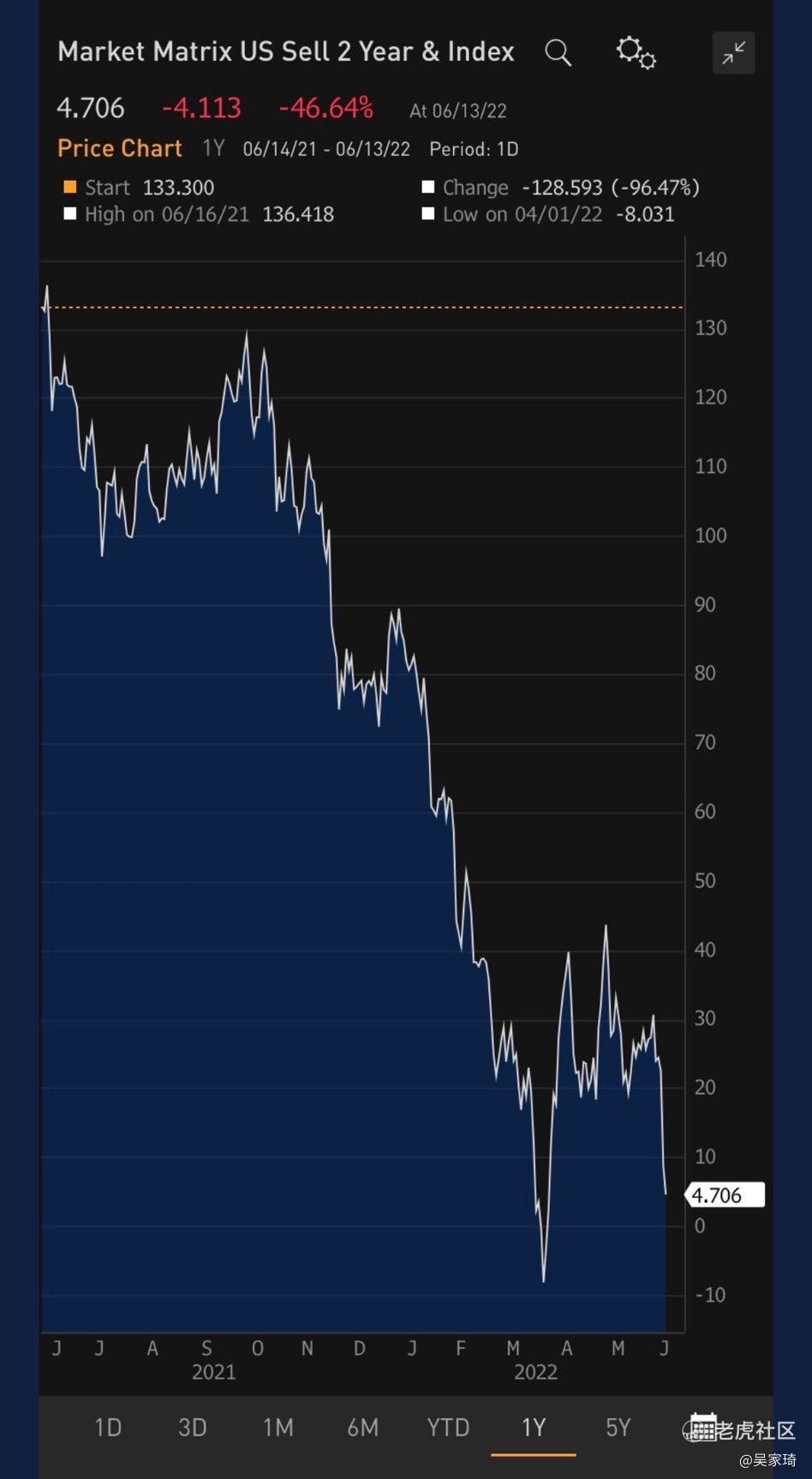

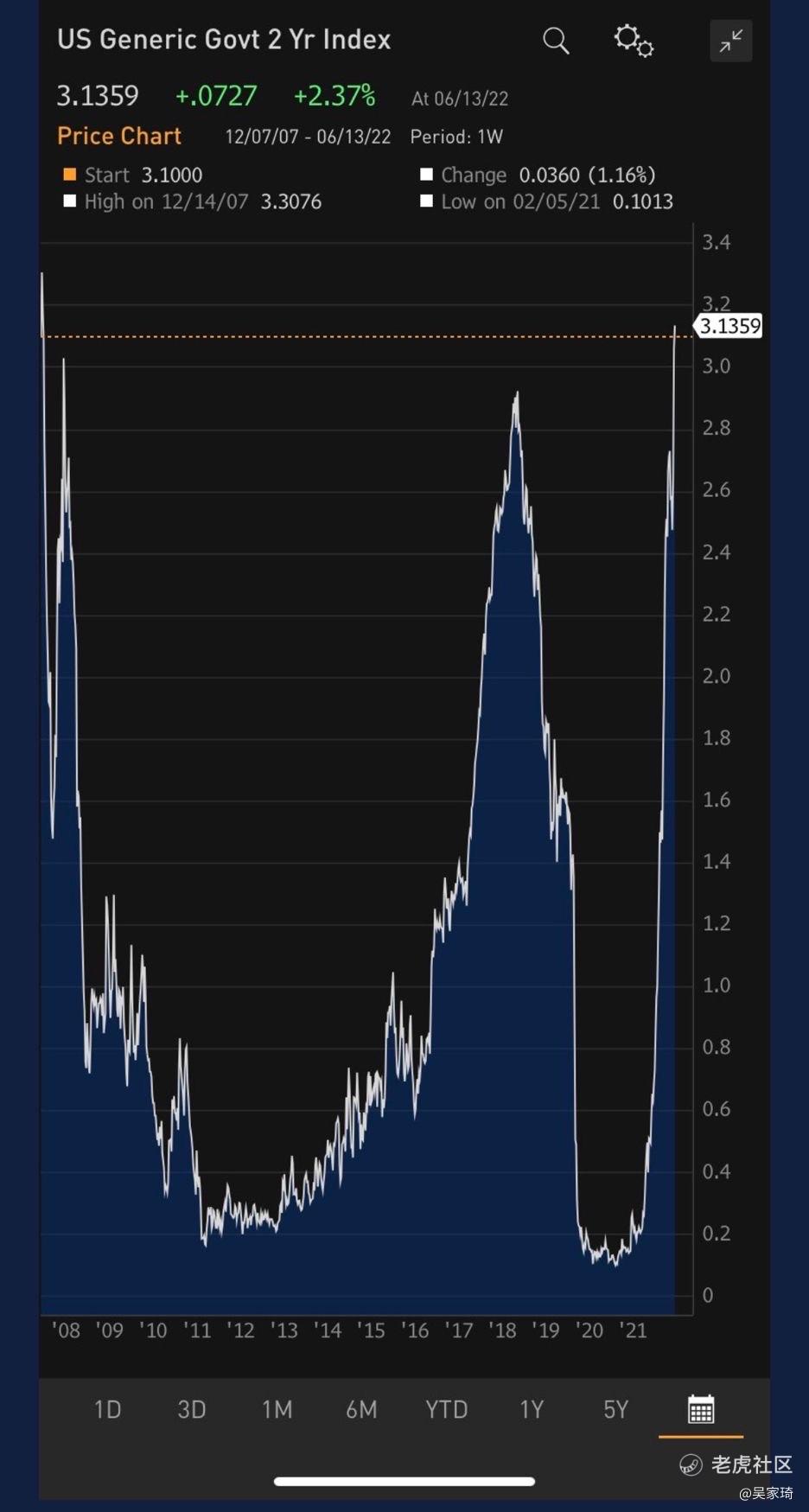

The pace of short-term yields ⤴️ is just impressive this time what was unthinkable just a few months ago is now a reality thanks to 🔥inflation. Yields on US 2-year Treasuries crossed the 3% mark — its highest level since 2007. The gap between 2 and 10-year Treasury yields is now less than 5bp, the yield curve ⤵️ flattening even more getting closer to an inversion 🔄 which tends to be 🚨 of a recession.

The FOMC is all but guaranteed to ⬆️ its fed funds target by 1/2 a percentage point, but this week's meeting is more crucial for laying the path of future potential rate hikes changes after the last week’s strong CPI reading. Will they go up to 0.75%? (Now priced at 40% at the Fed's July meeting according to Barclays economists)

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。