Initial Report(part3): KE Holdings Inc. (NYSE:BEKE) , 73% 5-yr Potential Upside (VIP GC,曾庆麟)

Overseas leader review

The following section mainly analyzes the real estate brokerage market in the US

The real estate brokerage market in the US is different from that in China. Its characteristics are as follows: 1) The US mainly sells existing houses, with second-hand existing houses accounting for about 90%, while China accounts for about 33%; 2) House sales are mainly single-family houses, accounting for about 82%; 3) The MLS system (full name Multiple Listing Service System or Housing Information Sharing System) is adopted. MLS is a place where agents with their membership status publish real housing listings. According to NAR statistics, 90% of home sellers have uploaded their listings to MLS.

The US real estate brokerage market is relatively scattered. According to REALTRENDS Statistical Data, the market share of the US TOP1-10 in 2019 was 25.9%. The typical business models of the industry are offline brokers and internet real estate information platforms, represented by Realogy and Zillow.

Zillow US is the highest-traffic real estate vertical information website. In 2022, there were 220 million unique users, an increase of 1% year-on-year, with 140 million sets of US housing information. Zillow addresses the pain points of MLS being only open to member brokers and difficult pricing of houses. On the one hand, it accumulates housing resources through manual entry by sellers and brokers, as well as import of MLS housing resources, creating an Internet real estate information platform for buyers, and then providing services such as buying, selling, leasing, and loans. On the other hand, in 2006, it launched the automatic housing valuation model Zestimate, which attracts buyers through free valuation and creates a database centered on housing valuation. In 2022, the median error rate of Zestimate's for-sale housing valuation was 2.7%, and the median error rate of non-for-sale housing stock prices was 7.6% (source financial report disclosure, the same below).

In February 2015, Zillow Group acquired another leading internet real estate information company, Trulia (which attracts buyers' attention by collecting and displaying crime rates around properties), further enhancing its leading position in the industry. According to Statista, Zillow and Trulia are the two most popular real estate websites in the US, with monthly visits far exceeding other internet platforms.

In 2018, Zillow expanded its housing resale business and achieved its first profit in Quarter 1 of 2020. In 2021, Zillow announced that it would directly buy houses in full cash according to the valuation results of Zestimate, and rapidly expanded its business under the background of quantitative easing by the Federal Reserve that year. It paid a cost of $2 billion in six months, but due to inventory backlog, insufficient operational capacity, and poor reliability of Zestimate valuation, it caused difficulties in the capital chain, and finally had to shut down the business.

In 2022, Zilliow's operating revenue was $1.96 billion, of which Premier Agent (referring to the business where real estate agents from all over the country can display their company or personal information on Zillow for a long time by paying monthly or annual fees) contributed $1.29 billion, accounting for 70%, a year-on-year decrease of 8%. The financial report explained that the macro interest rate and house price increase, rental revenue was $2.7, a year-on-year increase of 4%, and other business revenue (construction market revenue, providing marketing and technical solutions for real estate developers) was $270 million. In 2022, Zillow's gross profit margin was 81%, a decrease of 4 percentage points compared to 2021. At the same time, sales expenses are also decreasing, while R & D expenses are increasing, indicating that Zillow is withdrawing from the resale housing business and focusing on real estate brokerage and advertising businesses.

Realogy Holdings Group is the world's largest real estate concession organization with numerous well-known commercial brands. As of the end of 2022, the company has 195,000 independent sales agents in the US and 142,400 independent sales agents in 118 other countries and regions worldwide. Realogy ranks first in the industry in the US, with a market share of 15.3% in the stock housing market in 2019. In terms of commission income, the total transaction commission in the US in 2019 was $1.20 billion, accounting for about 17%.

The characteristics of the US real estate property sharing market make it difficult for real estate brokers to have three-factor verification of properties, customers, and brokers at the same time. Zillow's breakthrough from customer sources challenges Realogy's position as a leader by accumulating a large number of broker resources through franchising. Zillow explores a new business growth direction for home resale, which has certain reference significance for the business expansion of domestic brokerage institutions such as Beike. However, it has high requirements for company business operations and higher binding with the real estate industry, and is more affected by its fluctuations.

The shell has accumulated the above Three-factor Verification, and the domestic competition landscape is still scattered, there is still a large space.

Key Issues - Real Estate Policy and Cycle Discussion

At present, policies will not allow large fluctuations in real estate prices. One of the major sources of funding for the Chinese government is land transfer, which prevents policies from allowing real estate prices to collapse. In addition, the debt risk of real estate is strongly related to systemic bank risk. The collapse of real estate prices will trigger debt risk and systemic bank risk, which China cannot afford. On the other hand, if real estate prices rise again on a large scale, it will further increase the risk of asset bubbles. Therefore, it is expected that the purpose of future real estate policies will be to stabilize real estate prices.

According to the recently introduced series of policies, the real estate industry will be fully supported by aspects such as income tax, house exchange, and purchase interest rates. It should be noted that this series of policies is particularly beneficial to residents who have a demand for "house exchange", which will be particularly beneficial to Beike House.

According to Harrison's "18-year cycle theory of real estate", the 18-year cycle will be divided into: the first 7 years of demand-driven market growth; the second 7 years, starting with a short-term decline adjustment, driven by speculation, first rising for 5 years, and finally accelerating the rise for 2 years, causing the market to bubble; the third stage lasts for 4 years, with prices falling sharply, and the cycle repeats itself. The real estate situation in China since 2008 fully conforms to its cycle theory. If this theory holds true, then starting from 2026, the big Kondratiev cycle superimposed on the two upward cycles of the real estate cycle may be a strong recovery.

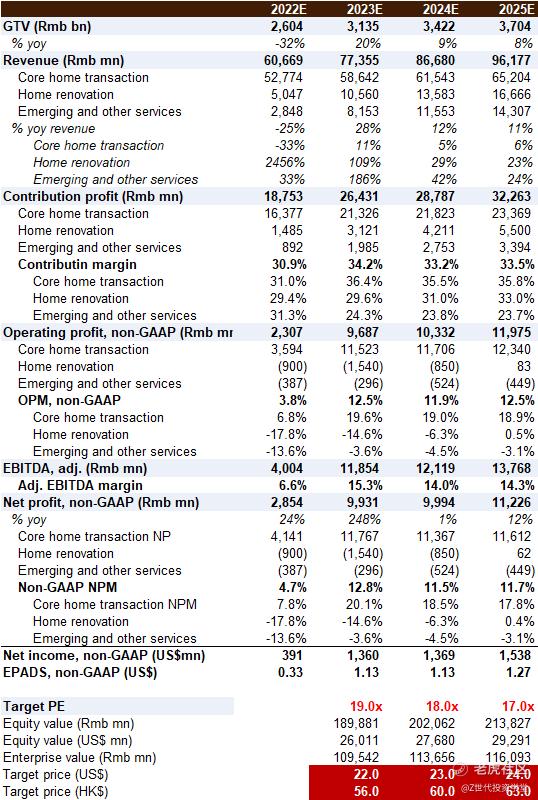

Valuation

Risk Warning

Real estate recovery falls short of expectations, growth falls short of expectations.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。