By Thomas Poh - 20Mar2020

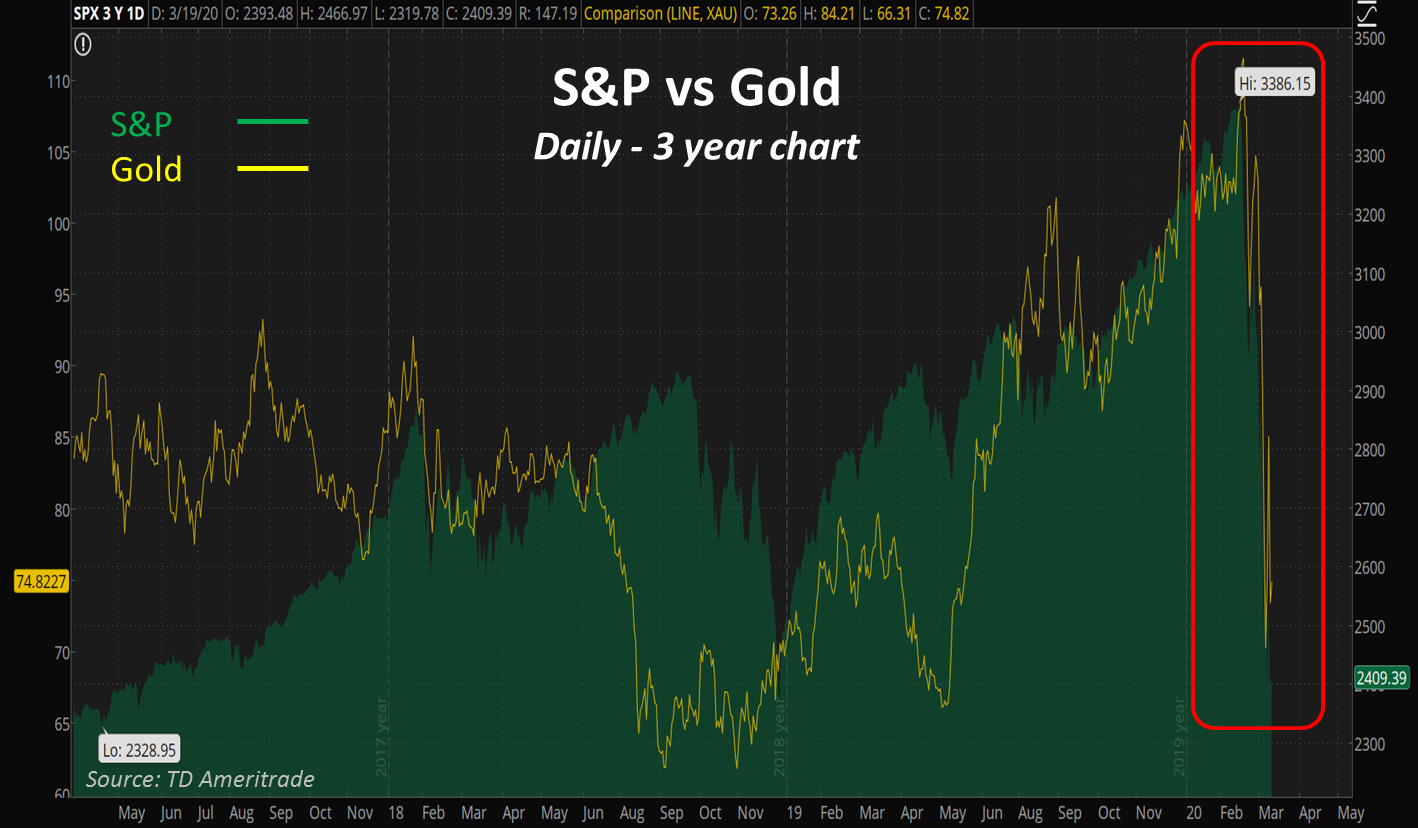

黄金作为一种晴雨表资产有它的一定作用。但是,过去几周的市场波动有所不同。股票的暴跌也导致黄金价格急速地滑落。哪我们怎么分析这个现象呢?

Indicator of the End of Market Panic - The Gold correlation

Gold as an asset class is indeed being used as a form of flight to quality trade.However, what had happened over the past few weeks has a slight difference. Gold sold off hard together with equities... ...

https://www.pzhconsultants.com/

全球经济停滞最大的次要影响是流动资金的猥缩,也就是现金。

全球经济停滞最大的次要影响是流动资金的猥缩,也就是现金。因此企业,基金管理公司和个人投资者等都在出售任何可以出售的资产,包括传统的择优而栖资产类别(例如黄金和美国国债)

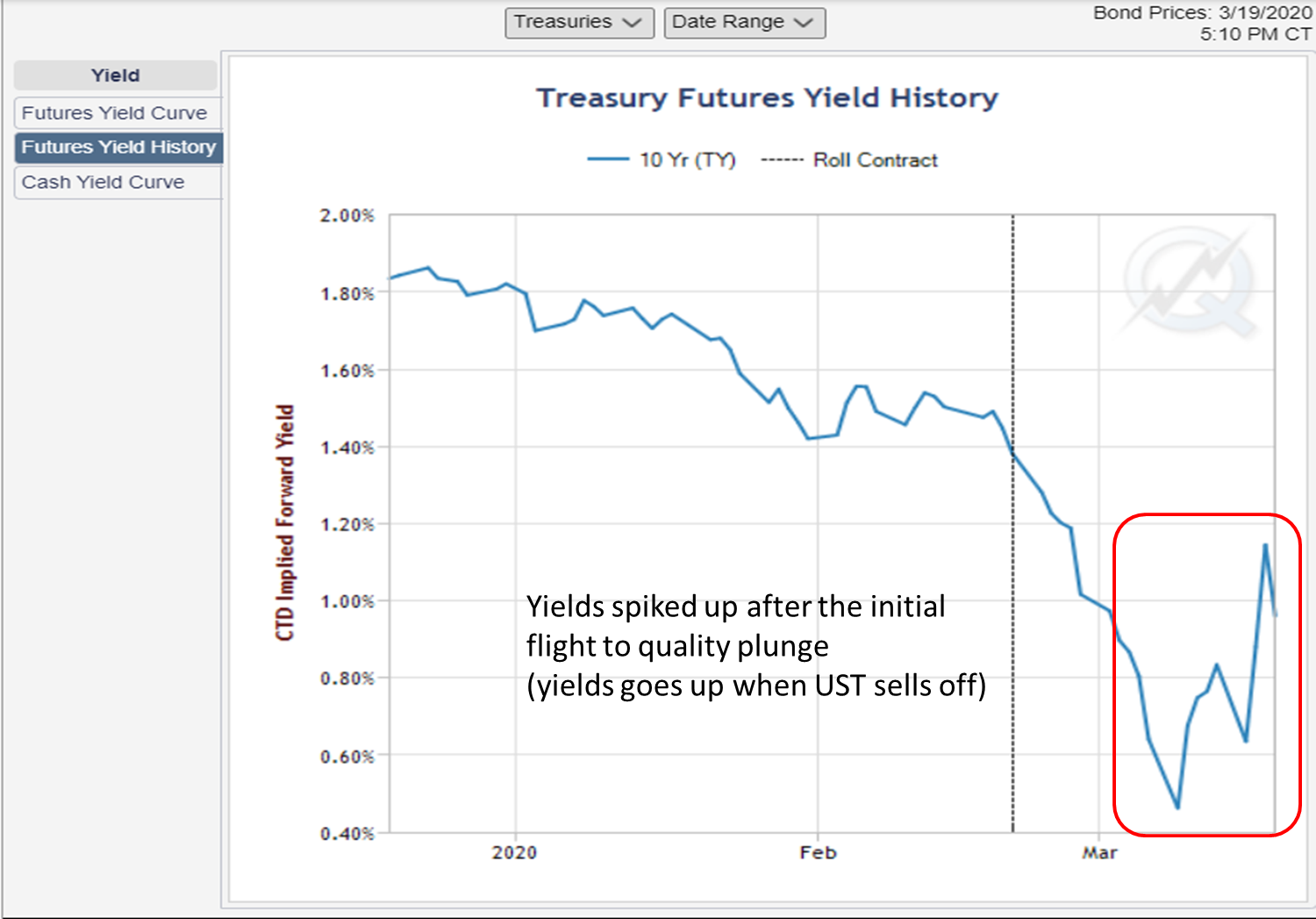

这种抛售行为解释了为什么美国国债(UST)收益率在暴跌后急剧飙升(国债价格与收益率有反响关系)。请参见下面的UST期货收益率图表。这也是许多交易所基金的交易价格低于其资产净值水平的原因。基本上,因大家急与套取现金,市场正在经历一段价格混乱的时期与价格脱钩的状况。

The biggest secondary effect of the global economic lockdown is the need to raise funding liquidity i.e. CASH.

The biggest secondary effect of the global economic lockdown is the need to raise funding liquidity i.e. CASH.So corporations, funds and individuals were selling anything that can be sold.This includes the traditional flight to quality asset classes such as gold and US treasuries (UST).This explains why the 10 year UST spikes sharply higher (yields go up when treasuries are sold) after the initial plunge in yields. (See UST futures yield chart below). This is also the reason why a lot of funds are trading below their NAV levels. Basically, the market is going through a period of price dis-location as everyone raises cash to stay afloat.

Source : https://www.cmegroup.com/trading/interest-rates/us-treasury/10-year-us-treasury-note.html

所以当我们看到各类别资产价格开始恢复通常的相关性时, 这预备着市场可能开始进入平稳阶段。这并不意味着市场将返回上升趋势,只是代表恐慌已经平息。市场价格也因此会从新反映各股票本身的潜在价值。

所以当我们看到各类别资产价格开始恢复通常的相关性时, 这预备着市场可能开始进入平稳阶段。这并不意味着市场将返回上升趋势,只是代表恐慌已经平息。市场价格也因此会从新反映各股票本身的潜在价值。

So indeed, one way to have a sense that the market is stabilising is when we see asset classes revert back to their usual established correlationships. This does not mean that market will trend back higher, just that the panick selling to raise funding has subsided and the market goes back to pricing asset classes based on valuation instead.

..... when we see asset classes revert back to their usual established correlationships... means ... ... panick selling to raise funding has subsided... ... the market goes back to pricing asset classes based on valuation instead.

Please feel free to share your thoughts and comment !

https://www.pzhconsultants.com/disclaimer.html

精彩评论

我们的人生也是投资。学习是对未来的投资,朋友是对生活的投资,运动是对身体的投资。所以不是每个人都能把握好投资的真谛。如果你不能够爱上这门艺术,让钱赚钱就去交给更厉害的人做