2020.1.29盘后Facebook发布了2019Q4的财报,发布后盘后下跌7%,第二天收盘下跌6.14%。

这一季的财报并不乐观,丸子照例来跟踪下,Facebook之前讲过很多了,没有什么太新奇的内容,这次就只记录下自己感兴趣的几个点,不做综合性跟踪了。$Facebook(FB)$

收入增速新低,后续还会继续降低

2019Q4总收入210.82亿美元,同比增长24.6%,创历史最低增幅,而且2020Q1收入增速会进一步降低。

We expect our year-over-year total reported revenue growth rate in Q1 to decelerate by a low to mid-single-digit percentage point as compared to our Q4 growth rate. Factors driving this deceleration include the maturity of our business as well as the increasing impact from global privacy regulation and other ad targeting-related headwinds. While we have experienced some modest impact from these headwinds to date, the majority of the impact lies in front of us.

David Wehner - CFO

如CFO在财报电话会上所说,现在还只是轻微的影响,更大的影响在后面。

Yes, we are seeing headwinds in terms of targeting and measurement. But as I noted, the majority of that impact lies in front of us. Just as a reminder, we utilize signals from user activity on third-party website and services in order to deliver relevant and effective ads to our users. And in that regard, there are sort of three overlying factors that I'd point to, and I spoke to these on prior calls as well.

First, the recent regulatory initiatives like GDPR and now CCPA have impacted, and we expect they'll continue to impact our ability to use such signals.

Secondly, mobile operating systems and browser providers such as Apple and Google have announced product changes and future plans that will limit our ability to use those signals.

And then finally, we've made our own product changes that gives users the ability to limit our use of such data signals to improve ads and other experiences. And there I'd point to something like the rollout of off-Facebook activity controls, and that's at 100% today.

So, each of these factors limits our ability to target and measure the effectiveness of ads on our platform, and that can negatively impact our advertising revenue growth.

David Wehner - CFO

数据隐私的影响比丸子之前预期的要影响更大,更长远。丸子之前预期数据隐私政策的影响可能会在2-3年消化完,但现在看来会是中长期的影响,需要Facebook完成基于新隐私环境的产品模式和商业模式转变,才能有第二增长曲线,这个时间长度不好说。

数据隐私问题在三个方面影响Facebook的财务状况。一,广告定向效果差,影响收入;二,内容审核及新的隐私产品的开发,成本增加;三,各种数据隐私的诉讼和解费用,2019诉讼和解费用达到55.5亿美元,未来不确定还有没有。

Facebook目前的4产品(Facebook、Instagram、WhatsApp、Messenger)融合计划,支付计划,Instagram Checkout购物等都是应对新隐私环境的产品举措,但现在都还太早期,不能对收入有实质性的贡献。Facebook的收入增速低迷,看来要维持一段时间了。

We Are Family(伐木累)

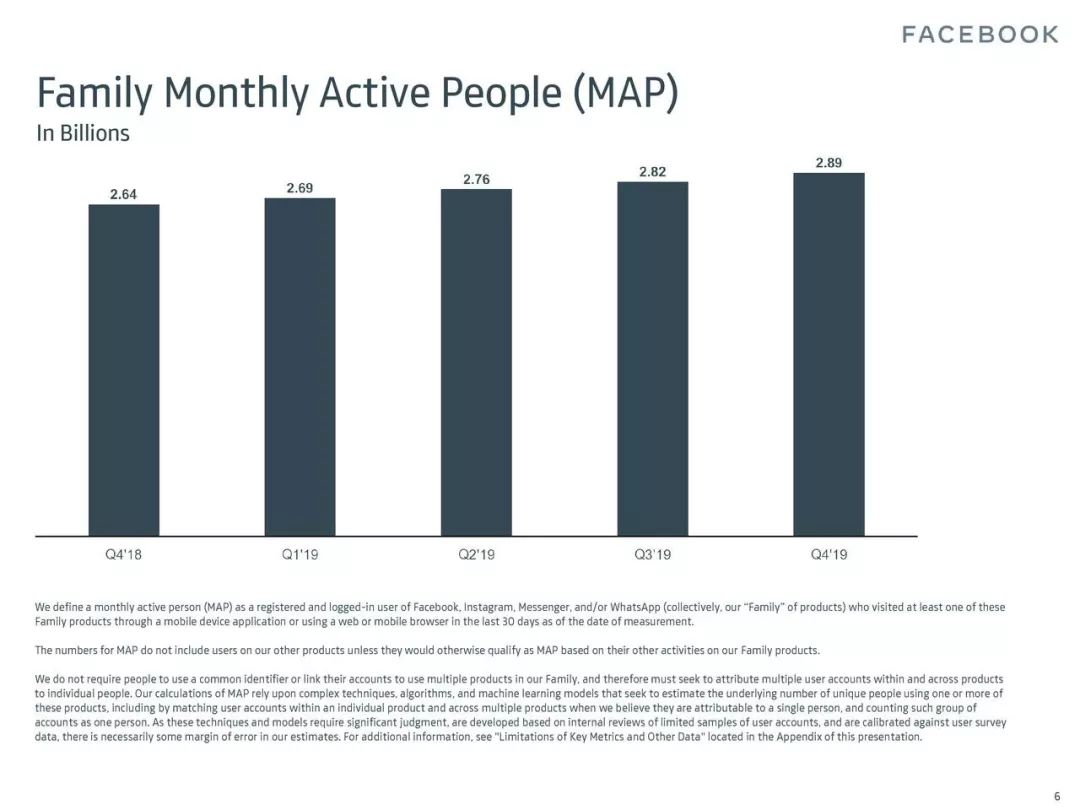

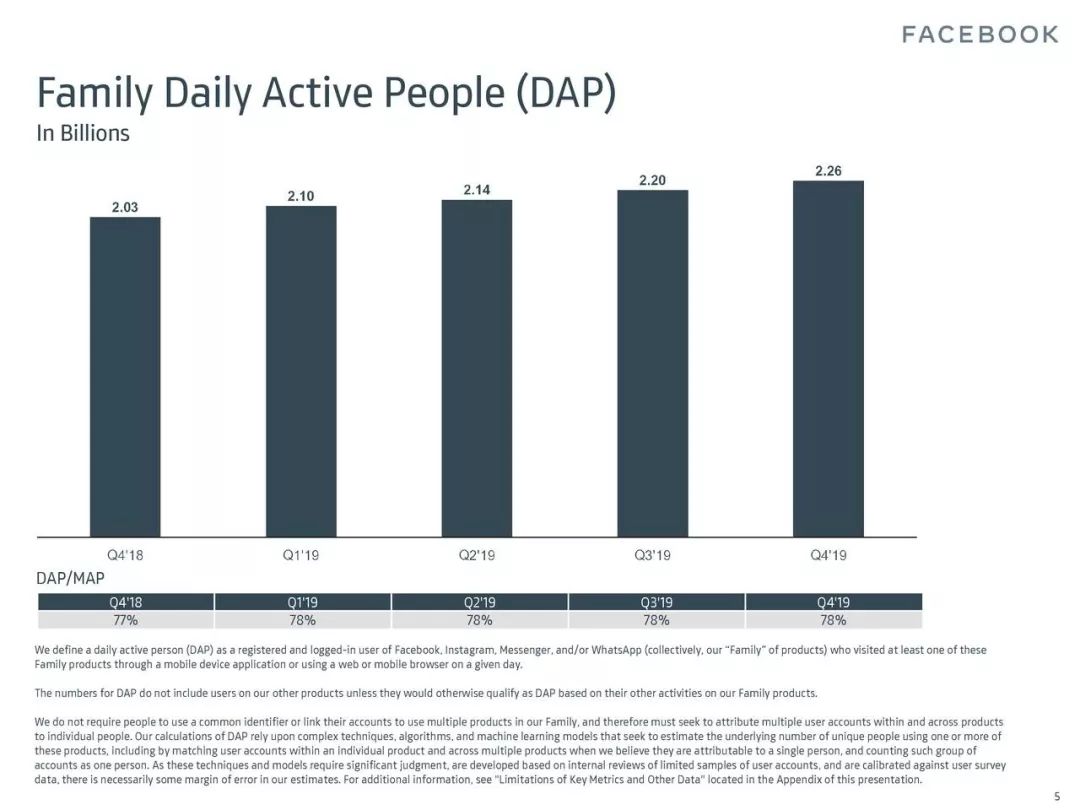

Facebook从2019Q4开始公布Family App的日活人数和月活人数数据。

2019Q4 Family月活人数28.9亿,日活人数22.6亿,DAP/MAP为78%。

全球人口76亿,世界上每个月有接近40%的人使用FB的某款产品,有接近30%的人每天使用FB的某款产品。

从产品上看,Facebook仍然非常优秀,只是目前原来的商业模式受阻,需要作出改变,但需要时间。

新的5.5亿的诉讼和解费用

2019Q1、Q2已经计提了50亿美元和FTC的和解费用了,本次又有了5.5亿美元。这是源于2015年关于人脸识别的一个诉讼了,看下10-K文件里的描述。

On April 1, 2015, a putative class action was filed against us in the U.S. District Court for the Northern District of California by Facebook users alleging that the "tag suggestions" facial recognition feature violates the Illinois Biometric Information Privacy Act, and seeking statutory damages and injunctive relief.

On April 16, 2018, the district court certified a class of Illinois residents, and on May 14, 2018, the district court denied both parties' motions for summary judgment.

On May 29, 2018, the U.S. Court of Appeals for the Ninth Circuit granted our petition for review of the class certification order and stayed the proceeding.

On August 8, 2019, the Ninth Circuit affirmed the class certification order.

On December 2, 2019, we filed a petition with the U.S. Supreme Court seeking review of the decision of the Ninth Circuit, which was denied.

On January 15, 2020, the parties agreed to a settlement in principle to resolve the lawsuit, which will require a payment of $550 million by us and is subject to approval by the court.

前几年看Google总是被罚来罚去的,这次轮到Facebook一直被罚了。一年被搞了55.5亿美元,都快赶上整个陌陌公司的市值了。

长期仍然看好Facebook

其实想想FB的这几款产品。

Facebook主App不断添加新的功能,增加用户活跃和粘性。

Instagram在Shopping上很有前景。

WhatsApp和Messenger作为海外版微信也值得期待。

然后再4产品融合、打通,前景真是广阔。

股价涨涨跌跌,只要这些产品一直在良性发展,丸子就不用太关心股价。

免责声明:文章涉及标的不作为投资推荐,市场有风险,投资需谨慎。

文:小丸子 / 微信号: 丸丸股票(wanwangp)

精彩评论