股票的波动率降至10%,而债券的波动率不变,而组合中股票的风险权重仍需要保持不变,那么新的股票投资比重应该是多少?

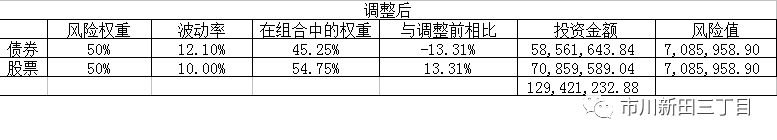

股票投资在组合中的占比=1- (债券的风险值) / (组合的总风险值)=1-10%/(12.1+10%) =54.75%

债券投资在组合中的占比=100%-54.75%=45.25%

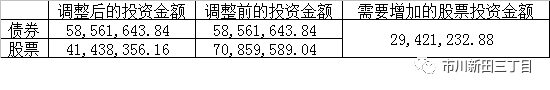

与调整前相比,股票投资权重上升了13.31%。因为债券投资的金额保持不变,那么投资组合的管理者需要多买将近3000万美元的股票以确保股票的风险权重不变。

样做的结果是股票的市值增加了,相应地市值波动的风险也在加大,为此需要买入一些股票看跌期权防止股价下跌拉低整个投资组合的回报率。

达里奥的桥水公司运用风险平价的投资策略对投资组合进行调整的做法应该与此类似。

译者 王为

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 得点·2019-11-27空还有说出来点赞举报