By Thomas Poh - 6 Apr 2020

www.pzhconsultants.com

在前两节课中,我们已经讨论了选择正确的产品来表达市场观点的重要性(第一节-上 和 第一节-下 在此)。选择错误的交易产品有如选择了错误的工具。事倍功半。下一个要讨论的“交易策略的必备关键要素”是对交易者而言,一个非常个人的关键问题。每个交易者之间都有所不同。但在交换市场观点与策略时,很少人会提到它。甚至可以说,大多数交易者都不认为这是交易策略的关键之一。这常被忽略的关键就是“时间范围”。

交易策略的“时间范围”是我们开始建立市场观点的第一步。

交易策略的“时间范围”是我们开始建立市场观点的第一步。它为我们在分析各未来市场状况与情景时,定下一个大体的时间概念。当我们认为市场正要上涨时,我们必须为该市场观点设定时间范围。我们是否认为市场会在交易日内上涨,还是在未来3-5年内上升? 如果我们在分析各种交易策略时,不把各策略中设定的时间范围列入考虑过程,那有如把日间交易者与沃伦·巴菲特两者的策略进行比较。后者是根据基本价值分析而有超长期观点的投资者。前者的日间交易员的收益顾虑只限于当日的交易成果。两者不能相提并论。

我们的交易时间范围也定下市场未来的变化与我们的头寸之间的时间关系

我们的交易时间范围也定下市场未来的变化与我们的头寸之间的时间关系。例如,如果我们为即将发布的并购公告而对某只股票进行多头交易。那并购协商过程将为我们的多头交易设定时间范围。并购结果宣布后,无论结果如何,当市场消化了这消息之后,促使我们所设立头寸的原因已消失。这时我们应该平仓。

做交易不能只期望明天会更好,而一直保留亏损的头寸! ... ... 如预测即将发生的状况已在预定的时间范围内已发生时(或从未发生),保持原有的交易策略的原因已经消失。

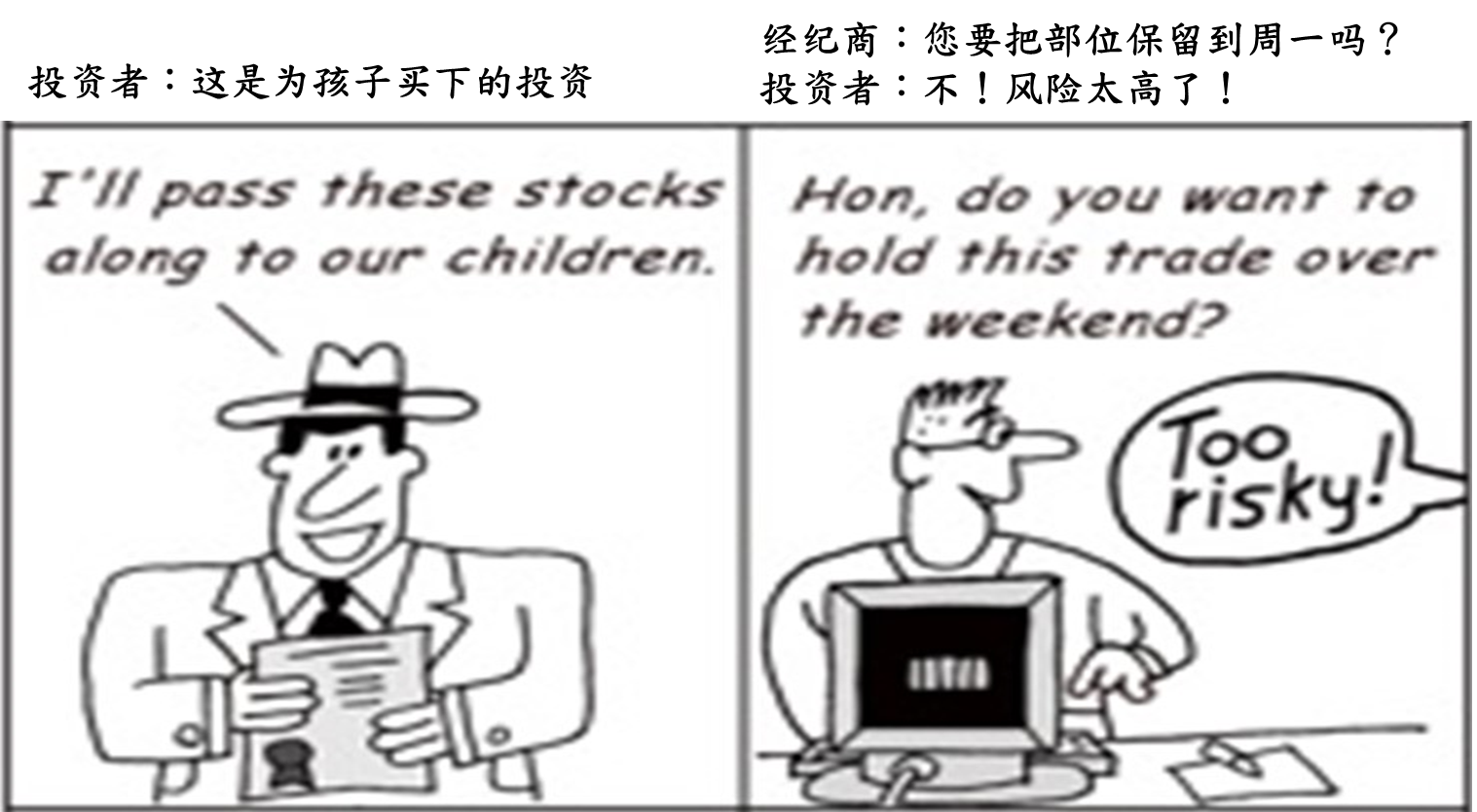

因此,为我们的交易策略设定时间范围的一大好处是它能帮我们保持交易纪律。大家或许听过甚至亲身体会过这个经历。那就是我们延续持有亏损的交易部位。把交易部位转变成长期投资部位。预先设定交易时间范围,迫使我们在预定时间过后,重新评估并分析保持部位的原因。做交易不能只期望明天会更好,而一直保留亏损的头寸!这里再次声明,如预测即将发生的状况已在预定的时间范围内已发生时(或从未发生),保持原有的交易策略的原因已经消失。

除了使我们保持纪律,我们的交易策略的时间范围还将直接影响我们对市场的看法以及使用的分析工具。我将会在“交易策略的必备关键要素 - 时间范围” 的第二节(下)中和大家继续讲解。敬请大家继续关注我的频道!

也请您阅读以下文章:

Critical Trading Strategy Components – Part 2a

We have covered the importance of selecting the correct product to express our market view in our 2 previous sessions (click here for link to Part 1a andPart 1b). Picking the wrong product is comparable to choosing the wrong tool for the task.The next component to be discussed is one that is VERY personal to the individual trader.It varies across traders and yet it seems to be the least discussed or mentioned when traders exchange their views or trading strategies.It is not an exaggeration to state that most traders do not even see this as a critical component of any trading strategy.This component is that of“Time Horizon”.

A trading strategy’s time horizon defines the time perspective in which we start building our market view.It would also set the timing of which we would expect the various scenarios, which we have envisioned, to pan out.When we have a bullish view and thinks that the market is heading up, we must set a time perspective to that statement. Do we think it is going up within the day, which would make us a day trader?Or do we think it would go up within the next 3-5 years, which will make us a medium term investor?Without taking different time horizons into consideration while comparing trading strategies, will like comparing a day-trader with Warren Buffett.The latter is an investor with an ultra-long term view based on the fundamental valuations.A day-trader will be concerned about the returns for his trades before the market even closes.It is like comparing chalk with cheese.

Our trading time horizon sets the timing parameters in which we see how events should unfold according to on our analysis.For example, if we enter into a bullish trade on a particular stock due to an upcoming M&A announcement, that sets the time horizon for our long trade.Once that announcement has been made, regardless of the outcome, and when the market has digested and priced in that announcement, the very reason for us to initiate our trade is over.We should now exit the trade.

Hence the benefit of setting a time horizon to our trading strategy allows us to stay disciplined.Countless stories (and jokes) are out there where many of us kept trading positions longer than planned.This is especially common for money losing trades which had conveniently become “long-term” investments.Having a pre-set time stop, forces us to re-assess and re-justify why that position is worth keeping. To-emphasize, when the market scenarios that we had initially planned out had already happened (or never happen), within the time frame, that we thought they might happen, the reason to keep that trade has gone.

Besides keeping us disciplined, our trading strategy’s time horizon will also directly affect how we look at the market and the tools that we use in our analysis.This will be covered in part 2b of Critical Trading Strategy Components – Time Horizon.Please stay tuned!

Disclaimer:www.pzhconsultants.com/disclaimer

精彩评论