No. 1 Rule for Stock Market Investors: Always Cut Your Losses Sharp.

In the battle for investment survival, the first and most important lesson is damage control.

And it's especially true when the market is heading into a major correction.

No one wants to sell for a loss. It's an admission that you made a mistake. But if you can set your ego aside, you can take a small loss and still be fit enough, both financially and mentally, to invest the next day. Cutting losses quickly prevents you from suffering a devastating fall that's too steep to recover from.

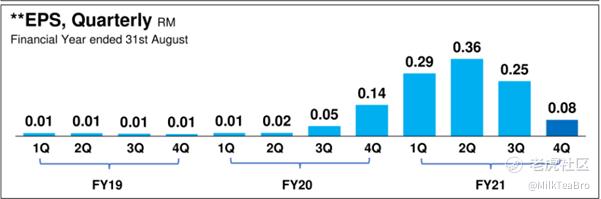

FY2021 Q4 earning per share dropped from Q3 0.2544 MYR to Q4 0.0759 MYR. it missed my expectation. I decided to cut loss.

Next Financial year, US market revenue will be added but ASP slipping can offset the revenue increase.

So, let’s use Q4 to forecast FY2022 earing per share=0.0759x4=0.3036 MYR= 0.098 SGD.

In SG market, many stocks P/E are less than 10, for glove industry, growing was uncertain, even I can accept P/E=10 for Top Glove, the price=0.98 SGD.

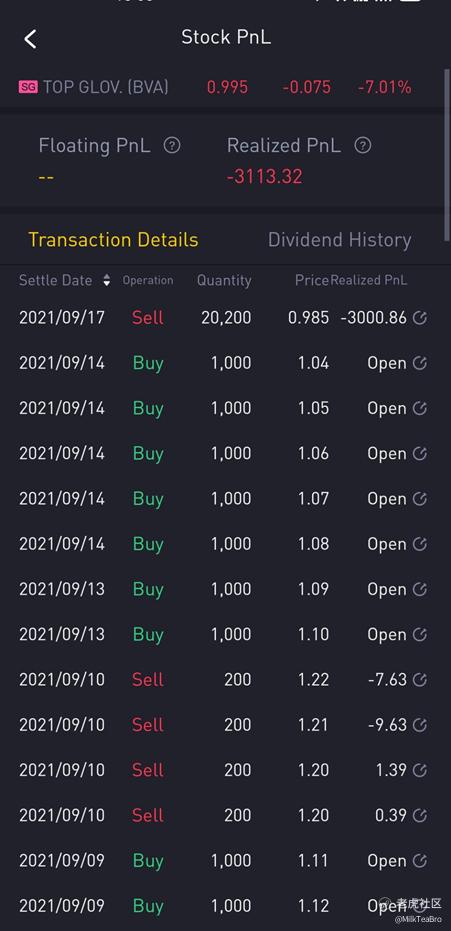

When I entered the Top Glove at SGD 1.58, I believed that Covid-19 variant spread widely, and Top Glove good earning can last much longer. Obviously my judgement was wrong.

No choice, it is not attractive anymore to me, cut loss.

Before buy stock, must read annual report to look for last 3 years growth trend. Just personal guess, easily make mistake, because market condition can change quickly.

精彩评论